FX News Today

USD mixed but biased higher, Yields move lower, Equities edge higher. Biden stimulus announcement later, Trump impeached. Asian markets move higher, US CPI & Oil yesterday inline with expectations, Lagarde talked of extending PEPP as required and hopes for a digital EUR with 5 years. Overnight – More good news from JPY and the the largest ever Chinese monthly trade surplus (78.2Bln and a +18.1% increase in Exports). AUD & NZD benefit the most. Gold & Oil lower, Bitcoin bounced again.

China reports first COVID death in six months.

USDIndex – Holds over 90.00. Trades at 90.36, – PP 90.20 – R1 90.50, S1 90.00

EUR – Back under 1.2200 (R1) – Trades at 1.2145 now– PP – 1.2170 (200HrMA). S1 1.2125.

JPY – Back to just break over 104.000 – Trades at 104.05 (R1) – PP 103.78, S1 103.60

GBP – Continued rally to 1.3700 yesterday. back to 1.3650 (PP) – R1 1.3680, S1 1.3600

AUD – Over 0.7700 – trades at 0.7750 (PP) now. R1 0.7772, S1 0.7710 NZD – Holds at 0.7200 (PP and 200MA) – s1 0.7152, r1 0.7226 CAD – Back under 1.2700 (S1) trades at 1.2680 (S2) – PP 1.2772 CHF – Trades at 0.8875 (PP) – S1 & 200MA 0.8850, R1 0.8890

BTC – Bounces back to R3 at $38,300. – PP today 34,000,

GOLD – back under 1850 (S1) and Trades at 1837 (S3) – S2 1842, USOil – Down from yesterdays 11-mth high at $53.90 after official inventories were in line with expectations. Trades at $53.00 now – PP 53.10, s1 52.55, r1 53.85

USA500 – Closed up 8.86 (+0.23%) 3809 – USA500 FUTS now at 3818 – 49 days north of 20SMA (3743).

Today – ECB minutes, US weekly jobs data, OPEC MOMR, President-elect Biden is to unveil his stimulus package, Fed’s Powell, Rosengren, Bostic, Kaplan,

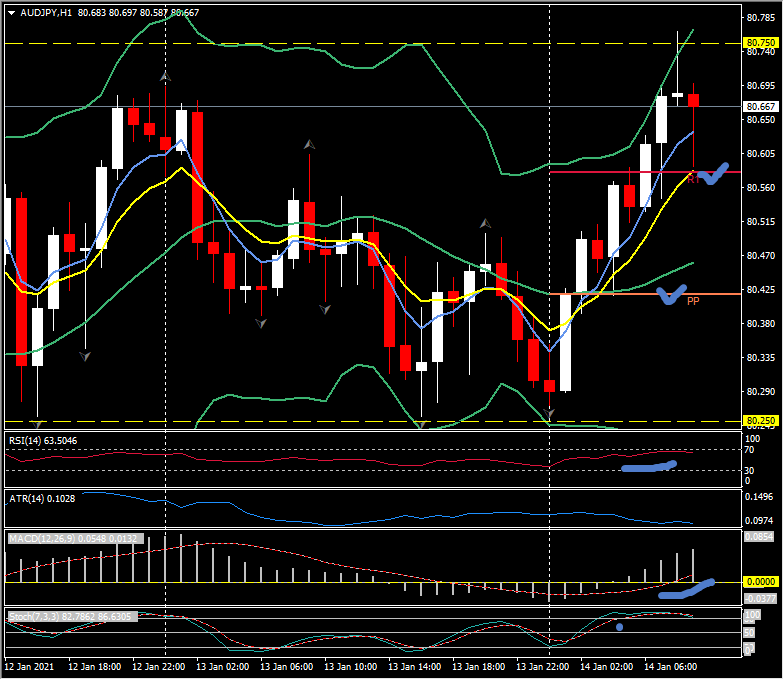

Biggest (FX) Mover @ (07:30 GMT) AUDJPY (+0.41%) Daily chart breached 20SMA Nov. 3 at 74.80 – Bounced from 80.25 on open, data and stimulus expectation helping tested 80.75 earlier. Fast MAs aligned and trending higher, RSI 61 and rising, MACD histogram & signal line aligned higher and north of 0 line from earlier, Stochastics OB since MACD broke 0 line. H1 ATR 0.1025, Daily ATR 0.6000.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.