One of the largest global banking groups, the British bank Lloyds, was recorded last week by Hargreaves Lansdown as the third most popular stock purchased based on the number of deals placed by its clients. This is in contrast with the ongoing negotiations between the EU and UK in regards to financial services. This uncertainty, as well as rising unemployment rates, puts the British bank at risk of a possible reduction in its economic growth due to its exposure in the real estate market that has placed it as one of the largest British mortgage lenders.

Lloyds offers a very diverse range of banking and financial services in the UK and internationally, operating through segments such as retail, where it offers a series of financial products (such as checking accounts, savings accounts, mortgages, vehicle financing, unsecured loans, leasing solutions and credit cards for personal and small business clients), commercial banking and products in the insurance and wealth segment. It is the largest retail bank in the United Kingdom with 30 million customers.

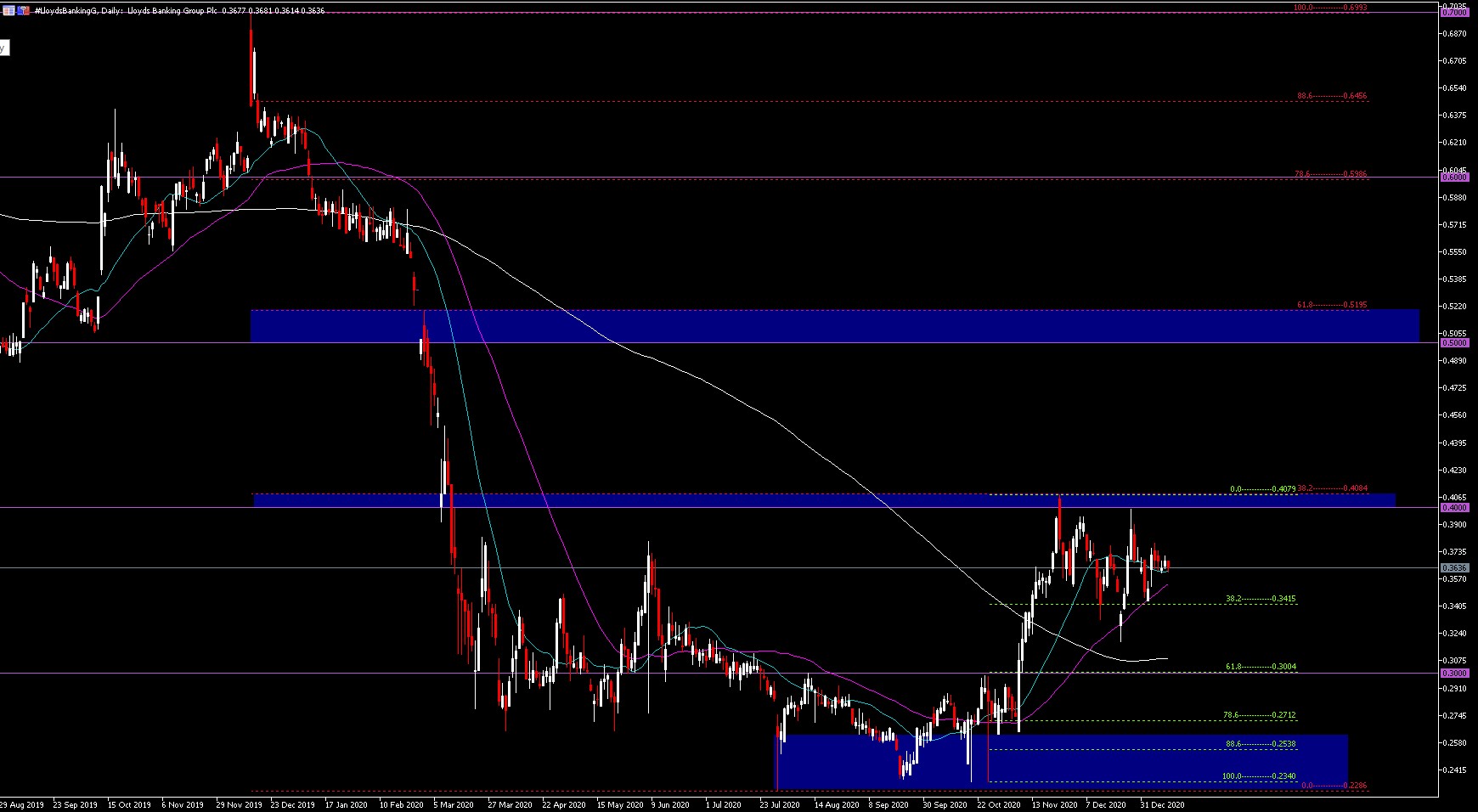

Despite its size, 2021 has so far not been the best year for Lloyds as it is one of the companies facing a significant amount of losses from 2020. Currently the price of Lloyds stock (#LloydsBankingG) is traded at 0.3636, after a 47.1% fall of its price since last year. Meanwhile in regards to its share price on the LSE, in a 52-week period its shares reached a maximum of 64.51 in December 2019, before the first coronavirus outbreak, while within 2020 it drifted to a 27.73 low. In the last quarter of 2020 it managed to rise to 40.49, posting a 73% spike in just over a month.

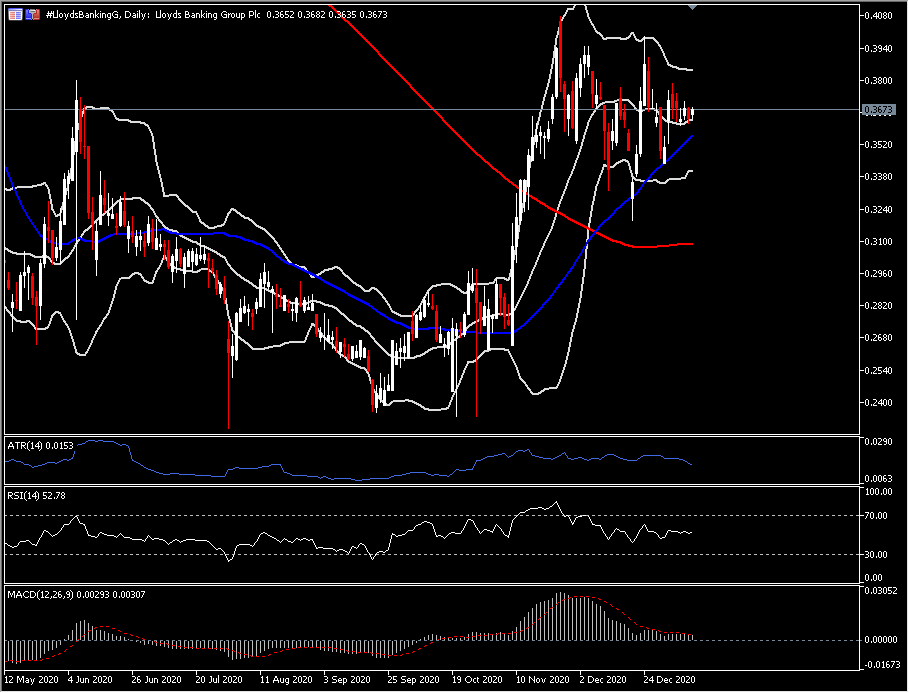

#LloydsBankingG had a bullish rally at the beginning of November from 0.2340 to the 0.4084 high which coincided with the 38.2% retracement since the 2019 dip. This move broke the 20-, 50- and 200-DMA. The psychological area of 0.3400 – 0.4090 is the area between the 23.4%-38.2% Fib. levels with the first presenting the key Resistance area seen in 2020 which now looks to have been converted to a Support area. If the asset manages to exit the range northwards, it could retest the 50% Fib. level at 0.4650.

Support levels: 0.3415 (50-DMA), 0.3400, 0.3090 (200-DMA), 0.3000

Resistance levels: 0.3850 (upper daily BB), 0.4000, 0.4090, 0.4650 (50% Fib)

Click here to access the HotForex Economic Calendar

Aldo Weidner Zapien and Andria Pichidi

Market Analyst – HF Educational Office – LATAM

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.