FX News Today

FX pairs rangebound, JPY&CHF weakest, AUD & NZD bid. Asian markets move higher today, US markets closed lower on Friday, Yields & Gold lower, Oil ticks higher. Over weekend – Biden promises $1.9 trln stimulus will happen. The USD is modestly lower amid a risk-on backdrop in asset markets. Data showing China had received $163 bln of foreign direct investment inflows, more than the U.S. received, boosted sentiment across Asian equity bourses. The MSCI Asia-Pacific came within a whisker of a new record high. U.S. stock indices futures also rallied. Global stimulus and a visible route out of the Covid-induced lockdown crisis remains a relevant investment thesis, although weakened in light of the ever-tightening response to Covid. Hong Kong, for instance, locked down an area of Kowloon for the first time since the pandemic started. There is also considerable media focus on variant strains of the SARS-Cov2, along with vaccine supply issues in Europe. This suggests the prevailing bullish bias in asset markets may not sustain, which may in turn leave the dollar and currencies in a directional limbo for a period.

This week – FED on Wednesday, GDP from EU & US and a big week for US Earnings – FB, Microsoft, Tesla, Apple and DAVOS goes on-line.

USDIndex – Holds over 90.00. Trades at 90.07, – PP 90.15 – R1 90.300, S1 90.00

EUR – Back under 1.2200 (R1) – Trades at 1.2180 now– PP – 1.2170

JPY – Back under 104.000 – Trades at 103.70 (PP) – S1 103.55

GBP – Continued to hold 1.3700. Back to test 1.3730 (R1) –

AUD – Over 0.7700 – trades at 0.7735 (PP) now. R1 0.7754, NZD – Holds over 0.7200 (PP and 200MA) – s1 0.7115, R1 0.7215 CAD – Back under 1.2700 (PP) trades at 1.2690, (S1) – 1.2660 CHF – Trades at 0.8850 (PP) – S1 & 200MA 0.8835, R1 0.8865

BTC – Bounces back to PP at $33,200. – R1 today 35,000,

GOLD – back to 1850 – PP 1855, s1 1837, R1 1870 USOil – Up in early European trading as Iraq agrees output cut – trades at $52.61 now – PP 52.15, s1 51.20, r1 52.90

USA500 – Closed down 11 (-0.30%) 3841 – USA500 FUTS now at 3860 – 56 days north of 20SMA (3783).

Today – German IFO, ECB’s Lagarde, Panetta, Lane, Elderson, BoE Governor Bailey, Chinese President Xi at the WEF

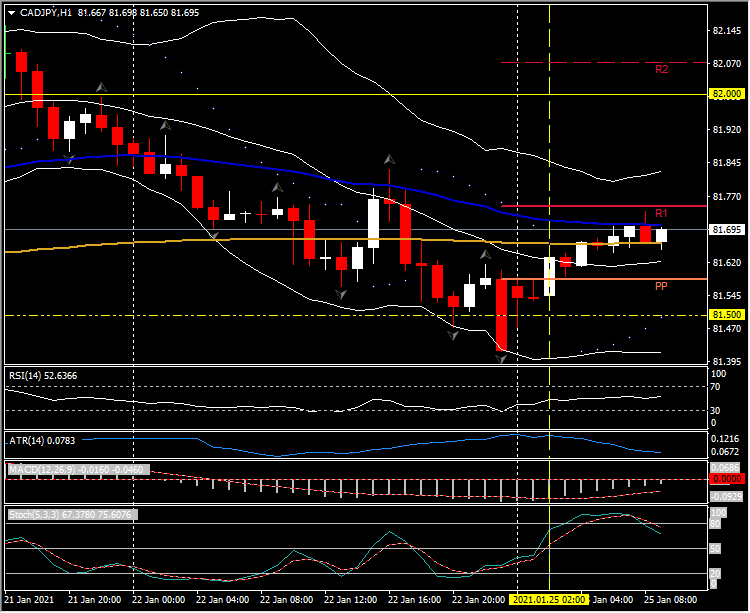

Biggest (FX) Mover @ (07:30 GMT) CADJPY (+0.51%) Recovered from Fridays test to 81.40, back over 20Hr MA today up to test 50hr & R1 at 81.75, R2 just north of 82.00. Fast MAs aligned and trending higher, RSI 51 but rising, MACD histogram & signal line aligned higher but remain south of 0 line from Fridays fall, Stochastics moving down from OB. H1 ATR 0.0780, Daily ATR 0.5180.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.