FX News Today

USD & JPY stage a wee comeback. US Equities had a very volatile day – (Huge surge in Options trading) US Futures down and Asian markets weaker – amid fears of a delay in stimulus programs and warnings of asset bubbles in China weighed. In Europe, virus developments remain in focus with clear signs that lockdowns are working in new infection numbers, but worries about the impact of virus mutations and in the EU dissatisfaction with the slow rollout of vaccines. Yellen confirmed as Treasury Secretary, Trump impeachment passed to the Senate, Italian PM Conte quits and NZD & China sign new trade deal.

This week – FED on Wednesday, GDP from EU & US and a big week for US Earnings – FB, Microsoft, Tesla, Apple and DAVOS goes on-line.

USDIndex – Holds over 90.00. Trades to 90.50, – PP 90.30 – R1 90.55, R1 90.70

EUR – Back to 1.2115 now – PP – 1.2145, s1 1.2106, S2 1.2077

JPY – Remains under 104.000 – Trades at 103.75 (PP) – S1 103.60, r1 103.88

GBP – Back to test 1.3612 (low from Thursday) form 1.3720 high yesterday. – s1 13645, s2 1.3605

AUD – Under 0.7700 – trades at 0.7675 (S1) now. S2 0.7654, NZD – Under 0.7200 – trades at 7170 (s1) S2 – 0.7146 CAD – rallies over 1.2700 – trades at 1.2775 (R1). r2 1.2830 CHF – rallied from 0.8850 to 0.8890 now. – PP 0.8875 – R1 0.8900

BTC – Retraces back to S1 at $31,500. – PP today $33,200, s2 sub $30,000 – $29,900

GOLD – Holds over 1850 – (1869 high yesterday) PP 1856, s1 1845, R1 1866 USOil – Trades at $52.45 (PP) Today s1 52.15, r1 53.15

USA500 – Closed up 13 (+0.36%) 3855 – USA500 FUTS now at 3834 – 57 days north of 20SMA (3789).

Today – UK jobs report, US consumer confidence, ECB’s Villeroy, Earnings – Microsoft, Verizon, General Electric, Johnson & Johnson, Lockheed Martin, 3M, Starbucks, Raytheon, LVMH, UBS and Novartis

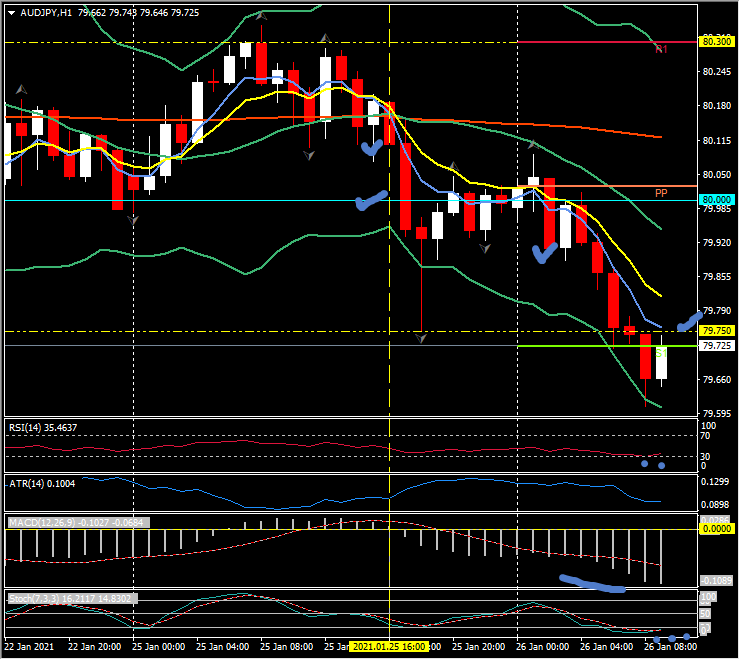

Biggest (FX) Mover @ (07:30 GMT) AUDJPY (-0.41%) Rejected 80.30 yesterday, broke 20 & 200hr MA and 80.00 to test to 77.75 low. Recovered into 80.0 at close but has moved below S1 and yesterday’s low to 79.70. Fast MAs aligned and trending lower, RSI 35 and falling, MACD histogram & signal line aligned lower and remain south of 0 line from the breach of 80.00 yesterday. Stochastics in OS zone from earlier. H1 ATR 0.1004, Daily ATR 0.5780.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.