FX News Today

USD slips again ahead of the FED and clarification over stimulus package. US Equities closed flat, (Verizon -3%, J&J +2.7%, GE +2.7% & MS) all beat Earnings expectations (MS up 6% after hours). Asian markets also flat. US Consumer confidence much better than expected. Overnight, AUD CPI improved, JPY data flat and German Consumer Confidence dropped significantly (-15.6 from -7.5). Vaccine rollout continues apace in the UK but the virus death toll passed 100,000 yesterday and unemployment hit a new record. Trump impeachment likely to fail as only 5 of the required 17 Senate Republicans agreed it should proceed.

This week – FED later Today, GDP from EU & US and a big week for US Earnings – FB, Microsoft, Tesla, Apple and DAVOS goes on-line.

USDIndex – Holds over 90.00. Tracks lower from 90.60 high to trade at 90.15, – PP 90.30 – S1 89.95.55, R1 90.48

EUR – Back to to test 1.2165 now – PP – 1.2145, s1 1.2120, r1 1.2188

JPY – Remains under 104.000 – Trades at 103.65 (PP) – R1 103.76, S1 103.50

GBP – Back over 1.3700 to test 1.3760. PP – s1 13645, s2 1.3605

AUD – back over 0.7700 – trades at 0.7740 NZD – Over 0.7200 – trades at 0. 7225 CAD – holds over 1.2700 – trades at 1.2718 CHF – declined from test of 0.8900 to 0.8865 now (s1)

BTC – Pivots through $31,800. – R1 today $32,500, S1 30,000

GOLD – Holds and pivots at 1850 – (1861 high yesterday) PP 1856, s1 1847, USOil – Trades at $52.95 (R1) Today PP 52.65, S1 52.10

USA500 – Closed down 5 (-0.15%) 3849 – USA500 FUTS now at 3850 – 58 days north of 20SMA (3796).

Today – US Durable Goods, DoEs, FOMC rate decision & Fed Chair Powell press conference, NZ trade, ECB’s Hakkarainen, Lane, Earnings from Apple, AT&T, Facebook, Boeing, Tesla, Blackstone

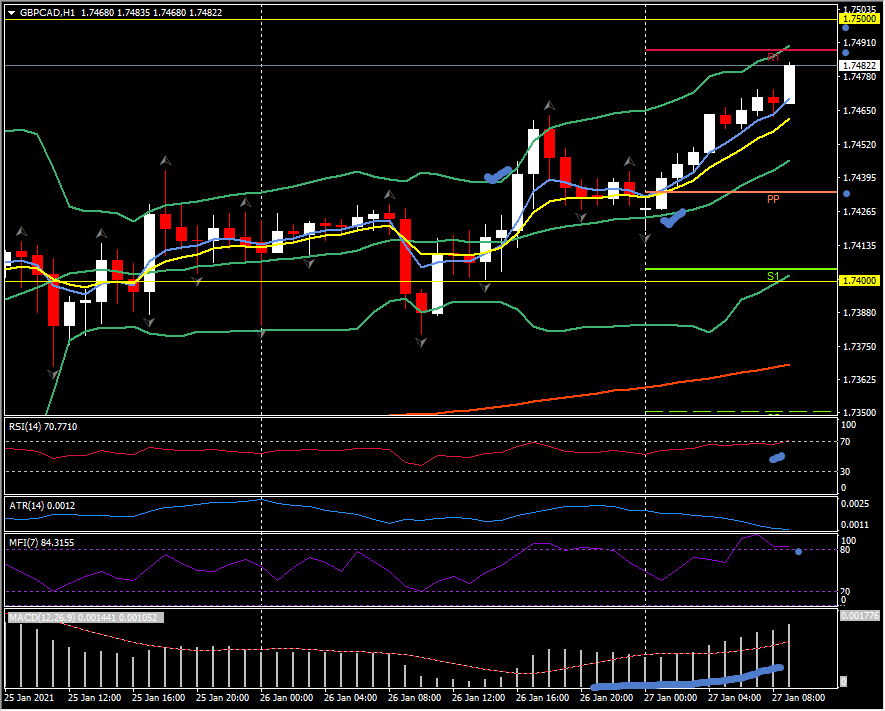

Biggest (FX) Mover @ (07:30 GMT) GBPCAD (+0.28%) Rallied from open today following break of 20hr MA yesterday. Support now PP 1.7435 andn testing R1 at 1.7490. . Fast MAs aligned and trending higher, RSI 70 rising & testing OB zone, MACD histogram & signal line aligned higher and significantly north of 0 line. MFI in OB zone from earlier. H1 ATR 0.0012, Daily ATR 0.0103.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.