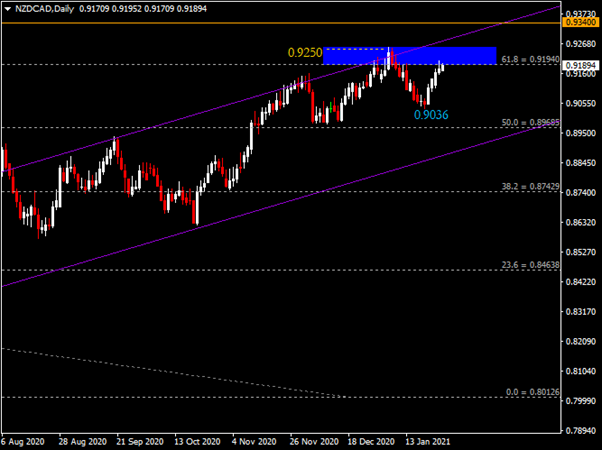

NZDCAD, Daily

In the past year, the best-performing cross-currency exchange was undoubtedly the New Zealand dollar/Canadian dollar (NZDCAD). After the currency pair rebounded from the low in March, it started a strong upward pattern to a maximum of 0.9221, representing an increase of about 15% for 2020.

The day after US President Biden took the oath of office, the NZDCAD stabilized and rose from the 0.90 median level, and has basically recovered from the decline recorded two weeks ago. The outstanding performance of the pair is not without reason. From a fundamental point of view, New Zealand has achieved very impressive results in suppressing the coronavirus. According to the latest data, as of January 27 this year, the total number of New Zealand coronavirus infections was 2,294, and the current confirmed active cases are 68, and the total number of deaths is only 25. The government’s great attention to the pandemic, its decisive decision-making power, the active cooperation of the people, and the adequate supply of epidemic prevention materials, these factors are sufficient to save New Zealand from the current public health crisis faced by most countries. In addition, the New Zealand government stated that the drug regulatory agency is granting interim approvals for Pfizer BioNTech vaccines, and is expected to vaccinate people as early as March.

In addition, Biden’s presidency may be beneficial to the establishment of close relations between the United States and New Zealand, and is likely to promote the conclusion of a bilateral free trade agreement. Compared with the previous president, people basically expect Biden to take a relatively moderate attitude in handling international trade relations. Prior to this, the former President’s tough attitude to repeatedly launch a trade war against China has also affected the trade relations between New Zealand (and Australia) and China to some extent. Now that the “Trump Era” has come to an end, the previous tensions between the United States, China, New Zealand and Australia should be eased.

On the other hand, Biden, who is determined to promote clean energy, signed a license to revoke the KeystoneXL oil pipeline project in the United States and Canada after taking office. This move not only means that US will rely more on OPEC+ imports, but the Canadian oil industry has also suffered a severe setback, which in turn led to the decline of the Canadian dollar.

Technical Analysis:

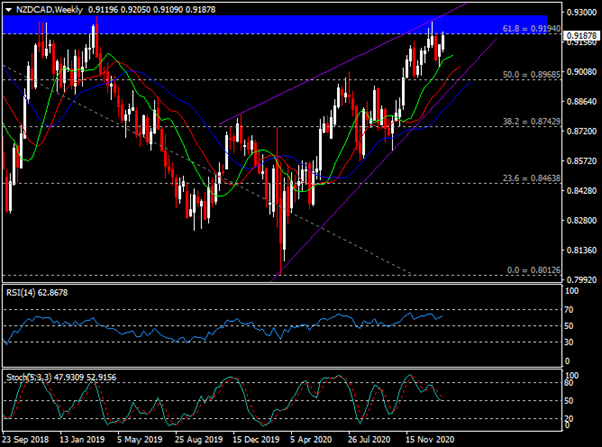

From the weekly chart, the NZDCAD traded in an ascending wedge and stabilized at the Alligator line, currently testing the 61.8 Fibonacci retracement (0.9195-0.9250) resistance. Relative Strength Index (RSI) and Stochastics (Stochastics) are still above the 50 level.

From the weekly chart, the NZDCAD traded in an ascending wedge and stabilized at the Alligator line, currently testing the 61.8 Fibonacci retracement (0.9195-0.9250) resistance. Relative Strength Index (RSI) and Stochastics (Stochastics) are still above the 50 level.

Judging from the daily chart , the NZDCAD stabilized and rose from the low of 0.9036 and formed a three white soldiers candle pattern. Yesterday, the currency hit the 0.92 level and then fell back against the short-term level. The important key resistance (0.9195 – 0.9250) is still being tested. If the breakout is successful, the next resistance will be seen at the upper channel trend line and 0.9340. On the other side, if the breakout fails, the currency pair may face short-term technical adjustments. Support attention to the recent lows of 0.9036, 50.0 Fibonacci retracements (0.8970) and the channel trend line below.

Click here to access the HotForex Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.