FX News Today

BOOM – Stocks tank (-2%+ worst day in 3 months), USD gets safe haven lift, AUD & NZD hit. Hedge Funds squeezed, stimulus stalled? and vaccine rollout questions. FED – No change to rates & $120 bln/month in QE, the mantra remains until “substantial further progress has been made toward the Committee’s maximum employment and price stability goals.” Durable Goods missed earlier in the day. Earnings from the tech players all exceed expectations (APPLE (-0.77% $100bln+ in revenues and record iPhone sales) FB record revenues but closed down -3.5% “significant uncertainty” ahead. TESLA (-2% missed expectations, but talked up deliveries and a new van. Asian markets closed down -1.53%. The VIX closed over its 200-day moving average for the first time since November 4.

USDIndex – Holds over 90.50 (PP). Tracks higher to 90.81 now – S1 90.15, R1 90.90

EUR – Back to to test 1.2100 now – Low yesterday 1.2057. PP – 1.2115, s1 1.2054, r1 1.2165

JPY – Breached 104.000 – Trades at 104.35 (R1) – PP 103.96, r2 104.55

GBP – Back down over a whole number to 1.3650. PP – s1 13700, S1 1.3640

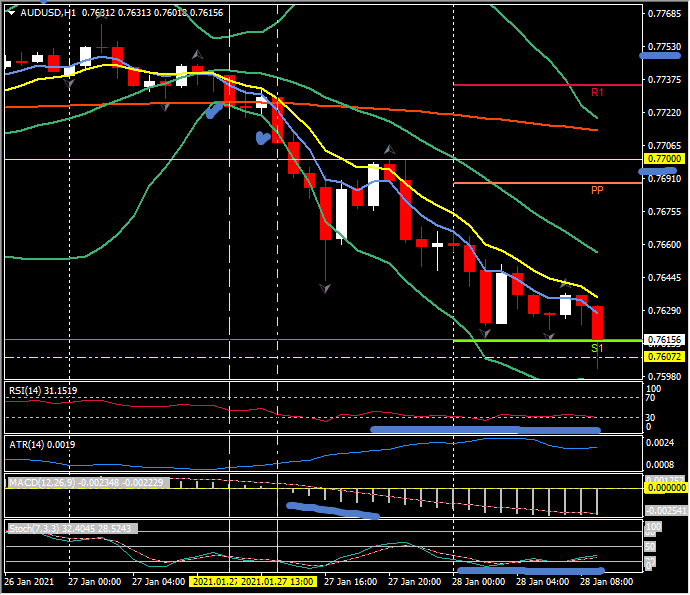

AUD – biggest loser today – back to test 0.7600 – trades at 0.7607 (S1) NZD – back to also test S1 0.7125, – pp & 200Ma 0.7186 CAD – breaches 1.2800 – trades at R1 1.2850 – pp 1.2770 CHF – up to test 0.8900 once again. PP 0.8895, r1 0.8915

BTC – Pivots through $31,000. – R1 today $32,900, S1 29,000

GOLD – Lost pivot at 1850 – down to 1836 and tested S1 (1832) earlier – PP 1840. USOil – Trades at $52.50 (PP) – Big draw down – spiked to 53.30 (R1) – but stock sell off pulled prices lower.

USA500 – Closed down 99.85 (-2.57%) 3750 – USA500 FUTS now at 3727 (50SMA) – 58 days north of 20SMA (3790), over.

Today – German CPI, US GDP (Q4), PCE, Weekly Claims, ECB’s Schnabel. EARNINGS – Comcast, American Airlines, Visa, Southwest Airlines, McDonalds, Mastercard, STMicroelectronics

Biggest (FX) Mover @ (07:30 GMT) AUDUSD (-0.60%) Rejected 0.7750 yesterday breached 20 & 200HR MA early PM. Support now S1 0.7615. Fast MAs aligned and trending lower, RSI 31 falling & testing OS zone, MACD histogram & signal line aligned lower and significantly south of 0 line. Stochs in OS zone from earlier. H1 ATR 0.0019, Daily ATR 0.0075.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.