FX News Today – Investors turned their attention to precious metals

Risk appetite improved over the weekend and Asian markets have moved broadly higher overnight, despite the weakness in China and Japan manufacturing PMIs, which left the latter in contraction territory once again. The European futures suggest a solid start for equities after both bonds and stock markets declined at the end of last week. There were also signs that the cash crunch in China is easing, which helped to underpin sentiment. The GER30 and UK100 futures are up 0.75% and 0.2% respectively, alongside gains of around 0.4% in US futures.

Headlines:

- China’s January PMIs dipped as activity slowed slightly, likely in part from the resurgence in the virus and more restrictive lockdowns in Europe and the US. But they remained in expansionary territory.

- Japan manufacturing PMI dropped to 49.8 in the January reading.

- German retail sales plunged -9.6% m/m in December, when lockdowns enforced a renewed closing of most shops. The contraction was still more pronounced than anticipated, although it is interesting that the annual rate remained in positive territory and sales are still up 1.5% y/y.

- ASTRAZENECA: The European Commission gave approval on Friday for the use of the COVID-19 vaccine developed by AstraZeneca, the final step to allowing Europe to use it across the continent.

- Silver rallied for a third straight session, soaring as much as 7.4% to a near 6-month peak, after social media posts last week called for retail investors to flood into the market. This morning: Unprecedented demand but lack of offers?

- Oil boosted by vaccination programs getting underway in hard-hit countries and output cuts by major producers like Saudi Arabia.

- Melvin Capital lost 53% in January, hurt by GameStop and other bets.

Forex Market

EUR – ranging between 1.2120-1.2140.

GBP– outperformed against the background of an accelerated vaccination process. Currently lower at 1.3720.

JPY – little changed at 104.70.

AUD – slightly higher at 0.7655 but well below January’s peak at 0.7800 – caution ahead of RBA.

CAD – declined on open as oil rallied. Currently at 1.2765.

GOLD – gapped up to 1860 – repeatedly stalled at resistance around $1,875.

USOil – surged to 52.60 (200-hour SMA) – above 20-DMA.

Bitcoin – gapped up to 34679, but remains below 20-DMA.

Today: Focus mainly on final manufacturing PMI readings for the U.K. and the Eurozone, which are unlikely to bring any surprises and confirm preliminary numbers, which suggested ongoing, but slowed expansion across the sector. US President Biden will meet with 10 Republican senators to discuss COVID-19. ISM Manufacturing PMIs on tap as well.

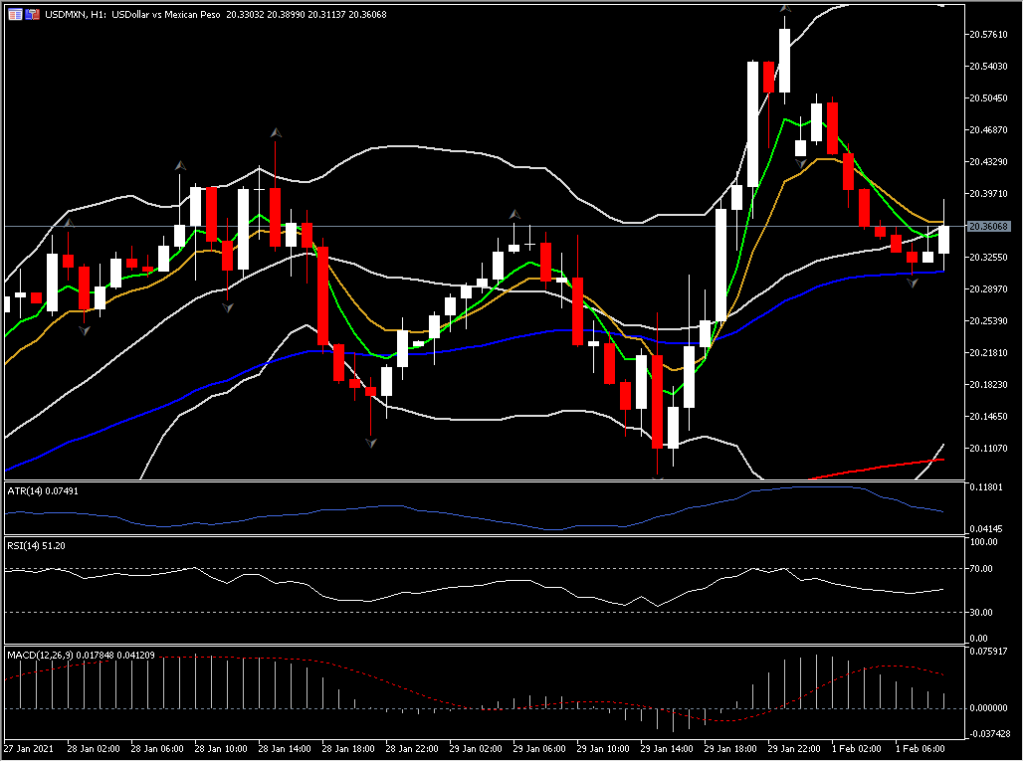

Biggest Mover USDMXN ( -1.12% as of 07:55 GMT)

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.