Qualcomm Inc. (QCOM) is a creator of semiconductors, software and services related to wireless technology. It is due to report its fourth quarter results today after the US market closes. Overall, the company’s performance is expected to be positive. Zacks forecasts return per share for the quarter to be $1.87, while the same quarter last year was reported at $0.99 per share, while fourth-quarter sales are expected to be $8.30 billion.

The company’s next dividend is due on March 25 at $0.65 per share, which includes a full-year dividend of $2.60, or an annual yield of 1.60%.

The company’s share price last night closed at $164.78. Share prices rose 1.2% to $166.78, while on the analyst side, in December, Cowen revised Qualcomm’s price forecast from $170.00 to $180.00 and placed it among the best performing stocks. Canaccord has also raised its Qualcomm price estimate from $175.00 to $180.00.

In the wake of the 2020 Covid-19 outbreak, the semiconductor sector is among the most well-positioned compared with other business groups, as it benefits from more people having to work from home, changing consumer behavior, and people relying more on technology for communication. In addition, the arrival of 5G technology is another important factor that will continue to support the semiconductor group beyond the pandemic.

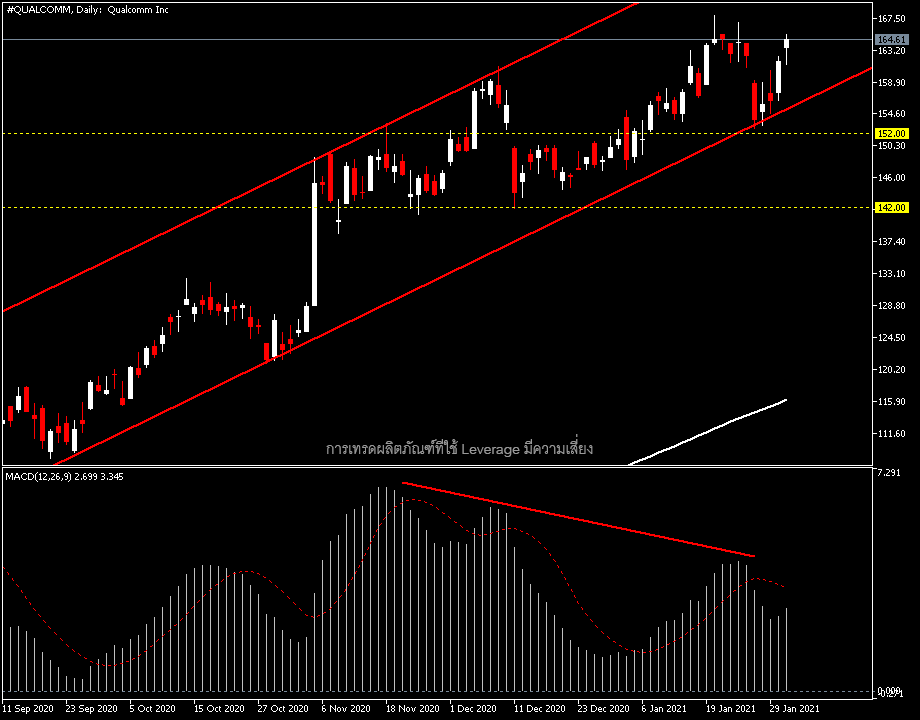

From a technical point of view, Qualcomm’s share price has been jumping above the previous two quarters of earnings announcements, on July 29 and November 4, making it interesting to see what the fourth quarter results will show. However, we currently see a bearish divergence as the MACD begins to move lower in conflict with price. Therefore, it is expected that the buyer side should be more cautious, as if the results are not as expected this may weigh on the company’s share price. Currently the first support is at $152 and the next support at $142, but if the results turn out good the company’s share price could end 2020 within the resistance zone of $176 (Fibonacci 161.8).

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.