The global stock rally has run out of steam and Asian equity indexes are broadly lower. Wall Street closed narrowly mixed yesterday as earnings continue to roll in. Wall Street did manage to rally most of the day after a wobbly start, though the indexes closed well off their best levels and the USA100 gave up gains to finish fractionally in the red. Risk appetite remained supported by mostly robust earnings, stronger than expected data, and hopes of a hefty $1.9 tln stimulus package. The JPN225 was down -1.1% at the close. Yields meanwhile continue to climb against the background of gradually building underlying recovery momentum in the world economy. The US 10-year rate is currently up 0.7 bp at 1.14% and the curve continues to steepen. This week’s recovery in risk appetite, along with supply considerations, weighed on Treasuries as yields continued to cheapen in a bear steepener.

Headlines:

- BoE Preview: The BoE will announce its latest policy review today and no change is widely anticipated, which would leave the repo rate at 0.10% and the QE total at GBP 875 bln. The central bank will also release its quarterly MPR (Monetary Policy Review, formerly known as the Inflation Report), which will likely bring tweaks to inflation and growth forecasts, although not much change is expected for central scenarios. The advent of the Brexit trade deal with the EU and the quick Covid vaccine rollout should keep policymakers on hold and looking for economic improvement during this year and into 2022. The BoE has let it be known that it has been considering the option of negative interest rates, though both Governor Bailey and Deputy Governor Broadbent downplayed this in January.

- Apple and Kia finalised electric vehicle manufacturing deal.

- The US House has secured the votes to pass a budget plan that fast-tracks Biden’s $1.9tln coronavirus economic support package. Voting continues.

- Mr Draghi met Italy’s president Sergio Mattarella on Wednesday and agreed to try to form a national unity government after the nation’s power-sharing coalition collapsed last month– whether they will get sufficient support in parliament to lead Italy through the pandemic with the help of a government of experts remains to be seen however. Global equities boosted.

Forex Market

EUR – broke the 1.2000 level earlier. Currently below S1 at 1.2006.

GBP – dropped to 1.3585, with S2 and S3 at 1.3580 and 1.3550.

JPY – sustained above 105.00.

AUD – ranging between in the 0.7600-0.7650 area.

CAD – set between PP (1.2785) and R1 at 1.2810.

Silver – sustains 26.00 floor.

Gold – under pressure at $1,815 low. Focus turned into $1,800 support and November’s lows.

USOil – surged to 56.10, as OPEC+ signaled it will continue to try and clear the surplus left behind by the pandemic.

Today: Focus mainly on Eurozone retail sales and the UK CIPS Construction PMI. The ECB releases its latest economic bulletin and markets will also look to Italy, where former ECB head Draghi accepted the mandate to try and form a new government. The BoE will announce its latest policy review today.

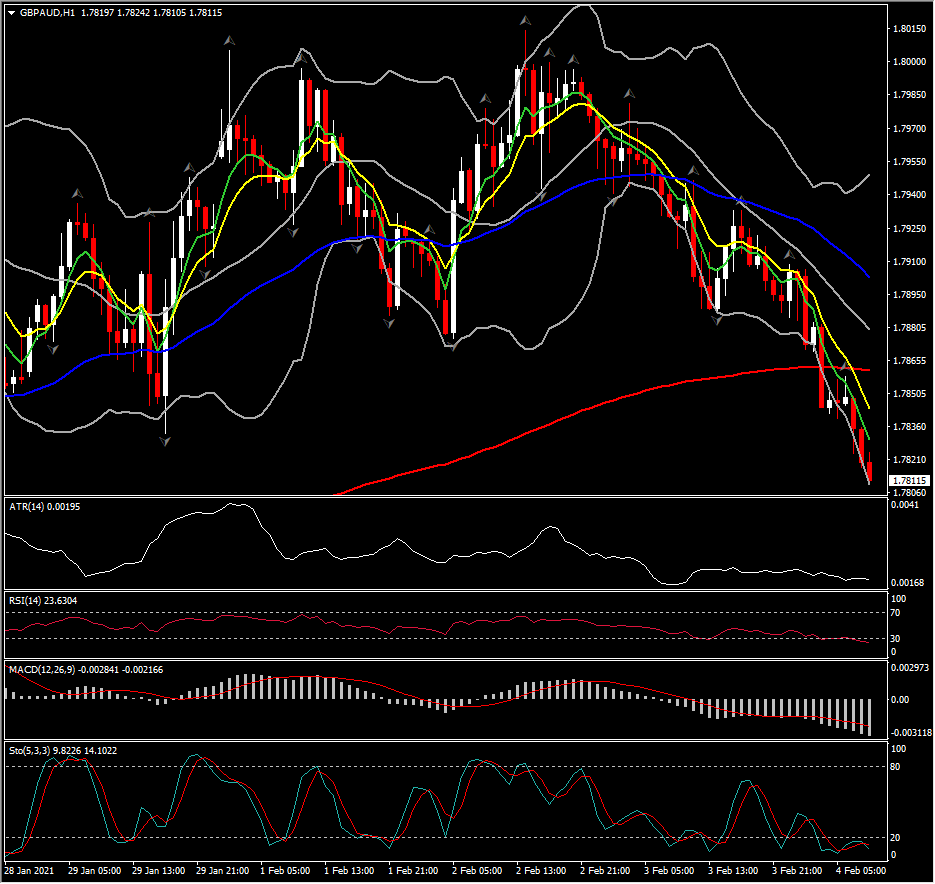

Biggest (FX) Mover – GBPAUD(-0.49% as of 09:50 GMT) – It continued aggressively southwards for the 2nd day in a row, reverting more than 35% of January’s gains. The asset is below 50- and 200-DMA, while intraday its fast MAs are sloping aggressively lower. Technical indicators are negatively configured with any rebound implying an increasing negative bias. ATR 0.00187, Daily ATR 0.01109.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.