Stock markets have moved broadly higher overnight after a strong close on Wall Street, which was supported by indications that the labour market is recovering, positive forecast for upcoming earnings and ongoing hope of stimulus as markets buy into the expected recovery in the world economy later in the year, when vaccination programs have helped to re-open economies. Strength was also broadbased though paced by tech, financials, and energy. The USA100 climbed to 13,777 while the USA500 rose to 3871. The USA30 firmed to 31,055 but fell shy of its January 20 historic high of 31,188. Bond markets steadied and the 10-year Treasury yield is down -0.5 bp at 1.1%, while the JGB rate has dropped -0.4 bp to 0.05%. GER30 and UK100 futures are up 0.3% and 0.1% respectively, alongside broad gains in US futures.

That left sentiment upbeat ahead of the US payroll numbers today. Also helping has been the improving outlook on the pandemic as vaccine jabs increase and virus cases slow.

Headlines:

- Strong earnings and improving fundamentals (jobless claims and factory orders today) supported, as did expectations for the $1.9 tln stimulus bill after the Democrats moved to fast-track the bill.

- The RBA’s quarterly statement on monetary policy stuck to the script and repeated that the bank can still extend asset purchases if needed.

- BoE not in the mood for negative rates! The BoE left policy settings unchanged, as widely expected. Lingering hopes that the central bank would join the negative rate club were dashed, and yields moved sharply higher while the Pound strengthened. – UK100 is still outperforming as the GBP remains supported following the BoE statement yesterday.

- The global stock rally also paused briefly and despite cautious words from central bankers highlighting ongoing risks, investors are increasingly buying into the recovery story.

- Earnings remain in focus with Ebay Inc and PayPal Holdings supported by positive forecasts.

- GameStop closed under $55, its lowest for two weeks – Robinhood lifted restrictions on buying Gamestop and AMC.

- Global bond funds led inflows in the seven days to Feb. 3, on the back of a rise in US yields, while money market funds witnessed the highest outflows in eight weeks.

- Investors purchased $27.2 billion in bond funds last week, the biggest in eight months, and sold $32 billion worth of money market funds, Refinitiv Lipper data showed.

Forex Market

EUR – down for a second day below 1.2000.

GBP – supported at 1.3680. Gilts selling off yesterday and weighed on the UK100.

JPY – retests the 200-DMA and 3-month Resistance at 105.60.

AUD – ranging between PP and S1 (0.7600-0.7665).

CAD – stacked at 1.28 lows.

GOLD – breaks 1800.

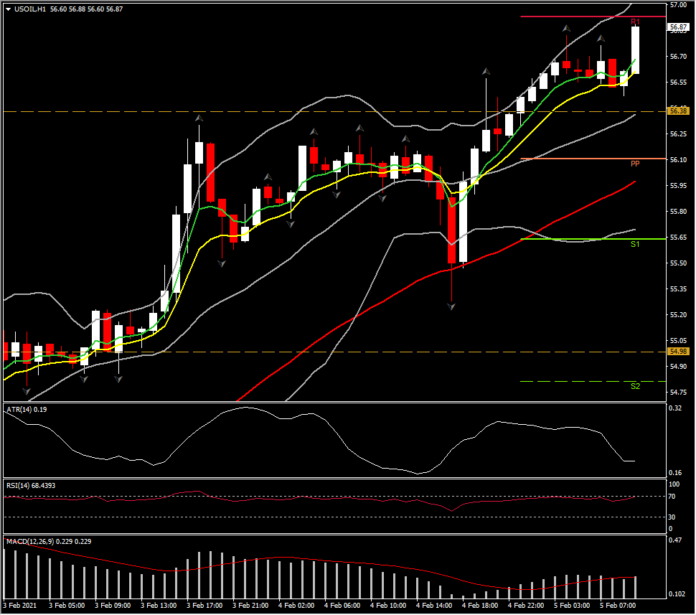

USOil – remains supported and the front end WTI future is trading at USD 56.61 per barrel.

Today: Markets will be waiting for the non-farm payroll report out of the US but for what it is worth today’s local calendar includes German manufacturing orders data for December.

Biggest (FX) Mover – USOIL (-0.80% as of 08:50 GMT) – It clocked a fresh 1-year high at $56.84, breaking the 200-week SMA, with a strong weekly bullish candle, ignoring the 3-week doji candles posted so far. Data this week showing a drawdown in US crude inventories, along with demand-bolstering colder than usual winter weather in large parts of the northern hemisphere, have been underpinning oil.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.