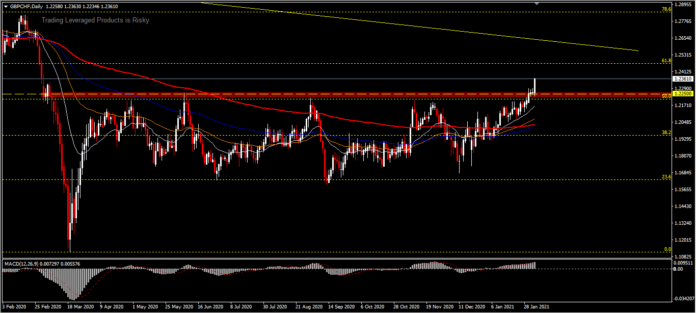

GBPCHF, Daily

The Pound remains buoyant after the BoE’s more upbeat than expected guidance yesterday, which catalysed a spike in UK yields. Sterling earlier edged out a fresh nine-month peak against the Euro, and Cable spiked through 1.3700 for a 3-day high. The UK currency yesterday rallied by nearly 1% against the Dollar in the wake of the BoE policy announcement. This was concomitant with the 10-year gilt year spiking by nearly 10 bp at the highs. Cable U-turned out of a 17-day low at 1.3567 and rallied to a two-day high at 1.3698, with 1.3745 a key resistance to the upside. EURGBP dove to fresh eight-month lows and GBPJPY spiked to a one-year high at 144.40. As we noted ahead of the meeting, market expectations seemed disposed to expecting dovish rather than less dovish policy signalling, so the BoE’s overall upbeat outlook was a jolt to the prevailing sentiment, especially in the context of recent ardent dovish signalling from policymakers at the Fed, ECB, RBA and others. The BoE’s emphasis that contingency preparations for negative interest rates should not be construed as a signal that negative rates are inevitable caught attention in market narratives, despite being a reaffirmation of standing guidance. The BoE’s 2021 UK GDP growth downgrade, to 5% from 7.5%, which was due to a harsher than anticipated return to Covid lockdown measures, was immaterial for markets, with the BoE still projecting a rapid recovery toward pre-pandemic levels during 2021, with policymakers assuming that the vaccination program will lead to an unwinding of societal restrictions. The BoE did caveat that the outlook remains unusually uncertain due to the vicissitudes of the global pandemic.

GBPCHF continued its advance after the BoE did not send any signals about negative Interest Rates. So far the price is moving higher at 1.2360 after breaking out of the average high of 1.2250 which is also the long-held 50% retracement level.

A further rally could be expected, as long as the support 1.2235 remains intact. The bulls are now seen continuing the overall medium term rebound from 1.1115. The next target is the 61.8% retracement of the FR at 1.2468. Technically, all indicators support the trend, which is seen as the price is moving away from its 20-day moving average (white line) and MACD remains above neutral. On the downside, a retest is possible at the 1.2250 level in the case of a momentum slowdown.

Click here to access the HotForex Economic Calendar

Ady Phangestu

Analyst – HF Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.