After experiencing range volatility in the past 3 weeks, the AUDJPY resumed its upward trend and closed up 1.66% at 80.85 last week, the best performing currency pair in the week. At the opening of the market today, the currency’s bullish offensive against the market has not been extinguished and is currently approaching the key level of 81.00.

The AUDJPY is one of the important indicators for identifying market risk sentiment, and a number of fundamental factors have recently successfully promoted the continued rise of the currency. First of all, as the Covid-19 vaccine is launched on the market, many countries around the world are actively launching vaccination activities.

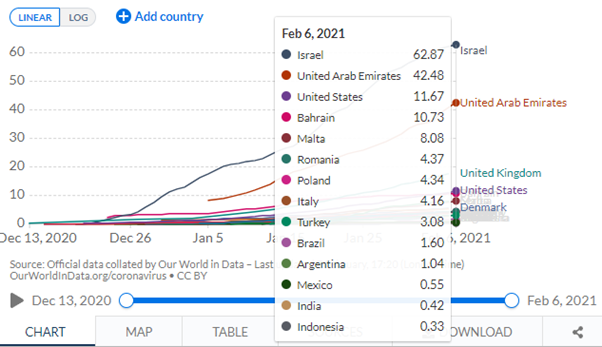

Figure 1 shows that as of February 6, Israel ranked first in the ratio of the number of coronavirus vaccines administered to the total population (that is, the total number of vaccines administered in each country/total population), and the country’s vaccine coverage rate was 62.87%. After President Biden took office, the United States also swiftly promoted the vaccination plan, thus reaching 11.67% of the vaccine coverage. As of February 5th, the UK had a vaccine coverage rate of 17.64%.

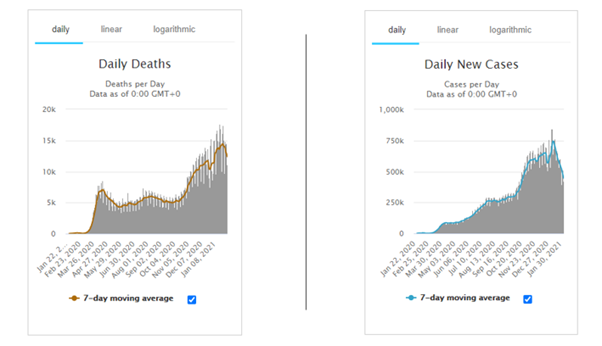

After the governments of various countries actively responded to the vaccination plan, we have also seen signs of a decline in the number of new daily cases and mortality rates recently. Figure 2 shows that the 7-day average of the two data has declined since the beginning of last month. Obviously, these phenomena have once again boosted market risk sentiment.

In summary, according to Bloomberg News , the current global vaccination rate averages 4.69 million doses. At the current rate, it will take about 6.7 years for double-dose vaccination to cover 75% of the population. (According to Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, if the US vaccination rate reaches 70% to 85%, the economy is expected to gradually return to normal levels.) However, the epidemic scientists have also warned that even if the vaccine is 95% effective, it does not guarantee that people will not be infected with the virus after being vaccinated. This is undoubtedly a hidden danger to the economic recovery. Until we really see the desired result, everything is still unknown.

In Australia, the Reserve Bank of Australia announced an increase of 100 billion Australian Dollars in QE last week, once the current billion Australian Dollar/week debt purchase action is completed in mid-April. In response to the short-term economic outlook, the Reserve Bank of Australia expects Australia’s GDP to return to the level of the end of 2019 in the middle of this year. Another positive factor for Australia is the rapid recovery of the Chinese economy, which has also successfully pushed up the price of Australian iron ore to a 10-year high.

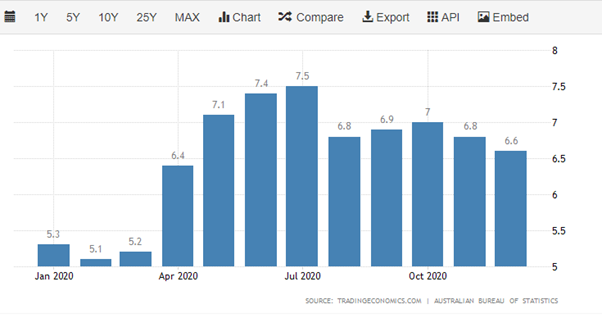

In December last year, the Australian unemployment rate recorded a modest decline to 6.6% from 7.0% in October. In any case, the market still needs to pay attention to the impact of the government wage subsidies on the job market that will expire in March. If proper assistance is not obtained in time, Australia may face the risk of corporate bankruptcy and the dismissal of a large number of employees.

Technical Analysis:

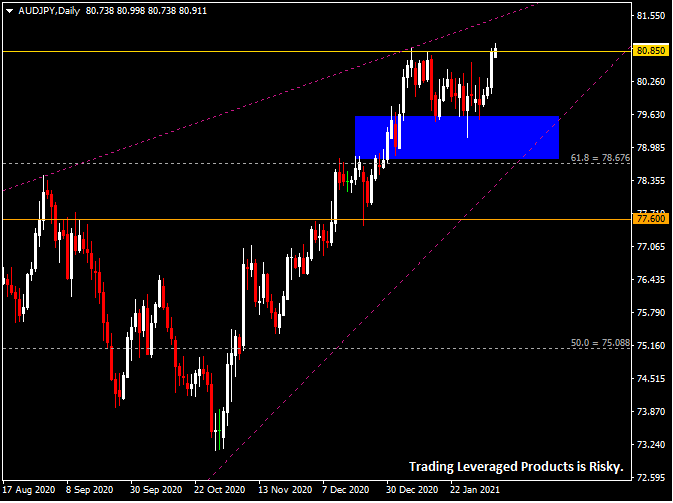

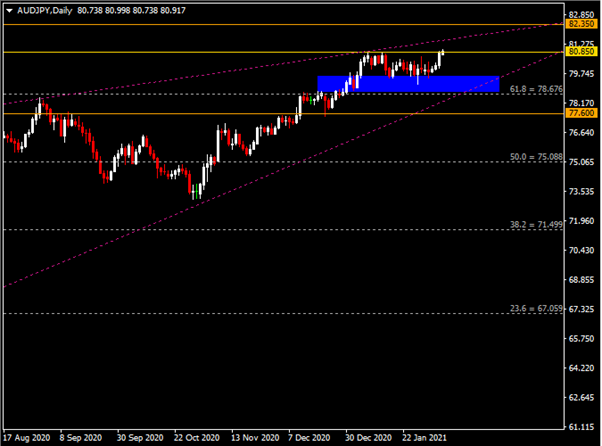

The weekly chart shows that the AUDJPY reached the lowest point of 73.169 in the call-back from the first round of gains, and then started the second round of gains and crossed the 61.8 Fibonacci retracement level (78.65). Currently, the key resistance of 80.85 is being continuously tested. The relative strength index (RSI) and random index (Stochastics) values are 67.87 and 82.91, respectively.

From the daily chart perspective, the current key resistance is obviously 80.85 . At the same time, the upper trend line also provides resistance for the currency against the bulls. Below that support at 78.65 (61.8 Fibonacci retracement level) and 77.60.

Click here to access the HotForex Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.