Baidu, Inc (NASDAQ: BIDU) is scheduled to report its fourth quarter and fiscal year 2020 financial results this Wednesday, 17th February 2021, after the US market closes.

From being a search giant and online marketing solutions and advertising services provider in China to then diversifying its business into artificial intelligence (AI) [Kunlun 2 for deep learning, AI algorithm for mRNA sequence optimization in developing Covid-19 vaccine], autonomous driving (AD) [MaaS platform, robotaxis and robobuses] and even electronic vehicles (EV) (in partnership with leading automobile and EV manufacturer Geely) in recent years, the company has since started to gain investors’ attention worldwide.

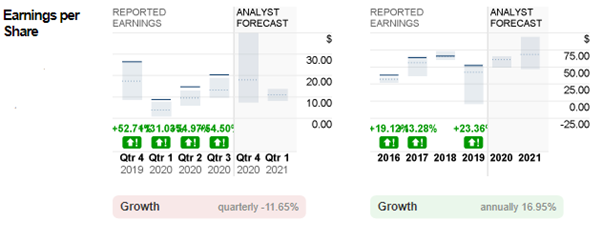

Consensus estimates for earnings per share (EPS) in Q4 2020 stand at $17.98, down 11.65% from the previous quarter. It is also expected that the annual EPS growth will be realized at $60.86, up 16.95% from a year ago.

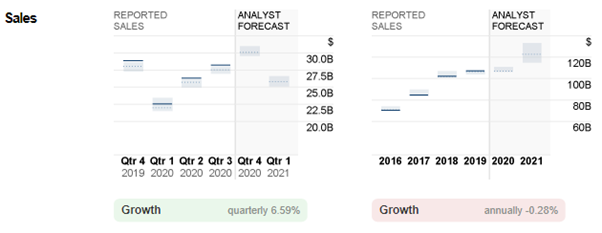

On the other hand, reported sales for Q4 2020 are expected to hit $30.1B, up 6.59% from the previous quarter. Nevertheless, consensus estimates for annual reported sales stand at 107.1B, down 0.28% from a year ago.

It is still worth noting that the company reported negative growth in net income (-93.09%), diluted EPS (-93.13%) and EBITDA (-23.32%) in 2019. The reasons behind this include continuing headwinds from the US-China trade war and a sharp deterioration in the company’s core search-related revenues.

However, considering the company’s interesting fundamentals and its ability to resolve unfavourable issues within a few quarters as well as bringing stable profits to the shareholders, 30 out of 39 polled investment analysts have given a Buy rating on BIDU. However, the median estimate for the 12-month price target was set at $254.72, down 22.86% from the last price of $312.94. This may be explained in terms of the forward P/E ratio. Based on the given information, forward P/E of BIDU stands at 29.72 versus its industrial figure, i.e. US Information Services sector which stands at 39.96, indicating that the Baidu’s reading is at a discount compared to its whole US industry’s figure, indicating pessimism of the market for the company’s prospective growth in the near-term.

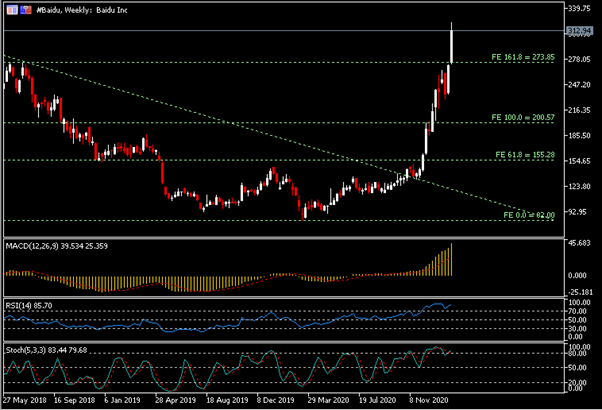

Technical Overview:

The Weekly Chart shows that the #Baidu share price has been riding on a strong bullish trend following its rebound since mid-March 2020. The company’s share price is currently trading above FE161.8 ($273.85). Indicators are aligned in positive territories: MACD lines extending towards north while RSI and Stochastics are seen hovering above 80.

From the Daily Chart, note that the #Baidu share price is currently testing an immediate resistance at $312.05 (D1 FE 61.8). A successful breakout above the level may indicate that the price will extend higher, with $362.75 serving as the second resistance. On the flipside, a failure in bullish breakout may suggest price correction towards the support level $273.85 (W1 FE 161.8), $230.00 (D1 FE 0.0) and $200.55 (W1 FE 100.0).

Click here to access the HotForex Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.