On Wednesday, February 3, the site for the auction and electronic commerce of products, eBay, released the results obtained in the fourth quarter of 2020, which exceeded analysts’ forecasts. The company consolidated an earnings per share of $0.86 and a turnover of $2.87B, with which eBay’s stock increased 9.98% to trade at $63.24. In the first months of 2021, the company’s stock has advanced 15%.[1]

Faced with the pandemic, some buyers have chosen to take refuge in online markets such as eBay and Amazon to avoid stores and respect social distancing, which helped eBay achieve 185 million active buyers by the end of the quarter, a 7% increase, showing that the company has managed to maintain gains despite the Covid-19 pandemic. In turn, the company registered an increase in its income of 28%, reaching $2.89 billion for the period that ended on December 31, where the profit was $0.86 per share. [2]

Given these results and the reports on the profits obtained in their fourth quarter, eBay shares managed to recover for the session on Thursday, February 4, and rise 11.7%. In light of this, the company’s management predicts greater growth in the remainder for the year with possible first quarter revenue in the range of $2.94 billion to $2.99 billion, ahead of analysts’ estimates that place it at $2.5 billion. It is also believed that adjusted EPS could consolidate between $1.03 and $1.08, while Wall Street estimates it at $0.85. [3]

Finally, it should be noted that within the fourth quarter of eBay, the gross volume of its merchandise increased by 21% to a value of $26.6 billion dollars, with 18% on a neutral base in terms of currency exchange. Its annual assets grew 7%, consolidating at $185 million, while advertising sales reached a new 2020 milestone as it managed to exceed $1 billion in revenue for that year, leaving the historical maximum price of its shares at $61.06. [4]

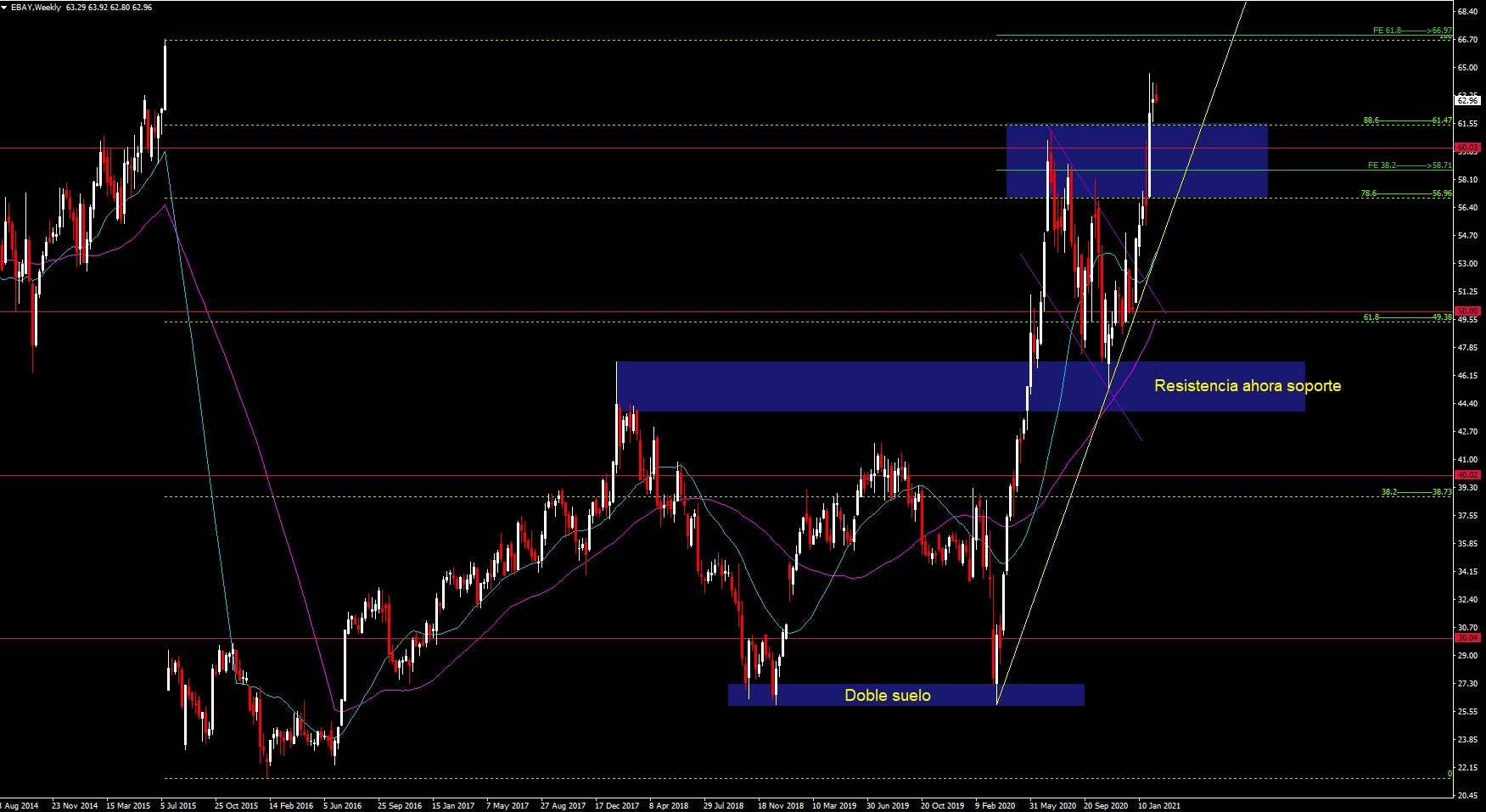

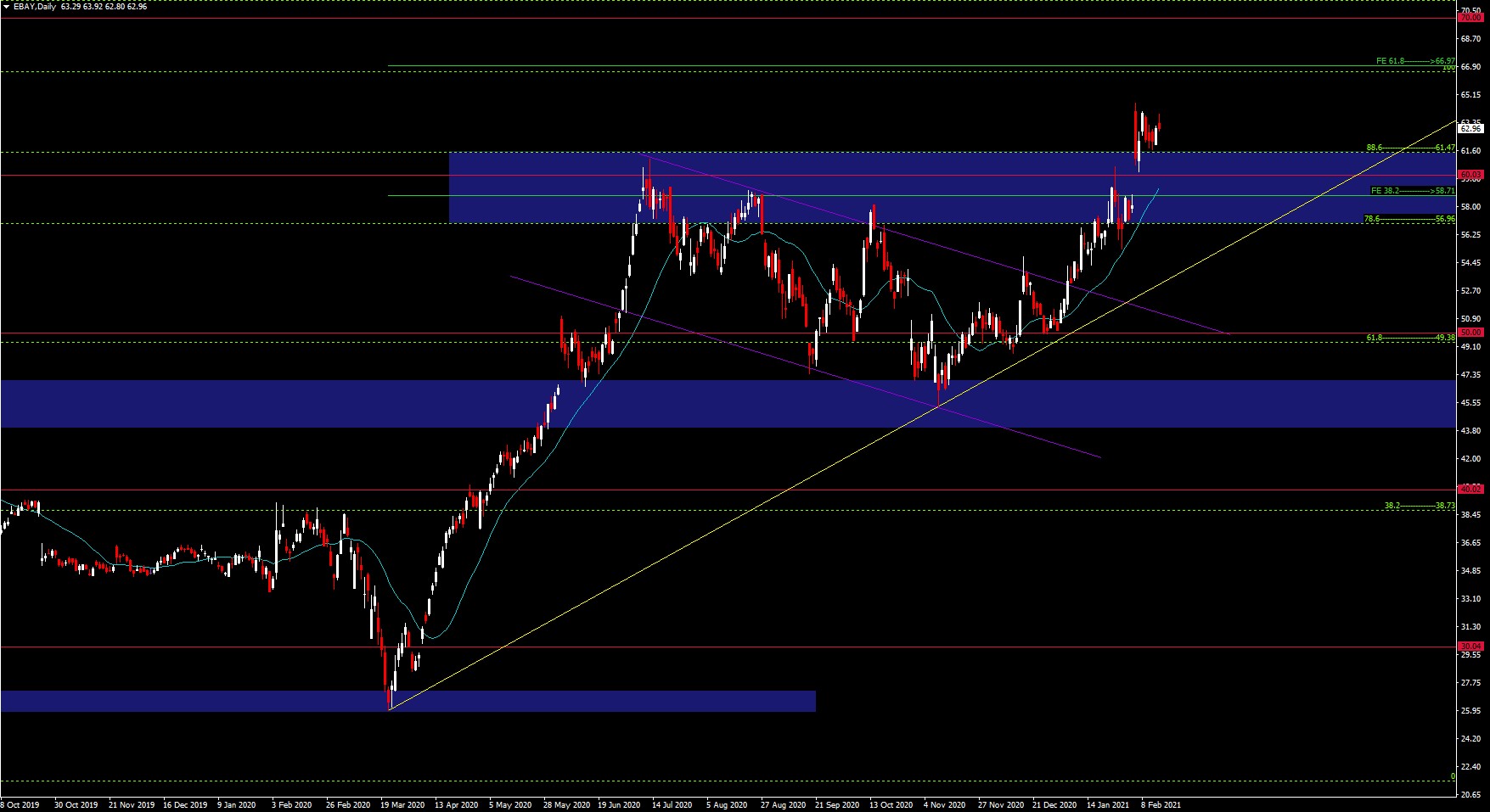

The price has been in a bullish rally since the beginning of March 2020 following a double bottom below its long 3-year support of $30. It formed a very strong bullish rally to the psychological level of $60 before continuing with a retracement in the form of a flag in Q2-Q3 2020 that broke to the upside by bouncing off the Resistance, now Support, from the previous 2018 high. Currently the price has broken above the $60 level and is at $62.96, leaving a support range from the 78.6%-88.6% Fib level at $56.96-$61.47. If it maintains this range and the bullish guideline, it could test the 2015 high at $66.71. If exceeded this level it would seek higher levels such as the FE 61.8 at $66.97, the psychological level of $70, 127.2% Fib. level at $79.13, the psychological level of $80 and FE 100 at $80.36.

Lower Supports are found on 61.8% Fib. level at $49.50 to the psychological level of $50, the range of the 2018 high at $44.34-$46.95 and 38.2 Fib. level at $38.80-$40.

- https://es.investing.com/news/stock-market-news/ebay-mejora-sus-beneficios-e-ingresos-en-el-q4-2078787

- https://finance.yahoo.com/news/ebay-projects-revenue-tops-estimates-212836581.html

- https://www.fool.com/investing/2021/02/04/why-ebay-stock-jumped-today/

- https://www.investors.com/news/technology/ebay-stock-fourth-quarter-earnings-announement-ebay/

Click here to access the HotForex Economic Calendar

Aldo Weidner Z.

Market Analyst – HF Educational Office – LATAM

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.