Lowe’s Companies, Inc. (LOW) is a home improvement retailer with more than 2,200 in-store locations and one of the FORTUNE® 50 companies, with a market capitalization of US $123 billion. It is in queue to report fourth quarter earnings today (24 February) before the US market opens.

As for expected earnings per share for the quarter, Zacks forecasts $1.22, which is lower than the previous three quarters, though it should be noted that the reported return per share for the past six quarters all came out better than Zacks expected. Meanwhile, the company’s sales forecast is expected to be $19.33 billion, well below the $22.31 billion third-quarter sales estimate of $21.07 billion.

According to the company, in the third quarter, due to the impact of Covid,, the company incurred over $245 million in hourly assistance costs, and more than $ 1.1 billion since the beginning of this year.

In addition to Covid’s impact, according to past sales statistics, Q4 is often the quarter where Lowe’s has lower quarterly sales. As CFRA Research analyst Kenneth Leon wrote in a note: “As Lowe’s has invested in a storefront, elevated service and e-commerce platform. All of this could result in an increase in profit in the quarter ended January. Including the first quarter of 2021.”

However, the effect of Covid through 2020 may affect the company’s Q4 sales compared to the previous quarter of the year even as vaccination programs and the relaxation of lockdown measures helps to increase confidence in shopping after the long Covid crisis.

In addition, last December the company discussed plans to increase its efforts to capture more of the contractor market share in hopes of doubling the income from these professional builders. If successful, t revenue would be on par with its main competitor, Home Depot.

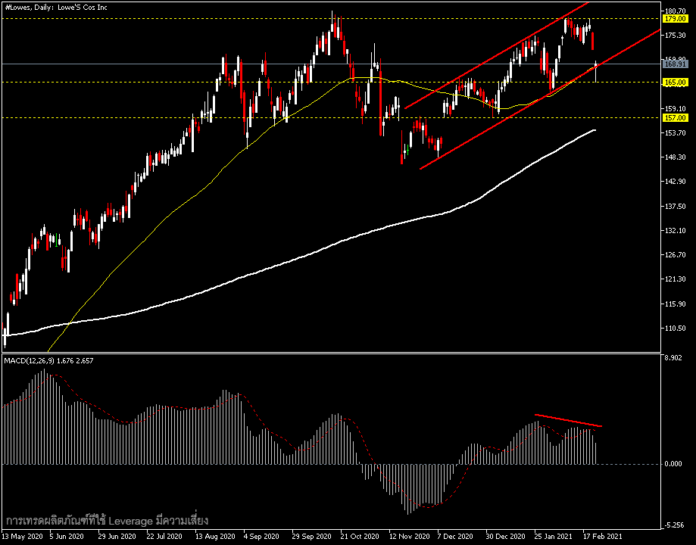

For the technical angle the share price has dropped from the All-Time High at $179 this week, and the price fell yesterday to close at the MA50 price of $168.59 after a likely bearish divergence since last week. The first support is at yesterday’s low of $165 and the next support is at the MA200 at $157, but if the numbers are reported better than expected we may see Lowe’s share prices test old highs and potentially lead to new all-time highs.

Click here to access the HotForex Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.