Market News Today – USD at 3-year lows, Equities recover over 1%, (Dow over 32K) Yields cool again but remain relatively elevated (10yr – 1.41%). RISK ON. JPY & CHF heavy. Commodity currencies & Sterling hold bid, EUR breaks January resistance. Copper at 10-year high, Oil at 13-mth high, Gold under $1800. BTC at 50K. Sentiment lifted as J&J announce a single shot vaccine and independent study shows Pfizer vaccine 94% effective. Overnight – Nikkei up 1.67%, German Gfk confidence ticks higher, Gamestock rallied over 100% and then another 75+% after hours!

Reflation trades are back in full swing with bonds selling off and stocks rallying, with the combination of fiscal stimulus and ongoing monetary support fulling the moves. US 10-year rates have dropped back from session highs, but are still up 3.2 bp at 1.41%. Japan’s 10-year has gained 2.1 bp to 0.125% and longer dated benchmarks have now broken multi-annual highs. Australia and New Zealand bonds underperformed and Australia’s 10-year rate lifted nearly 12 bp, despite the fact that the RBA bought bonds for the second time this week. Fed Chair Powell tried to dampen inflation concerns and Vice Chair Clarida said he expects current bond purchases to be maintained at the current pace for the rest of the year. That will likely continue to underpin risky assets and in some quarters add to concerns that easy money is fuelling bubbles in equities and elsewhere.

Today – US Durable Goods, GDP, Weekly Claims & PCE Prices. ECB’s Lane, de Guindos, de Cos, Fed’s Bostic, Bullard, Quarles, Williams, and Earnings from over 400 companies in US & Europe.

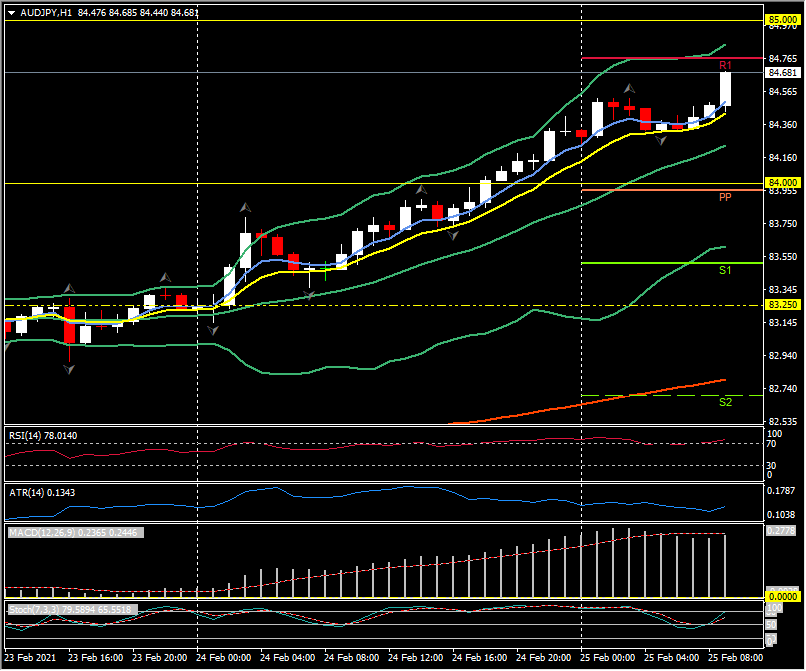

Biggest (FX) Mover @ (07:30 GMT) AUDJPY (+0.36%) Continued yesterday’s momentum rallying from 83.20 and holding over break of 20MA testing over R2 (84.50) to 84.65, R3 85.00. Faster MAs aligned and trending higher, RSI 77 and rising, MACD histogram & signal line aligned higher but flattening after big break of 0 line yesterday. Stochs down from OB zone but rising again. H1 ATR 0.1325, Daily ATR 0.6000.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.