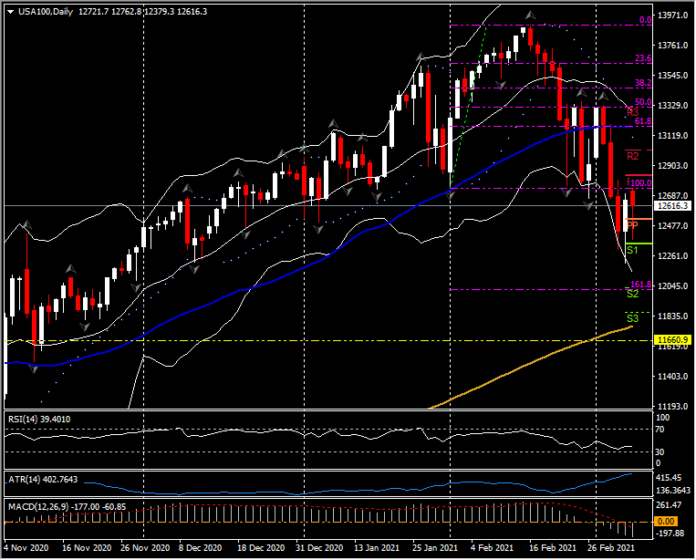

USA100, Daily

US equity markets continue to feature a churn from growth focused Technology stocks into cyclicals including Energy, Financials and Industrials. The logic is that technology stocks are more vulnerable to fall in the US Bond markets as the aftereffect of the rise in yields due to their valuations being based so much on future earnings. Today the USA100 is currently trading lower again around 12,470 ahead of the cash open and remains well below the converging 20 and 50-day moving averages at the 13,200 zone.

The continued soothing words from Jerome Powell last week, possibly the last before the FOMC meeting (16-17 March), and an expected similar tone from Christine Lagarde at this week’s ECB meeting and press conference (11 march) add to the feeling of an inevitable spike in inflation and therefore the premise that the bond markets remain on course for more weakness. The continued bid on major commodities such as oil and copper simply add to this outlook. The central bankers continue to tread a delicate balancing act between a benign attitude to rising inflation expectations and actively encouraging a spike and overheating their economies. The big beat from the US nonfarm payroll data on Friday also added to the argument that the spike in prices could come sooner than expected. However, jobs growth remains fragile; the wider U6 measure of unemployment in the US remains over 10% at 11.1% and although it is trending lower, it is still a significant caveat for the amount of slack in the economy. Friday’s payrolls showed a big welcome boost for services jobs (the hospitality sector in particular) but the workweek was trimmed in January and fell sharply in February, leaving a big undershoot for hours-worked. Payrolls over the May-February period have reclaimed 58% of the jobs lost in March and April. Hours-worked have reclaimed a larger 64% of the drop. The larger workweek surge means that hours have been recouped by fewer workers working longer hours. The impact of the severe cold snap in the US is also yet to be fully absorbed.

The US Senate passed the $1.9 tln rescue plan over the weekend, and it is expected back on the floor of the House on Tuesday to add to the wall of money being pumped into the US economy. The vote was on strict party lines with all Democrats supporting the bill and all Republicans opposing. A few changes were made to the size of unemployment funding, hence the return to the House. The bill includes $1400 checks to individuals earnings less than $75,000, along with $300 per week in enhanced unemployment benefits (versus $400 previously). The additional stimulus should help boost equities near term, though it’s been largely priced in and the probable rise in bond yields could limit the upside and weigh value stocks to make for choppy action as we have seen so far today with all three major US equity markets lower.

The USA100 broke below the 20-day moving average (13,525) on February 22, the 50-day moving average 3 days later and then gained momentum last week to post a new 2021 low at 12,205. Next support is at the 12,000 level, a psychological round number, with the confluence of the daily S2 and 161.8 Fibonacci extension close to it. Below the latter lies the 200-day moving average at 11,750 and then the October low at 11,000. RSI and MACD both continue to track lower. To move higher again, 13,200 is now key, with the convergence of the 20 and 50-day moving averages and the 61.8 Fibonacci level. Above here resistance lies at 13,500 and the all-time high at 13,920.

Click here to access the our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.