This week will be quiet for England. One of the data releases on Friday is January GDP which is expected to fall by 5%, which is driven by the closure of several consumer service sectors at the beginning of the year. It is likely that these data will not have a major impact, given the fast-running vaccination program and the anticipated strong economic rebound in the second quarter. The general risk sentiment and the swift UK vaccination process will still dominate the pound’s movements. The decline in the last 2 weeks, apart from the technical factor of the price having peaked which makes it likely that there will be a corrective action, is also influenced by the sharp increase in US yields. However, it has improved relatively recently, compared to other European currencies.

Today (8 March) BoE Governor Bailey will present his views. At the end of February he confirmed that the UK economy is likely to be negative in the first three months of 2021, but he expects the economic contraction to be lighter than the record decline recently in GDP.

If you pay attention to past risk sentiment, GBPUSD seems to be into corrective action compared to trend changes. After the sharp spike in yields subsides and risk appetite stabilizes, the pair is still likely to move upwards again. This week, if there is a further increase in yields this will still be a threat to the Pound.

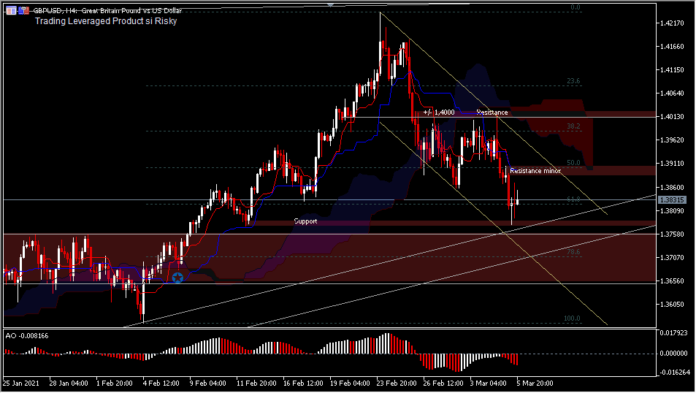

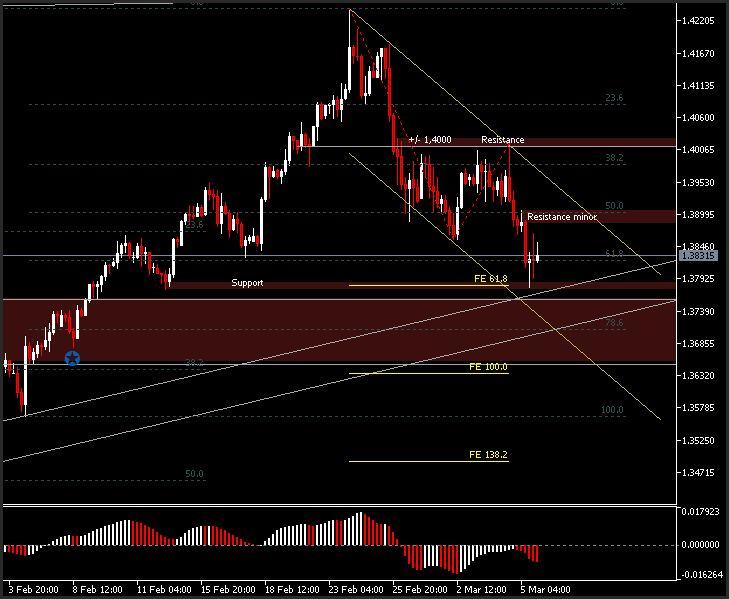

GBPUSD’s correction  from the new peak of 1.4240 continued to the 1.3777 level last week on the FE projections of 61.8. Initial bias still points to the downside this week for further projections in FE 100.0 (1.3635) to coincide with January 2021 opening prices. Temporary downside moves were constrained by minor support. On the upside, a break of the minor resistance 1.3905 will target the continued resistance near the psychological level of 1.4000. A break of this level would denote that the temporary correction has been completed, and the possibility of a retest of the 1.4240 peak.

from the new peak of 1.4240 continued to the 1.3777 level last week on the FE projections of 61.8. Initial bias still points to the downside this week for further projections in FE 100.0 (1.3635) to coincide with January 2021 opening prices. Temporary downside moves were constrained by minor support. On the upside, a break of the minor resistance 1.3905 will target the continued resistance near the psychological level of 1.4000. A break of this level would denote that the temporary correction has been completed, and the possibility of a retest of the 1.4240 peak.

Technically, intraday is still in risk sentiment as seen from the AO bar below the neutral zone, but if there is an increase it could form a divergence bias. Obviously the price is forming a pattern a, b, c and is below the Kumo after the “dead cross” of Tenken sen and Kinjun sen twice in the intraday period, but the thin January transaction range will be a strong equilibrium level; meanwhile the ascending trendline will be additional support.

Click here to access the our Economic Calendar

Ady Phangestu

Market Analyst – HF Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.