Market News Today – USD holds its bid, 10-yr Yields rally. Yellen calls the $1.9t stimulus package “very strong” for the US economy. Nasdaq closed down -2.4% (10% below Feb high, a technical correction) but DOW gained 0.97%. PBOC lifted sentiment saying money supply would be in line with GDP growth and they did not see need for stimulus for next 5 years. Nikkei +1%. Yields and USD slip. Overnight – mixed data from JPY, surprise jump for a UK retail sales tracker and the German Trade balance.

The Dollar posted fresh highs before receding, with the USDIndex hitting a fresh 15-week peak at 92.50 and then declining to levels around 92.05. The greenback’s softening was concomitant with a dip in US Treasury yields, which was seen as the Asian session progressed. The 10-year US note yield ebbed below 1.560%, after peaking yesterday at levels above 1.610%.

In other markets, base metals dropped, diverging from the rise in stock markets. Oil prices also turned lower. USOil ebbed to a four-day low at $64.34, extending a correction from yesterday’s 29-month high at $67.98. The already mentioned up-then-down action of the Dollar provided the only directional theme among the main currencies. EURUSD lifted from a new one-month low at 1.1836 to a rebound peak so far at 1.1888 while USDJPY fell from a nine-month peak at 109.24 to a low at 108.75. Cable rose from near one-month lows to a four-day high at 1.3885, and AUDUSD lifted out of a one-month low at 0.7621. USDCAD saw an ebb from highs, with the pair remaining well within recent range bounds. In the bigger view, we expect the reflation trade to hold up as the year progresses given the evident success of Covid vaccinations in countries that are more advanced in the vaccine rollout, which should allow for the continued reopening of major economies, and which in turn should maximise the impact of fiscal stimulus and an anticipated lockdown-savings-fuelled consumer spending spree. Given the outsized US fiscal stimulus and associated impact on yield differentials, this backdrop may not be the dollar bearish environment it was once thought it would be.

Today – BoE’s Haldane, RBA’s Lowe, Fed’s Kaplan & US supply – $120b of 3-, 10- and 30-yr US Treasuries being auctioned this week – last week’s “woeful” 7-yr auction saw yields double from the last auction.

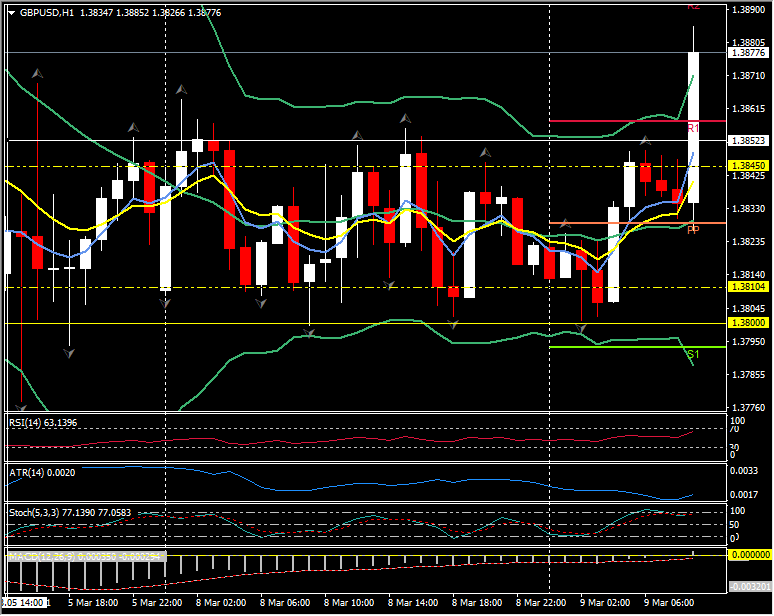

Biggest (FX) Mover @ (07:30 GMT) GBPUSD (+0.42%) Big spike at 07:00. Moved higher following support at 1.3800 yesterday, now breached R1 at 1.3857, R2 at 1.3893. Faster MAs aligned and trending higher, RSI 60 and rising, MACD histogram & signal line aligned higher and attempting to break 0 line. Stochs into OB zone. H1 ATR 0.0020, Daily ATR 0.0115.

Click here to access the our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.