The USD posted fresh highs before receding, with the Dollar basket reversing yesterday’s gains. The Greenback’s softening was concomitant with a dip in US Treasury yields, which was seen as the Asian session progressed. The 10-year US note yield ebbed below 1.560%, after peaking yesterday at levels above 1.610%. At the same time, stock markets in Asia rebounded from early declines, and US equity index futures also rallied, where a rotation out of tech and into cyclical stocks had been in play.

The USA100 future leads rebound in equities. It was government backed funds, in Europe, and a survey in US futures, in particular the USA100 future, that helped equities to find a footing. Calming words on inflation from US Treasury Secretary Yellen yesterday helped, but with the sense that the US economy is itching to roar back and that inflation is unlikely to disappear, we would expect yields to resume the uptrend before long. So bonds are once again only taking a breather, amid a wider uptrend in yields. Additionally, some market narratives ascribed the improvement in equity sentiment as being at least in part facilitated by remarks from PBoC Deputy Governor Chen, who said that China’s money supply growth would not exceed GDP growth and that the central bank did not see any need for major stimulus over the next five years.

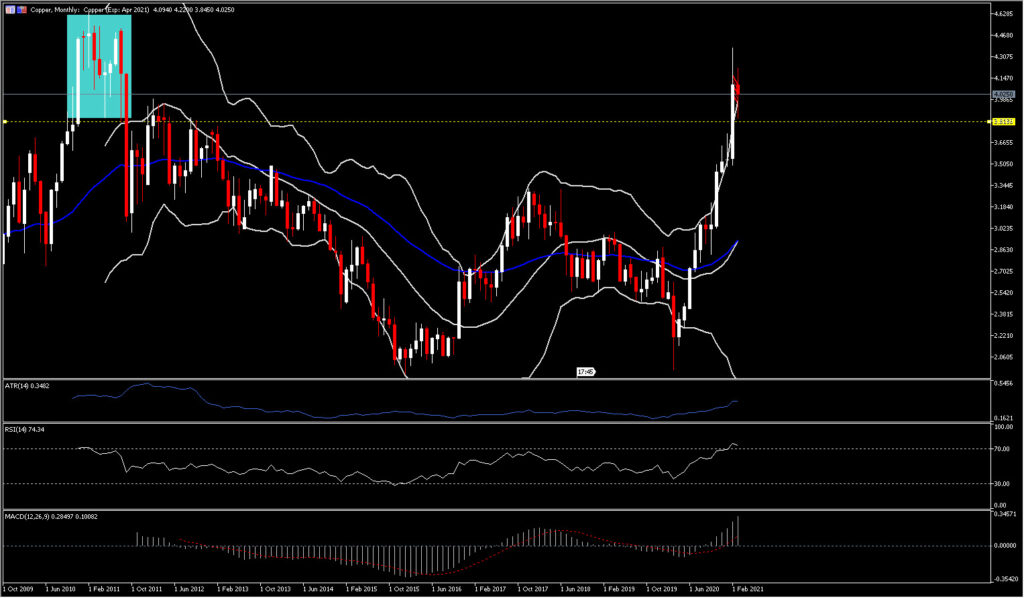

In other markets, base metals dropped, diverging from the rise in stock markets. Copper more precisely has been one of the biggest losers of the day and the past 9 days after posting a decade high at 4.37. As stated back in December in one of our Special reports, Copper is an asset which is strongly supported by underlying fundamentals which support and could continue to support the asset in the long term.

Even though stocks hit record levels in the middle of February, they have struggled to advance further since then as rising rates and fresh uncertainties over the virus weighed on risk appetite. Vaccinations were on the rise while new cases and hospitalizations declined, supportive of the market’s view that the recovery will broaden in the second half of 2021. The emergence of new virus variants provided an offset to the encouraging news on the vaccine, and surging commodity prices and rising inflation pressure, alongside the impending new stimulus package, drove up yields. The increasing tension between a stronger growth outlook but rising inflation risks, with new virus variants adding uncertainty, has rattled market sentiment.

But Copper, in contrast to precious metals, oil and natural gas, has a bunch of reasons to hold higher due to its essential use in the manufacturing industry. The Energy market’s performance reflected concerns in regards to demand with cold weather in Texas and the latest news yesterday that Yemen’s Houthi forces fired missiles into Saudi Arabian oil facilities which sparked the latest rise in oil prices, which had already been buoyed by the US stimulus bill’s passage in the Senate and the strong US jobs report last Friday, along with the unexpected decision by the OPEC+ group last week to maintain prevailing output quotas through April.

However Copper is not at this point, or in the long term, strongly correlated with weather and geopolitics, or even the current reflation trade but simply speaks to the transformation of the world into “green” economies. Joe Biden’s election for example was also another factor in Copper’s rally as he represents, as stated back in December, significant green tech spending. Copper is set to enjoy an even bigger rise in demand because of the transition away from fossil fuels, similarly to Palladium which is also a necessary component of electric vehicles engines.

As stated by FT, Copper is used in everything from power cables to electric vehicles and demand is expected to increase in coming years because of the “greening’’ of the global economy. According to Richard Adkerson: “Tackling carbon emissions is not impacting the near term price in any significant way but it will impact demand in a very significant way going forward. ”

In the meantime, the reflation trade story also supported and keeps supporting Copper amid the hopes of reopening of the global economy, and hence the rising demand is not solely from China but further regions. China’s strong demand was the main reason why Copper has doubled since the 1st wave of the pandemic in March 2020. According to Bloomberg the levels of Copper sat in China’s bonded warehouses have stayed high since the surge higher from July last year. Stockpiles have also been reported to be picking up in Shanghai, London, and New York since late February. Furthermore, with reports that China is also talking about walking back from easy policy it looks like Copper will find sellers in the short term rally higher.

However, in the medium and long term, pullbacks such as the ones that we have recently seen from decades highs to the 3.80 area (2010-2011 support area as well as 2021 support) could find buying pressure as global economic data and upbeat vaccine progress have prompted the markets to increasingly price in a recovery, something that implies rising copper demand and hence potential continuation of the year’s uptrend. That said, several institutional traders and big investment banks have already upgraded their near-term copper point:

- Citi bank: Price forecast (0-3 months) to $10,500/t (prev USD 9,000/t); and raised their 2021 forecast to USD 10,000/t (USD 9,000/t).

- GoldmanSachs also reckon Copper could surpass its 2011 high of $10,190 a tonne.

- JPMorgansaid “green” copper demand from electric vehicles and renewable energy would rise from 925,000 tonnes this year to 4.2m tonnes by 2030.

Additionally, the run-up in the copper price comes also as the Phoenix-based Freeport, a Phoenix–based mining giant, which operates large, long-lived, geographically diverse assets with significant proven and probable reserves of Copper, Gold and Molybdenum, is set to increase output from a multibillion-dollar underground expansion of Grasberg, its giant Indonesian copper-gold mine. Over the next two years Grasberg’s Copper and Gold production is expected to double to 725,000 tonnes and 1.6m ounces respectively.

In the bigger view, we expect the reflation trade to hold up as the year progresses given the evident success of Covid vaccinations in countries that are more advanced in the vaccine rollout, which should allow for the continued reopening of major economies, and which in turn should maximise the impact of fiscal stimulus and an anticipated lockdown-savings-fuelled consumer spending spree. Given the outsized US fiscal stimulus and associated impact on yield differentials, this backdrop may not be the US dollar bearish environment it was once thought it would be but would be base metals bullish as Copper is heading for its biggest supply deficit in more than a decade, with production failing to keep pace with demand in China and the rest of the world — especially as government spending on green infrastructure rises.

Click here to access the our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.