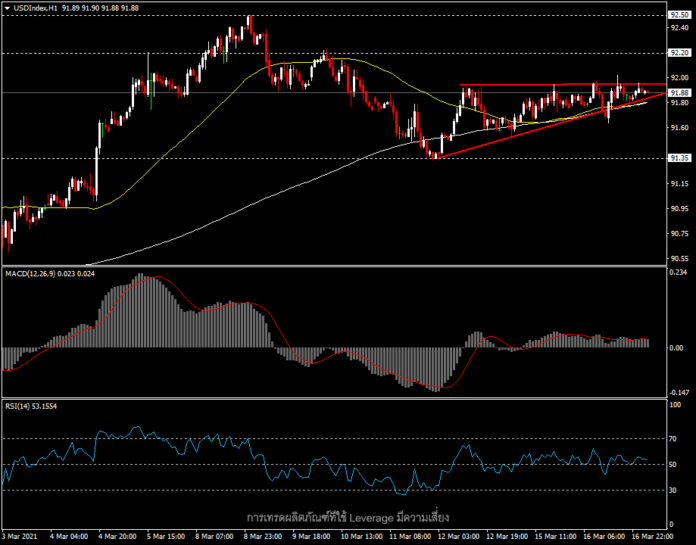

USDIndex, H1

The US Dollar Index has moved in a narrow range, biased to the upside. The Fed’s big interest rate decision meeting tonight comes after the economy has started to recover alongside a sharp rise in inflation and bond yields, although the Fed will continue to let inflation rise for a while. But this week, Fed Chair Powell may find himself in a tough spot, in which he must take a stand to defend a view of monetary policy that is easy and nothing new. Amid the rapid economic recovery, bond markets may need to be subject to serious scrutiny.

Fed Chair Powell’s calmness towards inflation and bond yields coincided with the stance of the ECB chairman Lagarde, who also overlooked inflation and bond yields. This is the reason that the outlook for medium-term economic growth is still regarded as weak by many.

Meanwhile Russia, and a number of other medium income countries in the G20, is considering shifting policy faster than ever. Tightening monetary policy could potentially move interest rates there up another 1.25% by the end of the year.

As a result of the Fed’s upcoming interest rate decision-making meeting and monetary policy, the USDIndex has been trading in a narrow range, with the MA50 and MA200 facing up since Monday. This indicates the market is waiting to hear from the Fed and possibly ready move higher, if there is any change to the anticipated single rate hike for December 2022. The key support is at the low of 91.35, while the first resistance is at 92.20, where if it breaks up, there is a chance of making a new high of the month.

Click here to access the HotForex Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.