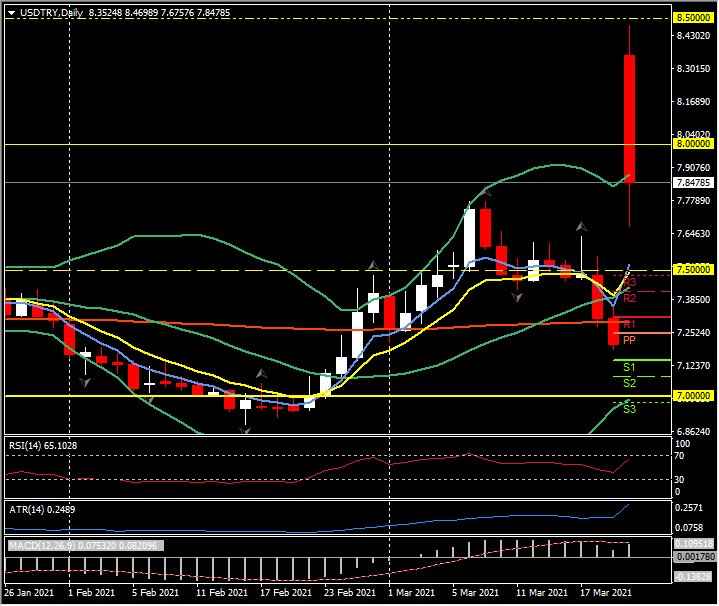

USDTRY, Daily

A plunge in the Turkish lira jolted global markets, following the sacking of the nation’s central bank governor, and with the credibility of the new governor in question. Many developing world currencies were pulled lower as a mostly risk-off sentiment ensued in global markets. Japanese investors are reportedly exposed to the high-yielding lira, which was behind an outsized 2.1% tumble in the Nikkei 225 stock index today. Australian and Chinese equity markets still posted gains, though most other markets declined. US equity futures are showing declines of 0.3% or more, as of early in the London session. The impact on the main currencies has been moderate so far, with the Dollar firming, despite a decline in Treasury yields, and the Yen also gaining following an early-session wobble in Tokyo.

Friday & Weekend – markets flat into close, (Nasdaq up, Dow down), VIX down 3.9%, 10-yr yields closed 1.732%, EUR 1.19, JPY 108.95, GBP 1.3860, Gold $1744 & USOIL $61.50. The COT report showed JPY longs now short for first time since June and USD buying up across the board. The PBOC announced they will be “selective” with policy. Aramco’s profits down -45% (to $49bn & will still distribute $75 bn in dividends). The UK has now vaccinated over 50% of adults (a record 800,000 on Saturday), as the spat with the EU over deliveries of the AZ vaccine rumbles on. AZ US trials show 79% efficacy.

The USDIndex lifted to a 92.15 high, which is 2 pips shy of the 17-day peak that was seen on Friday, while EURUSD edged out a 17-day low at 1.1871. Cable posted a six-day low at 1.3818, and AUDUSD pegged a five-day low at 0.7703. USDCAD, bucking the trend, settled about half a big figure down on the 10-day high the pair saw on Friday, at 1.2549, despite a softening in oil prices. USDJPY ebbed to the mid 108.00s, and most yen crosses saw a similar sinking price action, though the magnitude of movement was limited.

Regarding the situation in Turkey, President Erdogan sacked the central bank’s chief, Naci Agbal, who had only been in the position since last November and was seen as a credible, and orthodox, governor by markets, who had overseen a rebound in the lira from record lows. The central bank under Agbal last week announced a bigger than expected 2 percentage point interest rate hike, to 6.75%, to tackle inflation that is running above 15%. Russia and Brazil lifted interest rates last week for similar reasons. Much of the problem concerns the credibility of Agbal’s replacement, with Sahap Kavcioglu, who wrote in a newspaper article in Turkey last month that “interest rates will directly lead to inflation,” which is of course back to front to monetary policy orthodoxy, though a view also shared by Erdogan. The debacle will lead to capital flight from Turkey, unless capital controls are imposed. It also comes at a challenging time for emerging markets, given the rise in borrowing costs in the US and elsewhere, and with inflationary pressures bubbling up. The Turkish lira was showing a loss against the Dollar of about 17% at the lows, though has settled with a decline of about 10%.

Today – ECB asset purchases, and US Existing Home Sales, ECB’s Lane, Schnabel, Fed’s Powell, Barkin, Daly, Quarles, Bowman.

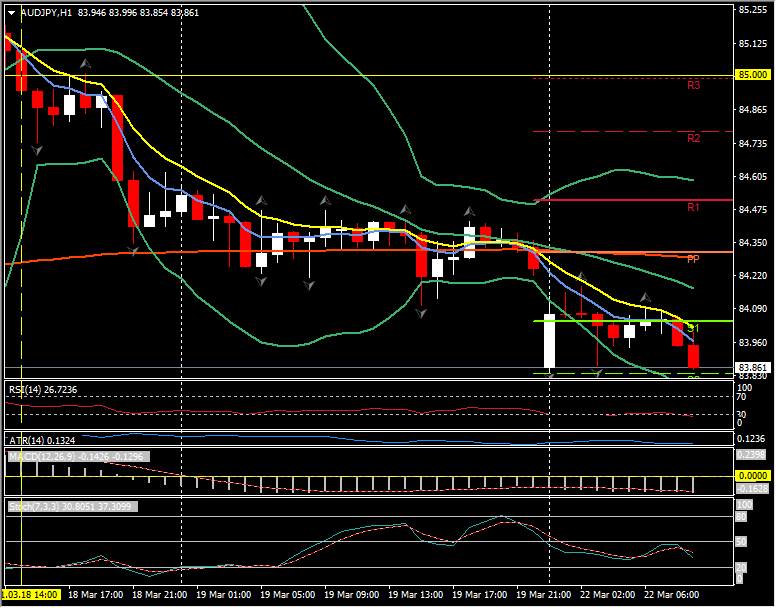

Biggest MAIN (FX) Mover @ (07:30 GMT) AUDJPY (-0.37%) Gapped lower on open this morning from 84.25 to S2 at 83.85. Retraced to S1 but back to S2 now. Faster MAs remain aligned lower, RSI 27 and falling, MACD histogram & signal line aligned lower, both under 0 line from Thursday. Stochs OS and still falling, H1 ATR 0.1325, Daily ATR 0.6950.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.