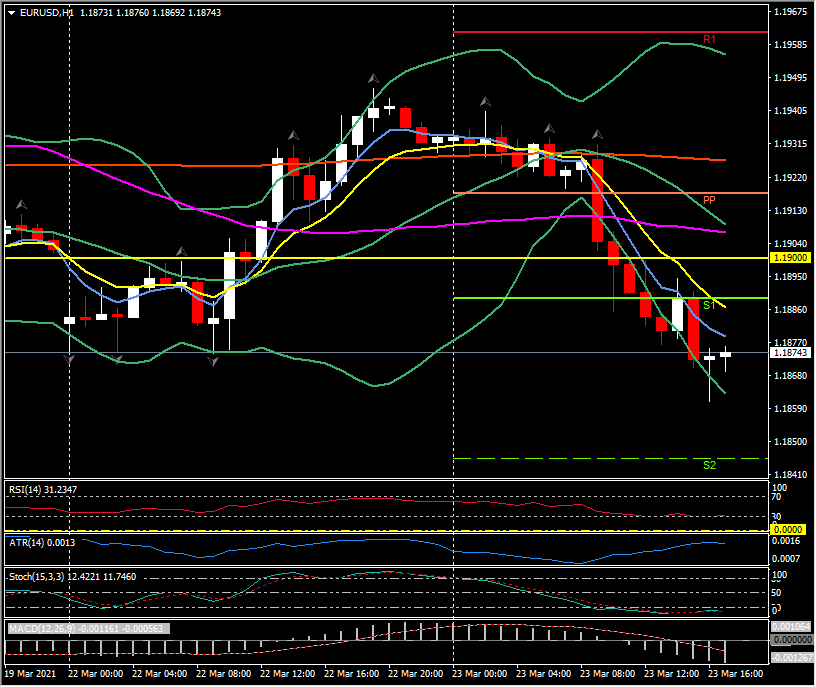

EURUSD, H1

US new home sales plunged -18.2% in February to 775,000, weaker than expected. Sales were up 3.2% to 948,000 in January and 7.2% to 919,000 (was 885,000) in December. The largely weather-related hit breaks a string of 8 straight months of sales at a pace that was the strongest since the 1.016 million in September 2006. Sales declined in all four regions, largely on the polar vortex that put much of the country in a deep freeze. The Midwest led the slide with a -37.5% slump, along with the -14.7% decline in the South, the -11.6% drop in the Northeast, and the -16.4% tumble in the West. So it wasn’t just the weather. The month’s supply of homes jumped to 4.8 from 3.8 (was 4.0). The median sales price slipped -1.1% to $349,400 versus the -1.0% decline to $353,200 ($346,400) in January. The appreciation in home prices slowed slightly to 5.3% y/y versus the prior 7.4% y/y (was 5.3% y/y) clip. The record high was hit in December at $356,600. The data follows yesterday’s big miss for existing home sales which declined to 6.22 million in February from 6.66 million in January.

More positive news is that the March reading of the Richmond Fed manufacturing index rose a significant 3 points to 17. The index was steady at 14 in February after falling -5 ticks to that level in January. The index is down from the 29 reading from October which is the all-time high. The employment component was unchanged at 22 from 22, with the wage gauge at 26 from 32. New orders were also unchanged at 10 from 10. The prices paid index was 6.15% from 4.47%. The prices received component was 3.52% from 2.83%. The 6-month outlook index was 28 from 22, well off the 57 from July that ties the record high from February 2002. The future jobs index was 34 from 36 with wages at 57 from 49. The future new orders index was 24 from 15. The price outlook showed prices paid at 4.66% from 3.78%, and prices received at 3.57% from 2.98%.

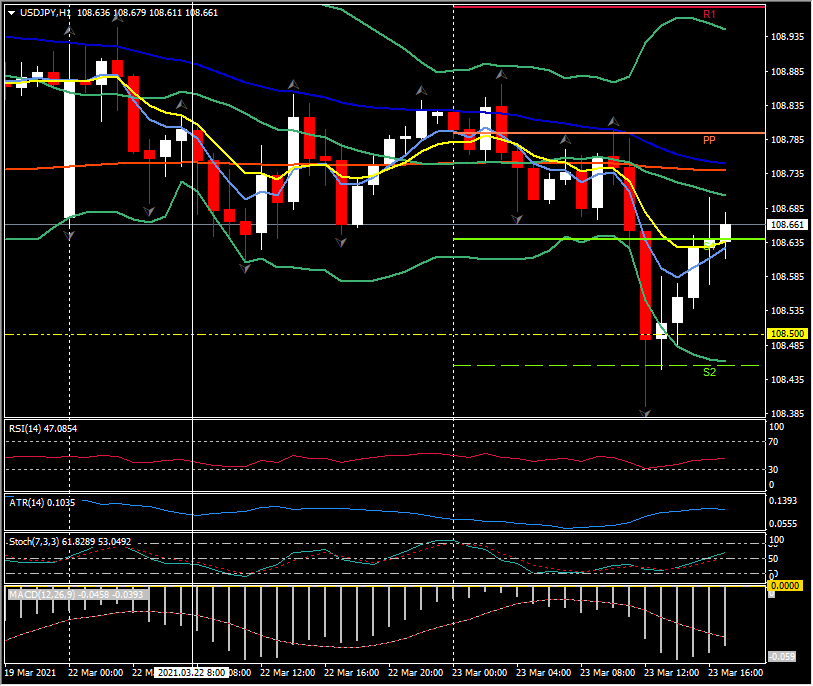

The Dollar moved slightly higher following the data, which saw new home sales miss the mark, while the Richmond Fed index rose more than expected. EURUSD dipped to two-week lows of 1.1861 from 1.1875, while USDJPY edged up from 108.63 to 108.71. Wall Street remains narrowly mixed, while yields are down on the session.

Next up, and potentially more significant, is Chair Powell’s first of 2 days of testimony, along with Treasury Secretary Janet Yellen, on the quarterly CARES Act report before the House Financial Services & Banking Committees.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.