The Pound is under pressure against the US Dollar and Euro after the release of economic data yesterday, and investors seem to be ignoring the unemployment figures. GBPUSD broke below the key support at 1.3777 and the round number 1.3700.

The Pound was dragged down after an ILO employment report revealed that unemployment fell by 5% in the three months to January, down from 5.1% in December and below expectations of 5.2%. An improvement in the unemployment rate occurred, despite a new lockdown taking place in the UK at the start of the year. Unemployment is expected to increase to around 6.5%, however, this will occur at the end of the year, when the leave scheme ends.

It should be noted that many sectors outside of consumer services are also tentatively starting to rise. Perhaps the clearest data point is the number of claimants, which jumped sharply in February to 86.6K, much bigger than the 9K figure expected. On the anniversary of the first lockdown, the number of people claiming unemployment benefits had jumped 1.4 million, equivalent to 116.3% over the previous year.

Stocks in European markets kicked off Wednesday’s session in negative territory as economic data and tightening containment measures across Europe raised concerns over a slower-than-expected recovery from the coronavirus crisis. Consumer prices in the UK missed analyst estimates despite rising 0.4% y/y and 0.1% m/m in February, the Office for National Statistics reported. Meanwhile, the Netherlands decided to extend its lockdown for another three weeks in a bid to curb the increase in the number of infections across the country.

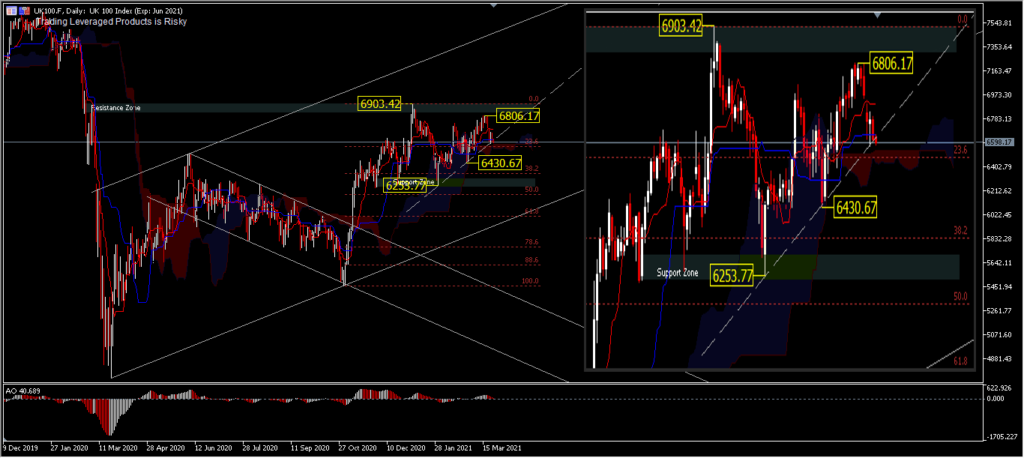

UK100

GER30 fell 0.81% at the opening bell and UK100 fell 0.50%, as FRA40 slopped up 0.79% at the same time. The Euro slipped 0.24% and the Pound continued its weakness against the Dollar.

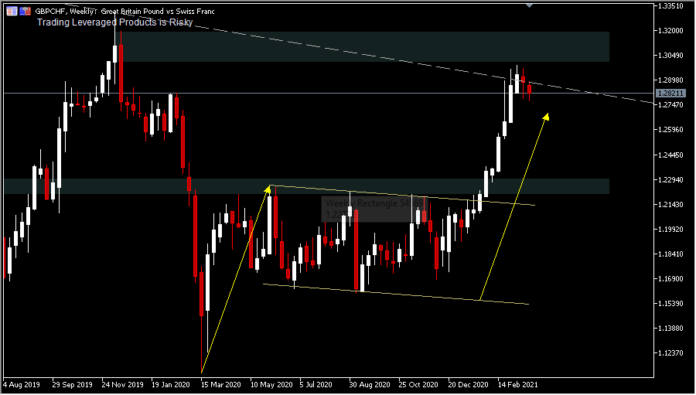

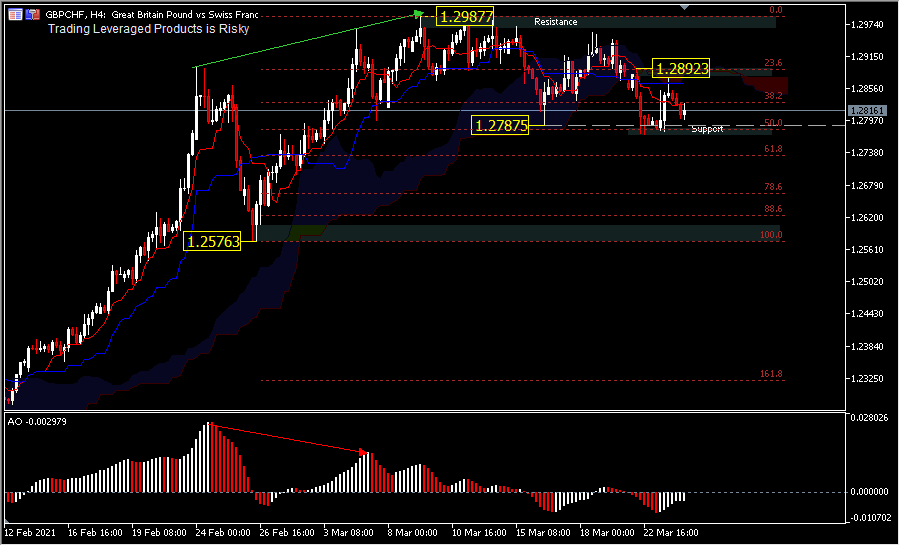

The Pound is still quite resilient against the CHF, although the upward momentum has lost steam with the recent divergence appearance. The peak price of 1.2987 temporarily becomes resistance and support is at 1.2576 will be the barrier that determines the reversal, if it is successfully broken down or continues the consolidation if it holds. Meanwhile, the price is still in the middle level of the 50.0% Fib. retracement below the 1.2892 minor resistance and 1.2787 minor support which has been broken several times. The structure and bias are still quite neutral and there is an overall downward trend.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.