Market News Today – USD gains on safe-haven & better econ. news, EUR & JPY pressured, Sterling, AUD & NZD higher. US stock markets higher (+0.5%), Nikkei closed +1.56%. Quarter end rebalancing & risk seeping back into markets. Good US data (Claims at 1-year lows (under 700k – this week last year 3.2 million), Q4 GDP upgraded to +4.3% and all the Fedspeak cool with the path for inflation. Gold $1730, USOil $59.60 (The Evergreen is not going anywhere soon – $10bn of global trade held up). Overnight – PBOC sees 6% growth for China in 2021, CPI in Tokyo ticks higher and UK Retail sales in line at 2.1%. Biden – 100 million vaccines in 42 days wants 200 million in 100 days, EU cases and vaccine problems persist – leaders disunited over action.

Investor sentiment improved on the last day of the week and Asian stock markets were broadly higher, after a positive close on Wall Street yesterday. Vaccine optimism outbalanced reports of a climb in global Covid-19 case numbers and strengthened confidence in a recovery of global economic activity later in the year. Chinese markets bounced after being weighed down yesterday by fears of escalating US-China tensions. Stable US yields also helped somewhat. The US 10-year rate is currently down -0.1 bp at 1.63%, after another lacklustre (7-yr) auction yesterday. Topix and Nikkei closed with gains of 1.5% and 1.6% respectively and the ASX lifted 0.5%. Hang Seng and CSI 300 also closed up 1.7% and 2.2%, respectively.

In FX markets the Yen weakened and USDJPY lifted to 109.27, although the Dollar fell back against most other currencies. AUD and NZD were supported. The EUR managed to recover some ground against the Dollar and is currently trading at 1.1783. Cable lifting to 1.3755 following the rebound in UK retail sales, which lifted 2.4% m/m in February after falling -8.7% m/m at the start of the year, is adding to the positive mood. The annual rate improved to -1.1% y/y from -3.7% y/y.

Today – German IFO, US PCE & core PCE, personal income & spending, Uni. of Michigan (final).

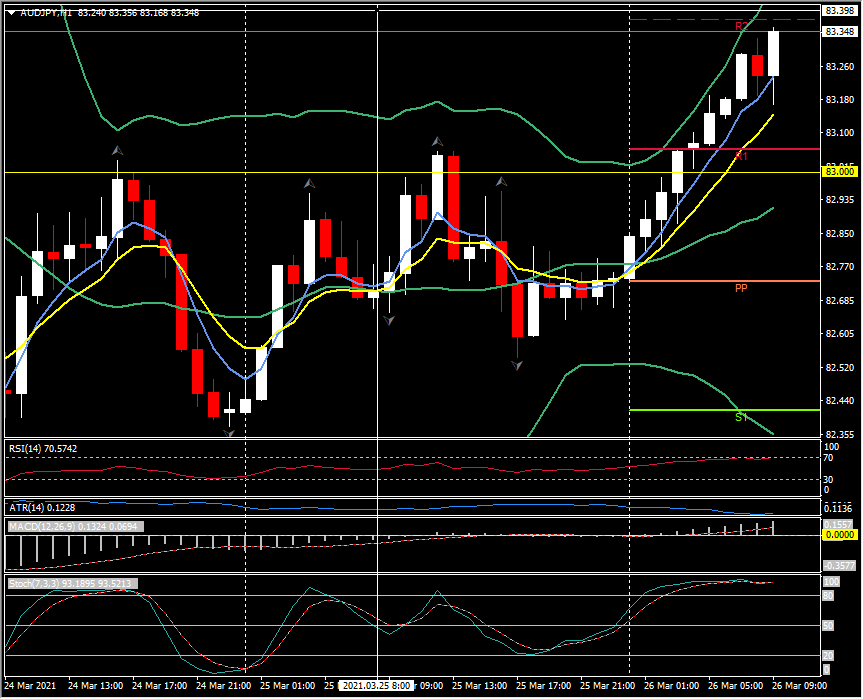

Biggest (FX) Mover @ (07:30 GMT) AUDJPY (+0.68%) Volatile week continues, big rally from 82.50 lows yesterday. Rallied to test R2 at 83.37. Faster MAs remain aligned higher, RSI 69 and rising to test OB zone, MACD histogram & signal line aligned higher and both back over 0 line for first time since 18th. Stochs OB but still rising. H1 ATR 0.1228, Daily ATR 0.7285.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.