During the month it became known that the FCA has initiated criminal proceedings against NatWest Group, which would be the first attempt at prosecution against a British bank under the money law that was enacted in 2007, due to the fact that the British bank showed some flaws in its fight against money laundering and was notarized by the Financial Conduct Authority on not having detected suspicious activity on a customer who deposited 365 million pounds ($500 million) between November 2011 and October 2016. The bank was notified by the FCA in July 2017 and has cooperated; if it pleads guilty before the Westminster Magistrates Court on April 14 of the current year, the bank may face an unlimited fine. (1)

The criminal proceedings brought by the FCA against NatWest are linked to a separate case by the Crown Prosecution Service, which filed charges for money laundering offenses against 13 people based in cities across the country, of which several individuals stand out: former gold trader James Stunt, who runs a Mayfair-based gold bullion business and once supplied Formula One with Gold and Silver coins; Fowler Oldfield, a Bradford gold dealer and a former NatWest customer, whose company’s assets are in the hands of the police; and Gregory Frankel and Daniel Rawson, who have not declared anything to the press, who have both been liquidated. (2)

Added to this, today, the British government raised around £1,100 million ($1,525.70 million) by selling part of the stake of the taxpayers who helped NatWest during the global financial crisis when it was still calling itself the Royal Bank of Scotland and announced that it had gone bankrupt due to its enormous exposure to risk when it acquired ABN Amro. The government announced its third sale of the taxpayer’s stake, reducing stake in the group from 61.7% to 59.8%. (3)

At the same time, the British Treasury sold 591 million shares to NatWest at 190.5 pence per share, when the purchase of shares was around 440 pence, so the loss of the transaction was £1,500 million ($2,080.50 million), marking an important step in the Government’s plan to return private property to institutions that became public property as a result of the financial crisis of 2007 and 2008. (3)

This would be the third sale of shares that the State has made with the objective of returning the bank to the private sector by March 2025, after sales made in 2015 for £2,100 million ($2,912.70 million) and in 2018 for £2,500 million ($3,467.50 million), with which the Office of Budgetary Responsibility, which supervises public finances, expects that the reprivatization operation of the State entity will lose around £38,800 million($53,815.60 million). (4)

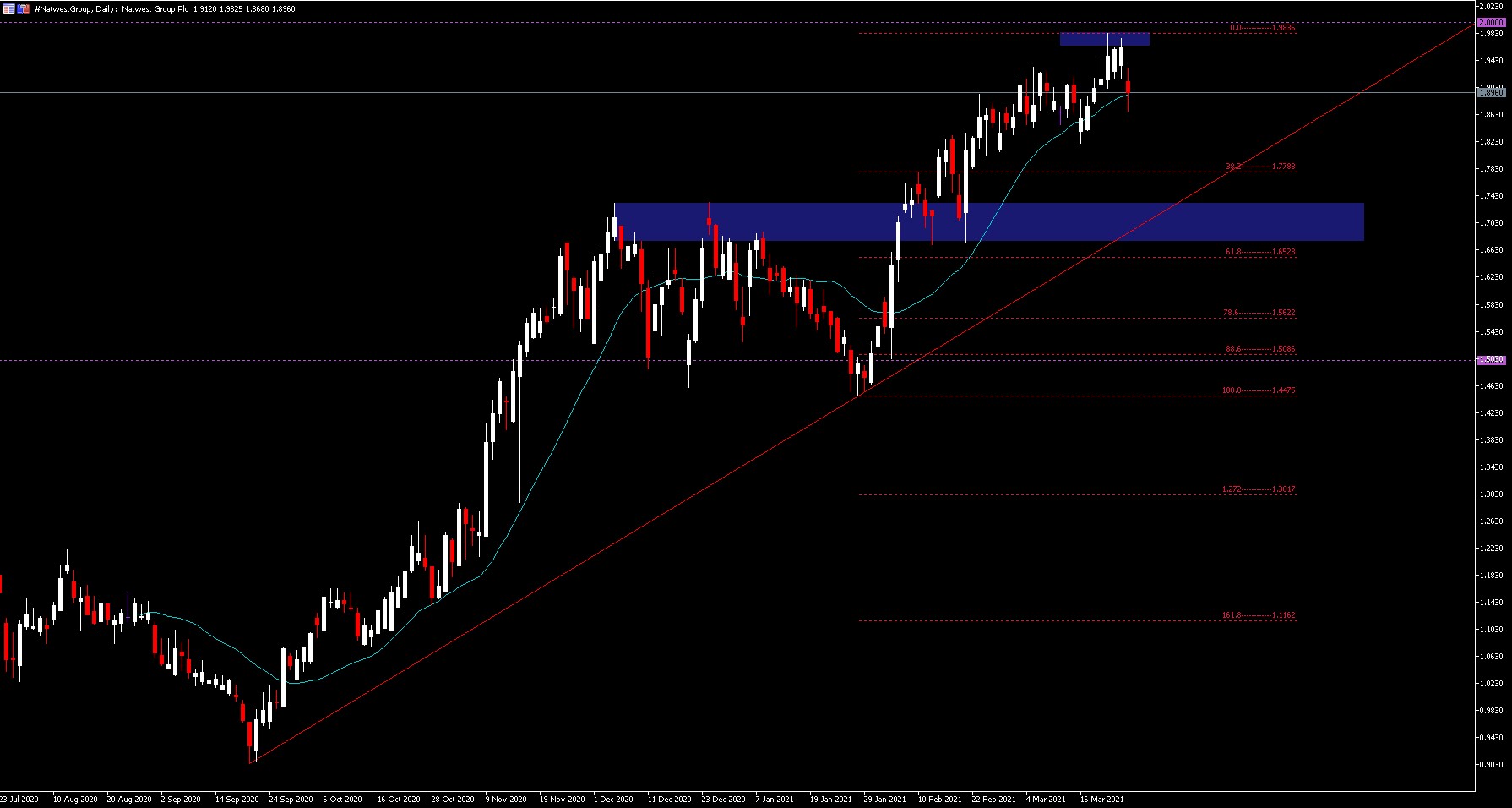

NatWest has marked an all-time high at 1.9835 very close to its psychological level of 2.0. The current price of 1.8960 remains above the 21-day SMA thus ending the second long impulse of its bullish rally that started from the low of 0.9046. In the case that the moving average is broken support will be at the 38.2% Fib. level at 1.7788 that joins the bullish guideline of the channel. To break the guideline we will have to look for the past highs as supports that coincide with the psychological level of 1.7000 and below the 61.8% Fib. level at 1.6523. If all these supports fall we have the level of 1.5000 which was where the first momentum of this bullish rally reversed.

ADX at 25.26 confirms the uptrend while holding above 25. +DI at 20.77 with a bearish slope at the moment, and -DI at 14.50. Crossing the -DI over the +DI would cast doubt on the continuity of this rally momentum.

1.https://finance.yahoo.com/news/natwest-nwg-face-charges-over-160104783.html

2.https://finance.yahoo.com/news/natwest-money-laundering-case-linked-190408579.html

Click here to access our Economic Calendar

Aldo Weidner Z.

Market Analyst– HF Educational Office – Mexico

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.