A positive start to the Canadian economy, as Statcan noted real gross domestic product grew by 0.7% in January. Although, total economic activity is about 3% below the February level before the COVID-19 pandemic. This comes after a 0.1% growth in real gross domestic product the previous month and marked the 9th monthly increase in a row since the COVID-19 pandemic first forced a massive economic shutdown in March and April 2020. January growth exceeded initial estimates of 0.5 percent.

The USDCAD currency pair weakened after this report. The Canadian dollar, which is one of the major commodity currencies, could return more volatile ahead of today’s scheduled OPEC+ meeting. It is expected that the group will extend its current production quota, as global oil demand remains unstable. The Saudi-led coalition was widely criticized three weeks ago, when it rejected calls to revive some crude oil production that was halted during the pandemic. Energy Minister Prince Abdulaziz bin Salman even explained that he did not believe in the post-Covid rebound predictions and would only believe in the recovery of demand when he saw it. According to several OPEC+ delegates, they predicted the group would refrain from significantly increasing production when it meets on April 1.

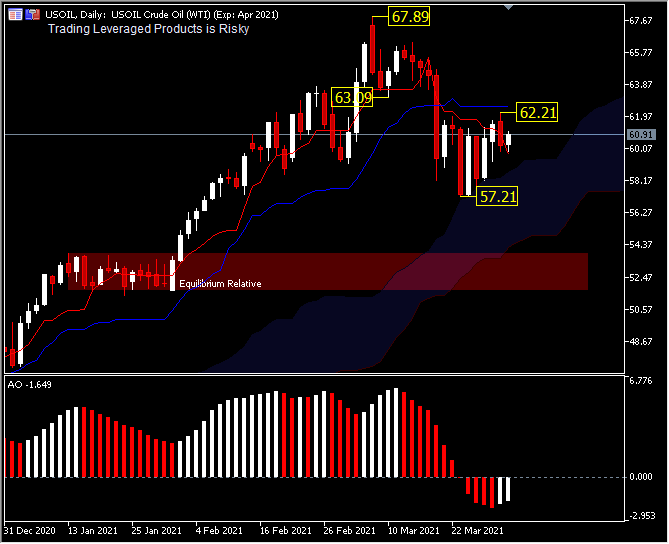

Cartel intervention has helped boost crude oil prices by +/- 20% this year, at a time when the global economy is battered by a pandemic. This has underpinned the revenues of members of the group as well as the beleaguered global oil industry. USOIL prices are currently trading in the range of $60.8 moving between the low price range of $57.21 – $62.21, the Suez Canal incident, only temporary, was exploited by speculators.

Cartel intervention has helped boost crude oil prices by +/- 20% this year, at a time when the global economy is battered by a pandemic. This has underpinned the revenues of members of the group as well as the beleaguered global oil industry. USOIL prices are currently trading in the range of $60.8 moving between the low price range of $57.21 – $62.21, the Suez Canal incident, only temporary, was exploited by speculators.

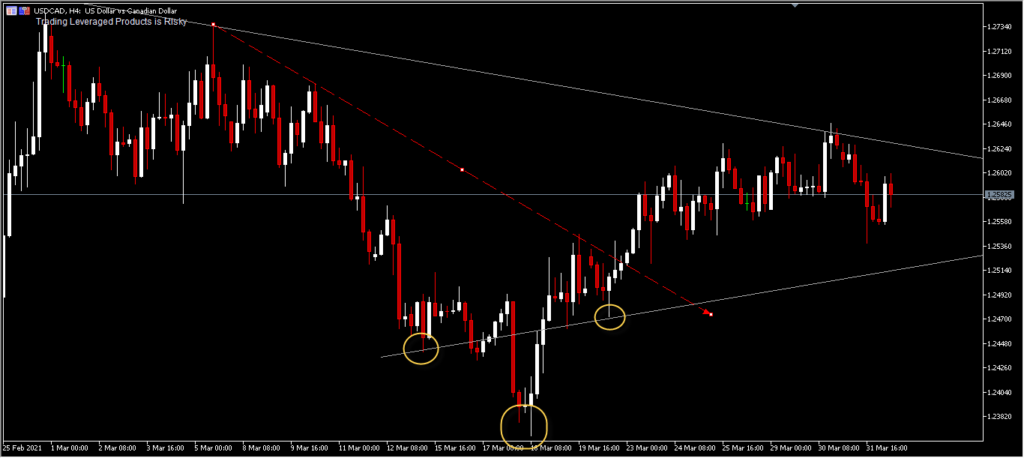

Back to the USDCAD, from January to March it traded down to close to 1.2248 annual key support and set a 3-year low of 1.2364, at 116 pips.

Throughout the strengthening of USOIL price and the weakening of the USD, the Canadian Dollar has benefited greatly in 2020. Recorded for Q1 this year, it still booked a strengthening against the USD of 2.8% before rebounding 1.2364. From technical perspective, by monitoring the monthly candle, we could find the buyer’s encouragement and profit taking action from retail sellers that have formed 3 candles in the form of “pinbar”. This certainly gives a hint that investor turn cautious amid the recent USD strengthening, due to the increase in global yields. The intraday chart above, shows that the price has begun to form an inverse head and shoulder pattern which could be confirmed if the price breaks through the resistance of 1.2646. In the short-term the price is already moving above 1.2536(low of the week). While the upward movement shows a divergence against the AO that tends to thin towards the neutral line for the recent rebound correction. The Support level still puts 1.2467 as key support (61.8% Fib. retracement level). A move below 1.2460 could signal that the rebound of 1.2364 has ran out of steam and that the price mode will consolidate again, if not fall further to the annual support level of 1.2248.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.