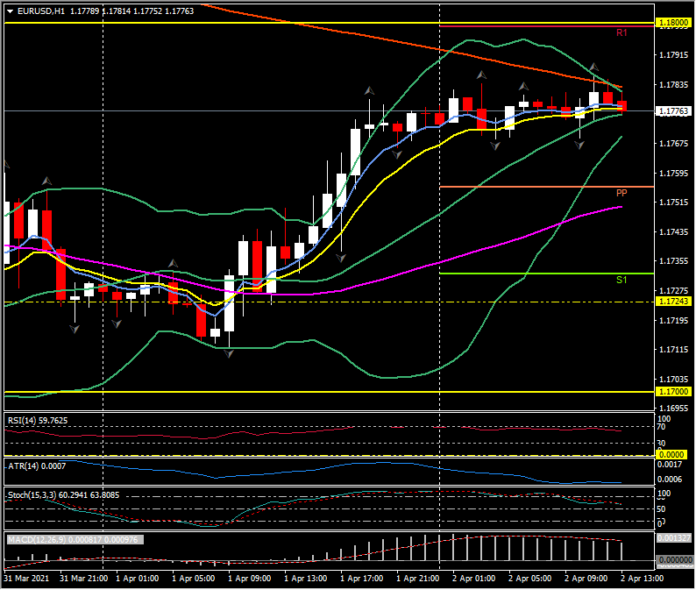

EURUSD, H1

With most of Europe closed for the Easter holiday weekend, forex markets remain becalmed in rather tight ranges ahead of the non-farm payroll data later today at 12:30 GMT. 650,000 new jobs is consensus for the headline with unemployment down to 6.0% from 6.2%, big rises for the hospitality & construction sectors expected, along with a rise in women returning to the work force as the vaccine rollout continues to gain traction.

In FX markets, the USDIndex is currently down at four-day lows around 92.86, today’s pivot point is at 93.02 with s1 and R1 at 92.75 and 93.18 respectively. The EUR holds onto four-day highs at 1.1778, JPY trades round s1 at 110.50, whilst Cable holds over the 1.3800 pivot point at 1.3838, with R1 at 1.3862. The USDCAD has rallied from S1 at 1.2527 to test today’s pivot point at 1.2562, with the AUD and NZD holding north of 0.7600 and 0.7000 respectively. The USDCHF holds over 0.9400 for a fourth day, but down from yesterday’s high at 0.9465 to 0.9405.

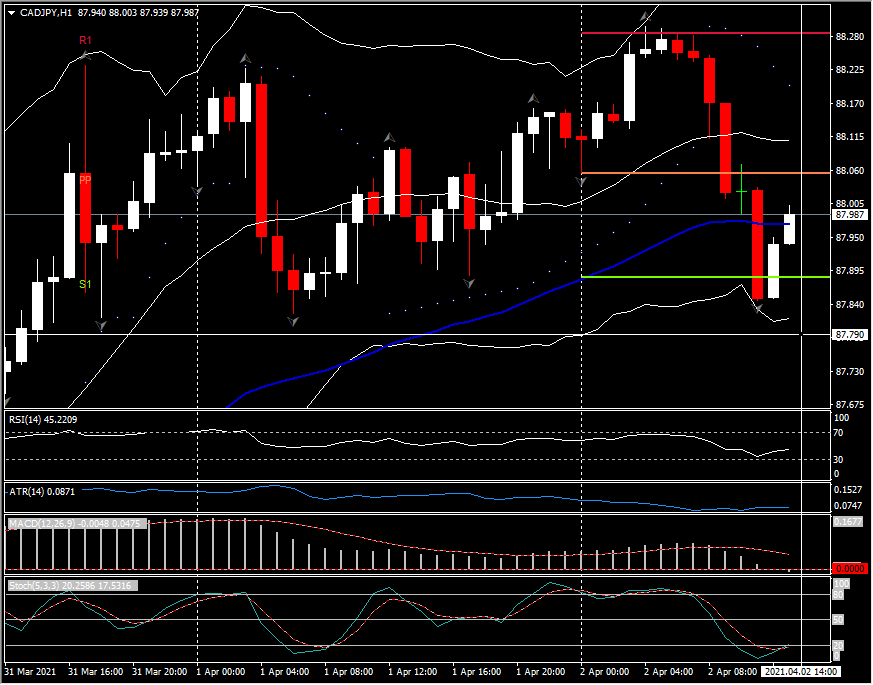

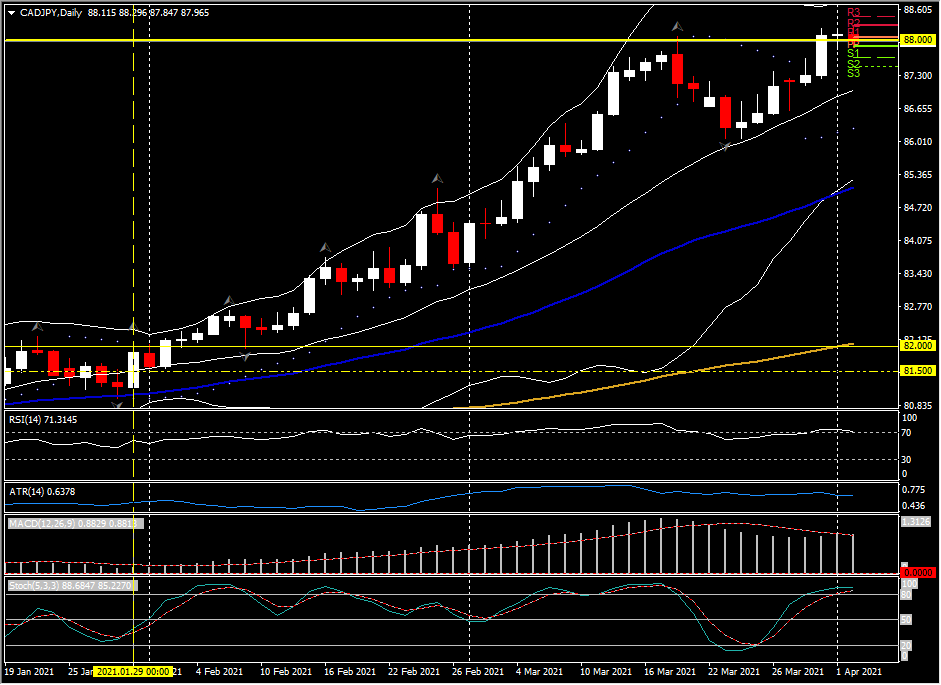

The largest mover of the major crosses today (at 10:30 GMT) is the CADJPY which is down 0.24% from opening trades which touched R1 at 88.28 to lows under S1 at 87.85. The pair is currently testing back to 88.00. The daily pivot point sits at 88.06, with the H4 20-period moving average at 88.12. The daily pivot point sits at 88.06, with the H1 20-period moving average at 88.12. In the higher time frame the pair remains well bid in a “consolidating-at-highs” trend ; from a break of the 20-day moving average at the end of January at 81.80, to the current resistance at 88.00.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.