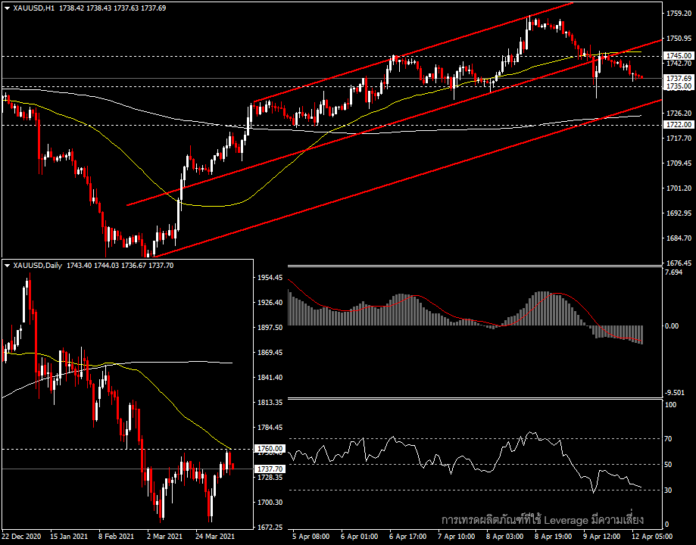

XAUUSD, H1

Gold prices fell on Friday, partly due to an increase in bond yields. That encouraged the Dollar to appreciate, plus this could be a sell-off for traders and investors who bought in early April. As for the stock market itself, the S&P 500 and Dow Jones continued to hit new all-time highs. As the new round of stimulus continues to boost investor confidence that the US economy will be able to grow ahead of the Eurozone and other countries, there is still a risk from the Covid-19 epidemic, although infection rates continue to decline as vaccination rates accelerate.

The fall in the gold price on Friday can be explained from a technical perspective. It can be seen that in the Day time frame, the gold price could not pass the MA50 resistance at the 1,760 zone, and the low zone from the end of 2020 (30 November). A break of 1,745 was also not sustained as the price closed the week at 1,743.

For the trend of gold prices today it is clear in the H1 timeframe that the price has come down to trade in the lower zone of the channel and is currently stuck between the MA50 and MA200, with the gold price oscillating between these support and resistance areas. The continuous downturn from Friday is still not seeing a promising reversal trend in the H1 timeframe where the MACD remains in the negative area, while the RSI is at 31.84 and still heading into the oversold zone, with the first support at 1,735. Breaking below here, there is the next support at 1,722 while the main resistance for today is at the MA50 line at 1,745.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.