Cable has settled below yesterday’s 5-day resistance at 1.3778, while the Pound saw modest gains against the Euro and Yen. The biggest reopening so far in the UK, which yesterday saw non-essential shops, gyms and many other venues reopen, and which comes with well over 60% of the adult population now having been Covid vaccinated, and with new cases and mortality rates having hit the floor, has given Sterling a boost after underperforming last week.

The Pound’s strength is expected to continue in the months ahead as the UK economy is amid a phase of accelerating economic recovery, with Monday heralding stage three of four in the government’s road map to a return to societal normalcy.

The Covid vaccine rollout, although suffering a setback amid a phase of restricted supply that has been compounded by concerns about the Oxford AstraZeneca vaccine, has remained on track, and has evidently been successful in greatly suppressing both new cases and mortality, which are both less than 5% of what they were at the peak in early January. The latest data shows that while the UK has given 56.7 vaccine doses per 100 residents, the European Union has administered only 19.8 doses per 100 residents so far. In simple terms, the UK has so far managed to vaccinate more than 50% of the adult population, which makes it the country with the second highest vaccination rate after Israel, while COVID-19 infections are falling.

With the UK vaccination campaign much more advanced than in the EU, there is a lot of recovery and vaccine optimism priced in and therefore the Pound is anticipated to remain on a firming track against the Euro and Yen, thanks to positive yield differentials. In addition the “rip-roaring” recovery, with consumers chomping at the bit to spend lockdown savings, are also supporting the asset in the medium term. Deutsche Bank estimate that these savings amount to around £160 billion which is around 12% of the UK’s GDP output.

In the meantime, the economic data continue to improve based on expectations for a strong rebound in growth in the second half of the year. The latest were the UK’s BRC retail sales data for March which came in strong, while February data on production, GDP and trade came in mixed relative to expectations but the numbers looked pretty impressive, especially compared to the renewed contraction in economic activity across the channel in the Eurozone. More timely and forward looking indicators out of the UK, most notably the March PMI surveys, have pointed to an accelerating expansion in activity in the months ahead.

A stronger Pound is keeping a lid on UK markets, while US futures are hardly changed as investors wait for key US inflation data later in the day. However April tends to traditionally be a good month for GBP, hence seasonality takes place amongst the factors supporting the GBP, as Cable has gained significantly in April in 16 out of the last 20 years since 2000.

The seasonality, consumer optimism, and the assessment of the government’s policy that has turned very positive thanks to a rapidly advancing vaccination campaign, helped to sell Brexit as a success and gloss over the difficulties that are turning out to be more than short term adjustment problems. Therefore, there’s a solid fundamental case for GBP all around.

Currently, as the prime focus is on today’s release of March US CPI inflation data, GBPUSD is struggling to extend higher. The US inflation data comes with upside risk that could potentially be the catalyst behind a fresh spike in Treasury yields, despite Fed assurances that inflation is likely to remain contained beyond the anticipated pandemic-caused y/y base effect jump. For the US Dollar, this should be taken as bullish context.

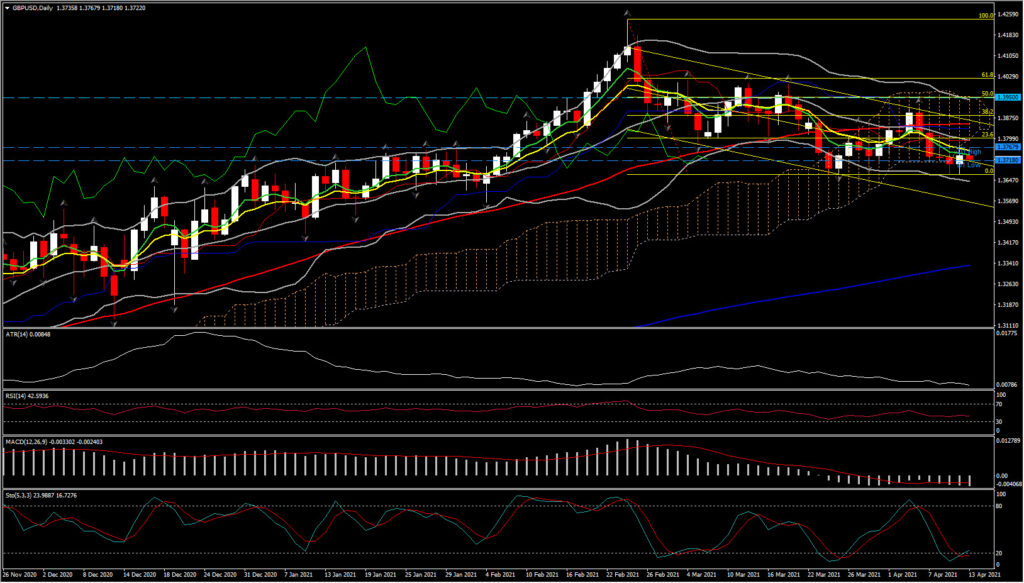

This keeps the GBPUSD within the down channel set since late February. The flattened 50-DMA, Bollinger Bands along with both RSI and MACD lines turning close to neutral zone and Stochastics bullishly crossed suggest weakness of negative bias and signal a slight pick up of positive bias.

That said, the GBPUSD faces a key near term obstacle at 1.3860 (50-DMA), which if it breaks could attract many bulls in the market which could boost the asset to the round 1.3900 and next to the 1.3950 level (50% Fib. retracement since February’s peak). However the asset needs a strong meaningful rebound above 1.3900 to switch the outlook from neutral to positive again.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.