This week the key Q1 Earnings season kicks off in earnest, with many of the major US banks reporting and expected to massively beat consensus, something that could please the bulls. But will this be the case? And if yes, then what? As Goldman Sachs and JPMorgan stated, Q1 is the peak in terms of earnings growth; even though the absolute level of growth will still be very healthy, deceleration is a powerful force in the market.

Nevertheless, investors seem to be waiting for new catalysts before pushing valuations out much further and the earnings season provides a major focus against the background of conflicting virus and vaccine headlines.

Hence the earnings slate remains busy for the remainder of the week, and will include reports from UnitedHealth Group, Bank of America, Pepsico, Citigroup, BlackRock, U.S. Bancorp, Truist Financial, PPG, Delta Airlines, J.B. Hunt, Morgan Stanley, HDFC Bank, PNC Financial, Bank of New York Mellon, State Street, Kansas City Southern, Citizens Financial, Ally Financial.

Hence the focus today turns to Bank of America and Citigroup Inc. and their first Quarter earnings release for 2021.

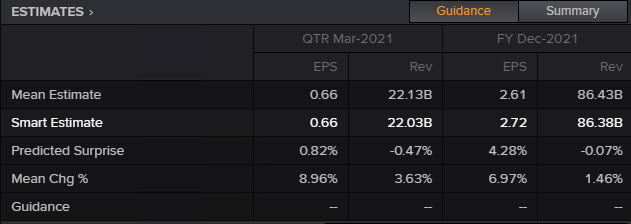

The Bank of America (#BankofAmerica OR BOA) consensus recommendation is “Buy”, even though revenues are expected to miss as earnings are likely to exceed according to the majority of the consensus recommendations from the Eikon Reuters terminal. According to Zacks Investment Research, the report for the fiscal Quarter ending March 2021 is expected to experience a near quarter rally of its Earnings Per Share (EPS) compared to last year, at $0.65 from $0.40. Reuters Eikon predicts similar EPS, while the company’s revenue is seen depreciating slightly from a year ago to $22.03 billion (Eikon) with a mean change at 3.63%.

The BOA has surpassed earnings forecasts in the last two quarters, driven by a positive decline in provisions of credit losses on a sequential basis, while its revenues have suffered due to weakness in core banking, which it is strongly dependent on. As Forbes stated, the company witnessed an 11% y-o-y drop in net interest income, which contributes around 50% of the total revenues. Despite the fact that the financial sector has been a major beneficiary of the “reflation” trade and the $1.9 trillion Stimulus Bill and the proposed $2.25 trillion Infrastructure Bill, which are all likely to continue benefitting the banking sector, the net interest drop led to a drop in the full year 2020 BOA revenues, despite a 20% jump in the Global Markets segment driven by higher sales & trading and investment banking revenues.

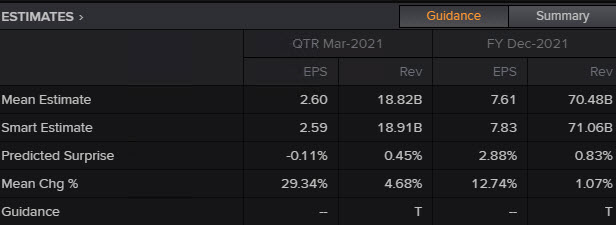

In regards to Citigroup now, things are slightly different as the bank’s pandemic reserves are worth almost 10% of the bank’s market capitalisation. However as more and more Americans are vaccinated and the government releases more stimulus, the more the pressure from the banks’ credit models will be for the banks to release some of the cash. This means Citgroup will face less pressure than other big banks. On top of the above, Citigroup is in general in a better setup as higher trading activity in the securities market and a jump in underwriting deal volumes boosted trading and investment banking revenues for all the main banks and Citigroup was no different. Further, with the stimulus and possible vaccination development (so far 119 million people have received the Covid-19 vaccine in the US), provisions are expected to see a further decrease in Q1 2021, boosting its profitability.

Hence Citigroup is expected to report adjusted earnings of $2.60, in comparison with the $1.06 EPS reported for the same quarter last year. The revenue is seen at $18.82 billion, according to Eikon group analysts estimates, nearly 9% lower than Q1 2020.

From a technical perspective, whatever the outcomes are, much is anticipated from the numbers of Bank of America and Citigroup, both banks are expected to outperform the consensus estimates for earnings, while revenues are likely to fall short of expectations. Both banks remain technically Bullish, trading north of their respective 20- and 50-day moving averages. Today #Citigroup is at $72.90, below its 2021 highs at $76.13 but still in 3-year high territory. #BankofAmerica is at $39.86, just a breath below all record highs with next Resistance areas at the Fibonacci extensions, at the $42 and $45.30 levels.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.