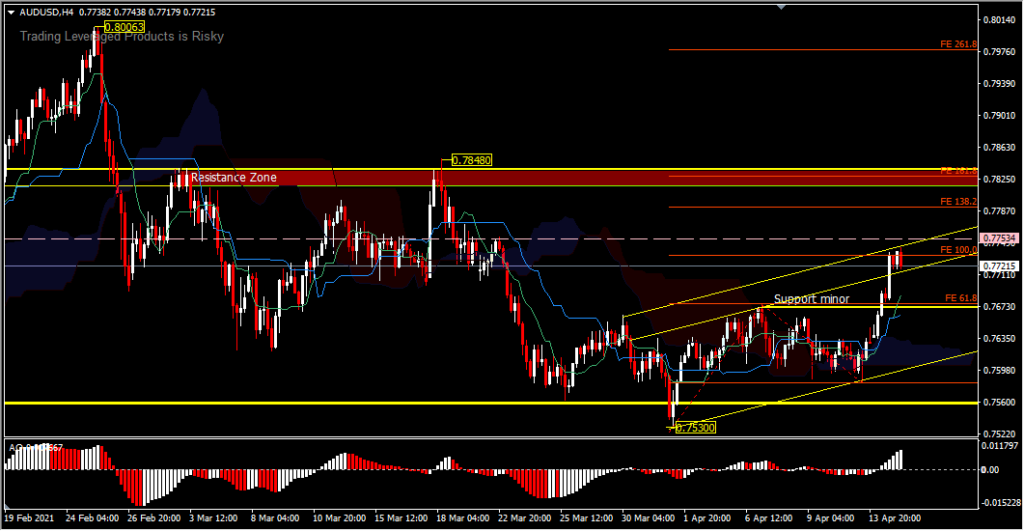

AUDUSD, H4

The Australian Dollar recorded a strong gain in trading yesterday, gaining around 1.14% against the US Dollar. Currently, AUDUSD is trading around 0.7750, leaving room for a rally of around 100 pips towards the average resistance level of 0.7848.

Employment in Australia rose 70.7k between March and February 2021, well above market expectations of 35k, reflecting a further recovery in the labor market. Part-time jobs rose 91.5k while full-time jobs fell slightly by -20.8k.

Australia’s seasonally adjusted unemployment rate fell to 5.6% in March 2021 from 5.8% the previous month, below market consensus of 5.7%. This is the lowest unemployment rate since March 2020, due to the ongoing economic recovery. The number of unemployed fell 27.1k to 778.1k, as people looking for full-time work fell 32.6k to 544.1k and those looking only for part-time jobs fell 5.5k to 234k. (Source: Australian Bureau of Statistics)

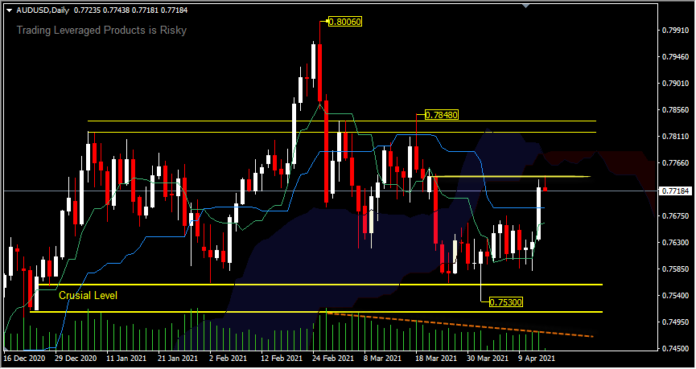

AUDUSD has broken the resistance at 0.7676 indicating that the rebound at 0.7530 is still continuing. The bias again shows the positive side for resistance at 0.7848 which is a strong average high price. A strong break of these levels does not rule out the possibility for the price to re-test the 0.8006 peaks. From the projection, the price has the potential to try to test the FE 161.8% of the 0.7530 drawdown to 0.7676 and 0.7583. On the negative side, the price also has the opportunity to test the resistance level which has now switched its function as support back to 0.7676, provided that the price does not continue yesterday’s rally. Technical support is still on the side of the bulls, with the AO above the buy zone, the golden cross Tenken sen and the Kinjun sen above Kumo at least still showing that the H4 arena is still dominated by bulls.

Click here to access the HotForex Economic Calendar

Ady Phangestu

Analyst – HF Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.