Treasuries posted strong and very surprising gains, overlooking robust data and a solid rally on Wall Street. It was something of a buy-the-fact trade as hefty data was the well advertised risk (Retail sales surged 9.8% in March and climbed 8.4% excluding autos & Initial Jobless Claims tumbled -193k to 576k). The 10-year yield dropped 10 bps to 1.530%, the lowest in a month. The break of key technical levels added to the bid, with some haven demand too amid virus and vaccine worries, along with some geopolitical risks.

The USA500 and the USA30 reached record highs thanks to strong data that supported the recovery narrative, along with hefty earnings, and the drop in yields. The USA100 outperformed with a better than 1% jump and is back over 14,000 for the first time since mid-February. As Refinitiv reported, USA100 traders were all bulled up buying the tech breakout yesterday after the USA100 rallied 10%. BUT we should keep an eye on technicals as RSI has reached overbought levels. Elsewhere, Asia markets were largely steady after China reported a sharp acceleration in first quarter growth, though the reading slightly undershot expectations while retail sales bounced strongly last month. For Europe, GER30 and UK100 futures are currently up 0.3% and 0.1% respectively.

In FX markets, EURUSD is little changed at 1.1968, while GBPUSD dropped back to 1.3761. USDJPY is little changed at 108.79. AUD and NZD fell slightly below yesterday’s peak. USOIL extended gains to 63.84. Gold held steady near a more than one-month high on Friday, en route to its second straight weekly gain, boosted by a drop in US Treasury yields and a weaker Dollar.

Today – Today’s data calendar focuses on final Eurozone inflation readings for March and February trade data also for the Eurozone. US Building permits, housing starts and Michigan Index are also on tap.

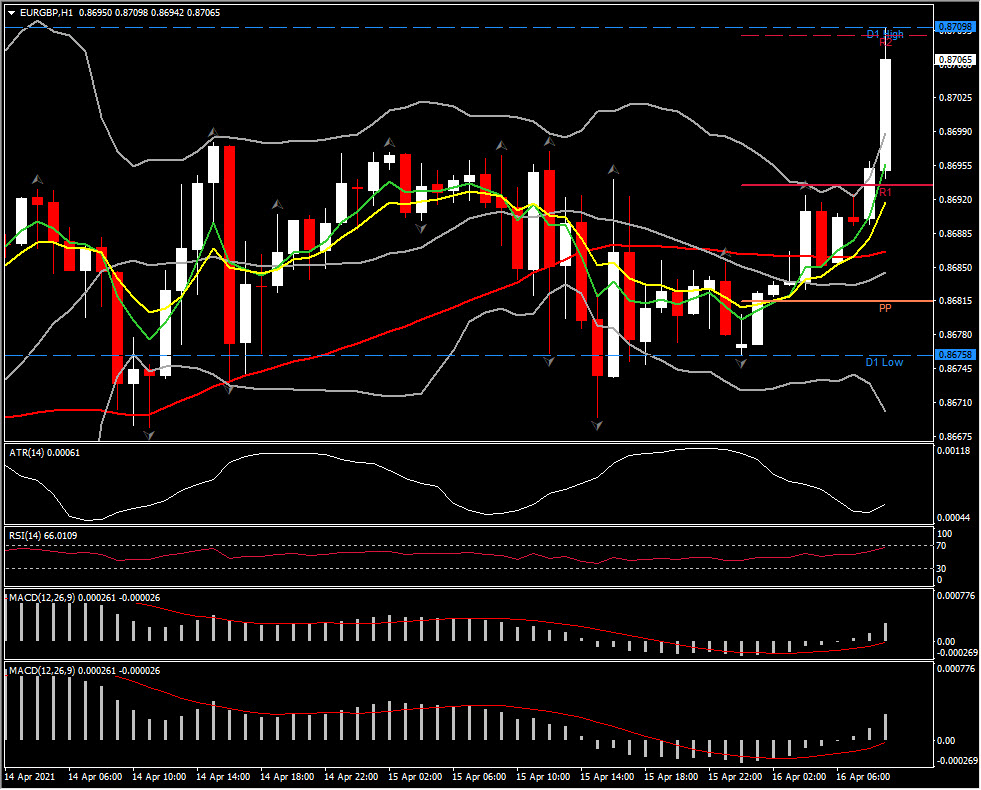

Biggest (FX) Mover – (EURGBP @ 07:30 GMT -0.43%) The asset rallied to 0.8710 retesting the 7-week highs for a 3rd time. Intraday the fast MAs aligned higher, RSI is at 66, while MACD is positive but signal line holds at neutral. ATR (H1) at 0.00061 and ATR (Daily) at 0.00488.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.