It’s red across equity screens amid a bout of risk aversion, though again many indexes are just off all-time highs. European stocks sold off, while US equity futures are weaker as a fresh round of risk-off sentiment rolls across equity markets globally. A resurgence in worries over the virus have caused jitters over the global recovery outlook, as some regions are experiencing a dramatic pick-up in infections. Profit taking also continues to feature following the record highs seen on Wall Street just last Friday.

Rising virus concerns have again hit the travel industry. Also, tobacco shares were hit by a report that the US is considering limiting the nicotine content of cigarettes. On earnings, J&J beat and boosted guidance. Shares of Altira Group dropped -2.2%, adding to yesterday’s losses that followed a WSJ report that the Biden admin is mulling plans to force firms to cut the level of nicotine in cigarettes so that the product is no longer addictive. Netflix reports after the close today. In the US, earnings dominate.

In Canada, after RBA minutes and PBoC, now the BoC’s announcement and Monetary Policy Report (both due Wednesday) take center stage this week. No change in the current ultra-accommodative policy setting is widely expected. However, there is a good chance they express some further concern over the strength in the housing market. Also, expect the market to at least entertain the possibility that policymakers might begin the process of talking about talking about a taper. But with the recovery still uneven and virus cases back on the upswing amid a choppy vaccine rollout, there is a doubt that bank officials will do anything more than to begin setting the stage for an eventual discussion of when they think they might begin to taper asset purchases.

While the recovery is progressing, central banks in general remain risk averse to spooking the market, driving rates higher and impinging on the recovery. Is this the right move?

Expect continued debate in the market, especially as vaccinations compete with rising infections and fresh lockdowns as new variants spread, challenging hopes for a return to normal as soon as this summer. But given the massive amount of stimulus and the pent up desire of the public to return to normal, the risk to current growth and inflation forecasts for 2021 remains to the upside.

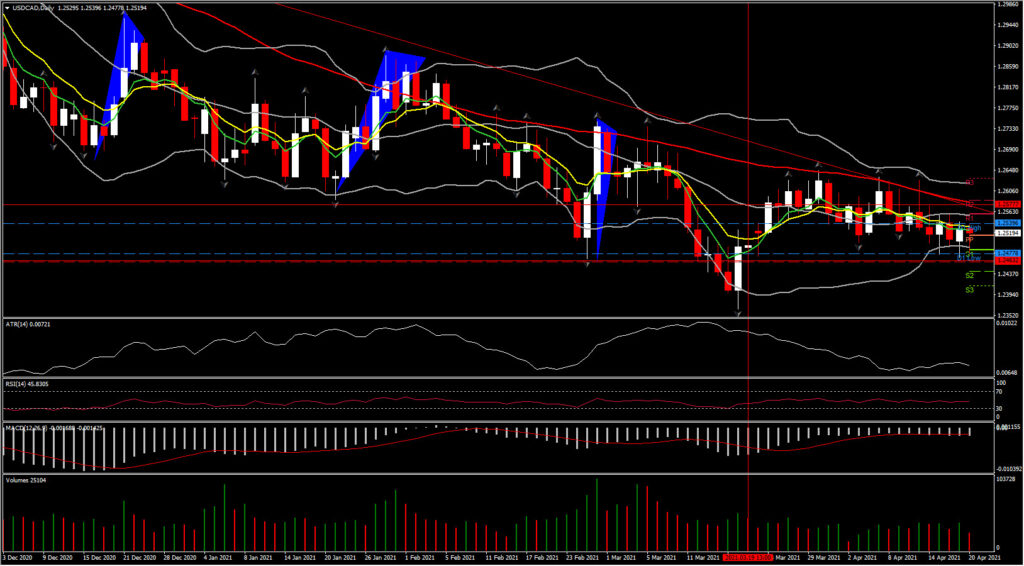

In the meantime, USDCAD, consolidating between 1.2470-1.2540, but overall supported this week as USOIL prices hit a 1-month highs of $64.37, and as the USD came under broad pressure.

Oil prices since dipped, and the Greenback has bounced some in early North America, seeing USDCAD head back toward intra day highs. The move to the highs for USOIL came as Libya declared force majeure at one of its export terminals, shutting in about 200k bpd. Reports the the US DoE will sell 9.0 mln bbls this month from the SPR likely had little impact, as the sale had been telegraphed earlier in the year. Meanwhile, surging Covid cases in India has put the demand side of the equation in question, though a reported 8.8% y/y surge in China imports from Saudi Arabia has offset to a degree. Of note, today marks the one-year anniversary of when oil prices settled at -$37.63.

The USDCAD however will likely be driven by positioning adjustment through the session, in anticipation of Canada CPI data on Wednesday, along with the BoC policy meeting and announcement. A third wave of Covid is hitting Canada quite hard currently, with record numbers of cases occurring in some provinces, Ontario in particular. The most populous province has implemented a six-week stay-at-home order, travel restrictions, and the stoppage of non-essential construction. The current situation will almost certainly have an economic impact, and as a result, the BoC will in all likelihood keep the status quo on rates and QE. Risk for the CAD near term would appear to be to the downside.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.