Market News Today – US Equities slip (TSLA, Nvidia and Peloton) all hit by news (-0.5%) as Yields & USD move from lows. EUR, GBP & AUD bid, JPY pressured. Asian markets at 6-week high on weak USD, Nikkei down, German PPI and UK jobs data both beat expectations. Xi cautioned against “meddling in others internal affairs”, Kuroda no change to ETF purchases and cautions on recovery.

The Dollar has diverged from US yields, with the greenback, as measured by the narrow trade-weighted USDIndex, extending yesterday’s steep decline in posting a fresh seven-week low at 90.82. The index is now down by a cumulative 2.8% from the five-month highs that were seen in late March. Today’s decline marks a break from the recent correlative pattern, being concomitant with rising longer-dated Treasury yields. The 10-year note yield is up 2.2 bp on the day, at 1.627%, as of the early London morning, which is the loftiest level since last Thursday, while marking an 8 bp rebound from the recent low. The 10-year yield remains some 17 bp down on the high seen in late March, and clearly the currency market is anticipating limited risk for a return to a sustained yield ascent, similar to what we saw during the first three months of the year.

Instead, markets are running with a similar dollar-bearish sentiment that was prevailing over the final quarter of last year, with the greenback weakening amid a backdrop of buoyant global equity and commodity markets, with optimism running high for global economies to rise strongly from pandemic hardships on the back of vaccinated-assisted reopening of societies, along with massive stimulus policies and an expected unleashing of consumer ‘lockdown savings’ in major economies, all alongside a benign outlook on inflation, particularly in the US where the fiscal stimulus is the largest, both by contemporary global standards and by post-second world war standards. We suspect this won’t last, and markets will return to pricing in contingency risk that the Fed may be forced to tighten much sooner than the 2024 start point for tightening that has been signalled by the central bank.

Today – Highlights include still to come on a quiet day CB’s de Cos, & Earnings from Netflix, Johnson & Johnson, Phillip Morris, P&G & Lockheed Martin.

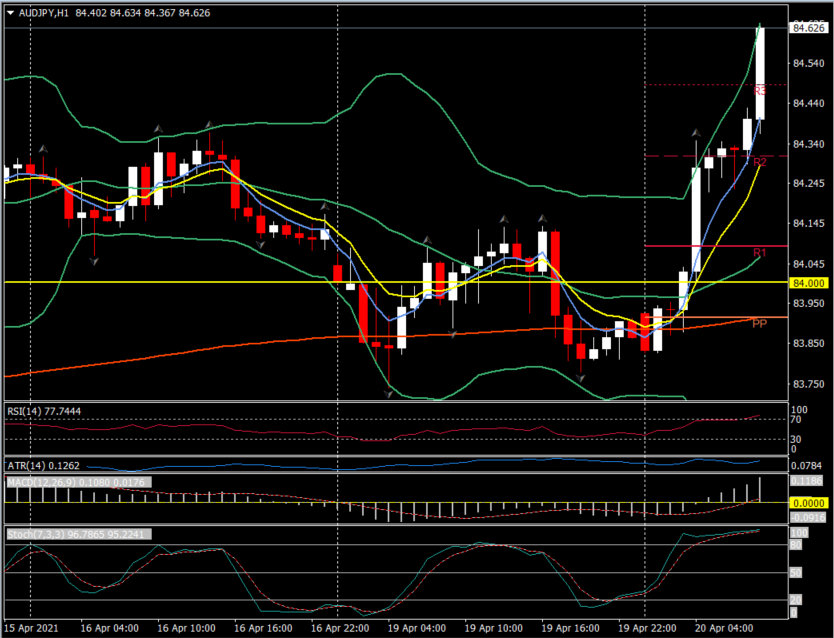

Biggest (FX) Mover @ (07:30 GMT) AUDJPY (+0.84%) Rallied on open from PP & 200MA at 83.90 to beyond R3 at 84.60. Faster MAs remain aligned higher, RSI OB at 77 but still rising, MACD histogram & signal line aligned higher and over 0 line from earlier. Stochs OB zone and rising. H1 ATR 0.1260, Daily ATR 0.6050.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.