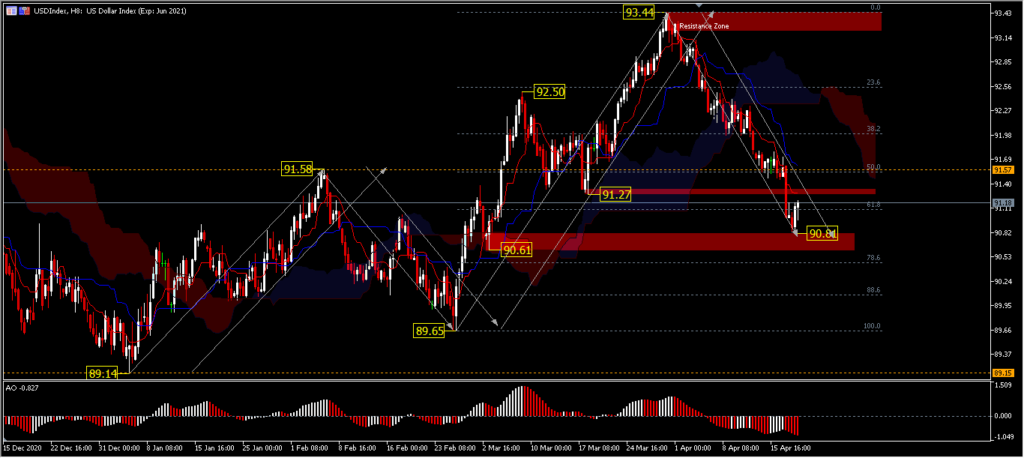

The US Dollar is losing traction, as US bond yields have slumped from the 14-month peaks touched last month, with the benchmark 10-year Treasury yield trading around 1.60%, reducing the greenback’s appeal. This follows repeated promises by the Fed that short-term price pressures are only temporary.

The Dollar Index, which tracks the Greenback against six other peers, edged up 0.21% on Tuesday, after bouncing off a low of 90.81. The outlook for the USDIndex remains bearish with visible indications from AO’s technical tools, and price movement below Kumo showing a quite deep retraction from the 89.65-93.44 price wave. As long as the 90.61 Support holds, there is technically a possibility that the price will return to the upside.

Meanwhile, US President Joe Biden earlier this month called for an end to gun manufacturers’ immunity, as he announced gun control measures. He suggested “accountability” measures should put arms companies on the same level as tobacco companies in terms of the harm their products could cause.

Tobacco stock prices led the losses in most major markets following news that the United States was considering reducing cigarette nicotine levels to less addictive levels. According to The Wall Street Journal report on Monday that the US Food and Drug Administration is expected to decide on a ban on menthol cigarettes by the end of the month, the Biden administration is also considering a ban, along with requirements to lower nicotine levels.

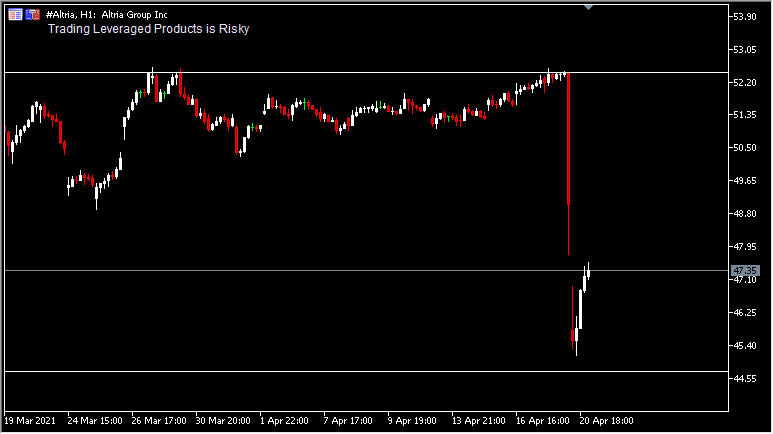

The Altria Group Inc.’s stock, which is Marlboro manufacturer, fell as much as 6.9% on Tuesday, losing more than $11 billion in market value since Friday. Ideas for cutting US nicotine levels cost Altria dearly, given that it controls 53% of the $90 billion domestic market. British American Tobacco Plc also fell as much as 8.3% in London. Imperial Brands Plc, which makes Kool cigarettes, fell by 7.5%.

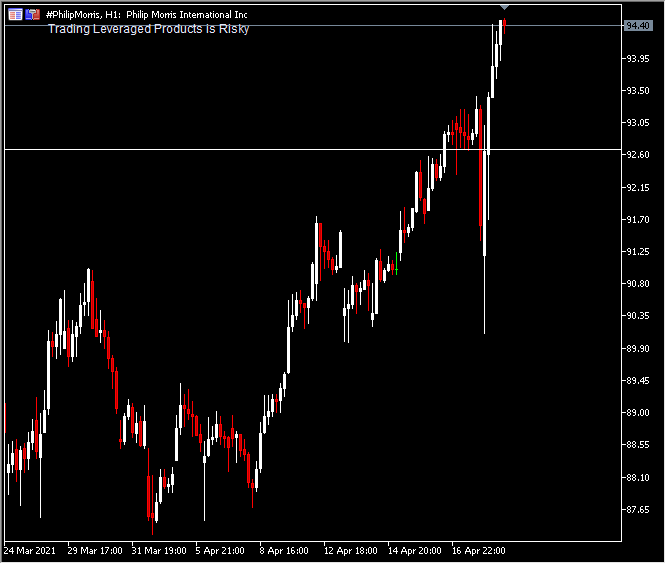

Meanwhile, Philip Morris International Inc. was little changed on Tuesday after boosting its outlook for the year amid stronger demand for its IQOS cigarette alternative. Philip Morris, which does not sell cigarettes in the US, fell only 1.3% on Monday, outperforming rivals on the prospect that tighter tobacco regulations could spur demand for IQOS, according to CNBC.

Click here to access our Economic Calendar

Ady Phangestu

Market Analysts – HF Educational office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.