Market News Today – The markets are grappling with diverging virus and vaccine developments globally, with improving conditions in the West while Asia, and especially India and Japan, have become Covid hotspots.

Wall Street was quick to rebound from the knee jerk drop due to the Biden tax proposal as it was a sell-first, question-later trade. The USA100 and the USA500 more than recovered from the -0.9% declines which provided a buying opportunity, rising more than 1%. The USA30 rallied 0.67%. Investors pounced once they analyzed the situation and figured the proposal may not come to fruition, along with research showing cap gains changes typically don’t impact valuations. Another much stronger than expected set of data provided a spark to buyers too. Treasuries gave ground, however, on the jump in risk appetite.

Asian stock markets are mostly higher. Much higher than expected services PPI numbers out of Japan highlighted that inflation risks are also picking up, although for now investors are banking on ongoing support from the Fed and a confirmation at this week’s meeting that there won’t be a taper any time soon. That is helping to keep stock market sentiment underpinned at the start of what is going to be a busy week for earnings. USD moved off 8-week lows (USDIndex at 90.72) & JPY dropped back to 107.70. EUR spiked to 1.2116 & GBP is at 1.3912. USOil holds at $62.00, Gold at $1773. Bitcoin reclaimed the $53,000 mark, triggered by US President Joe Biden’s plan to raise capital gains taxes for wealthy investors.

European Open – The June 10-year Bund future is down -13 ticks at 170.70, underperforming versus US futures, although in cash markets, the 10-year Treasury yield is currently up 1.4 bp at 1.57%. GER30 and UK100 futures are up 0.1% and down -0.1% respectively. BoE’s Broadbent over the weekend predicted rapid growth for the coming quarters and that of course will not only hold for the UK, but even more so the US thanks to sizeable fiscal support. Central banks meanwhile seem in no rush to take their foot off the accelerator and investors are not expecting a Fed taper any time soon it seems, which may add to lingering inflation concerns. After a sluggish start on the vaccination front and despite ongoing restrictions to public life, German business confidence data has been very strong and after the robust PMI readings last week we also expect another improvement in German Ifo confidence readings.

Today – Highlights include US durable goods, Earnings from Tesla, Canadian National Railway, Southern Copper, NXP Semi, Cadence Design, SBA Communications, Ameriprise Financial, SS&C Technologies, Sun Communities, Check Point Software, Brown & Brown, Lennox International, and Universal Health Services.

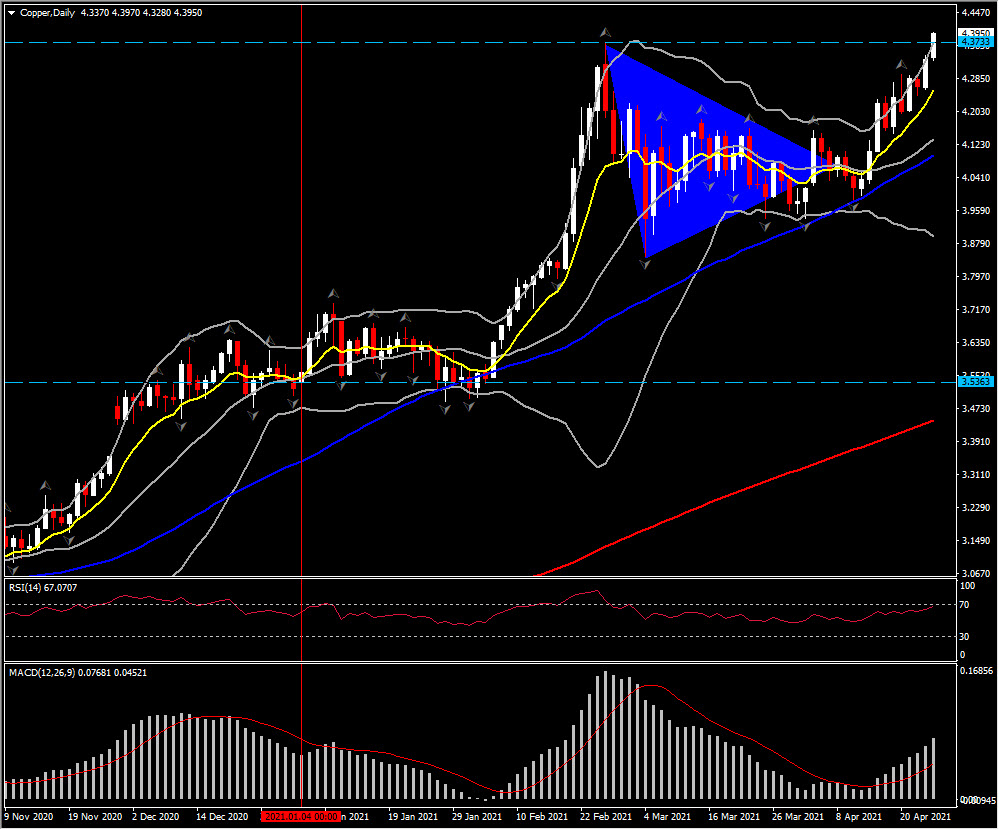

Biggest (FX) Mover @ (07:30 GMT) – Copper hits 10-year high on supply concern, easing USD. In the 1-hour chart, momentum is rising higher with fast MAs aligned higher, while RSI is at 82 with MACD extending northwards again. The USD is lower amid speculation Fed Powell will shun talk of tapering bond purchases at a policy meeting this week, making greenback-priced metals cheaper to holders of other currencies.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.