USOil, H1 – US crude oil prices fell for a second consecutive day to below 61.00, as the USDIndex posted a two-day low at 91.00, extending the decline from yesterday’s high at 91.43 and returning focus to Tuesday’s seven-week low at 90.86. Weekly US Stockpiles came out much higher than expected and was the first increase in as many weeks at 600,000 barrels. In addition, the number of people infected with COVID-19 is skyrocketing globally, raising concerns that lockdown measures may be reintroduced. In Asia, Japan is preparing to announce lockdowns in Tokyo and Osaka, while India is now recording near 300,000 daily infections as the number of people infected every 13 days in Latin America also increases.

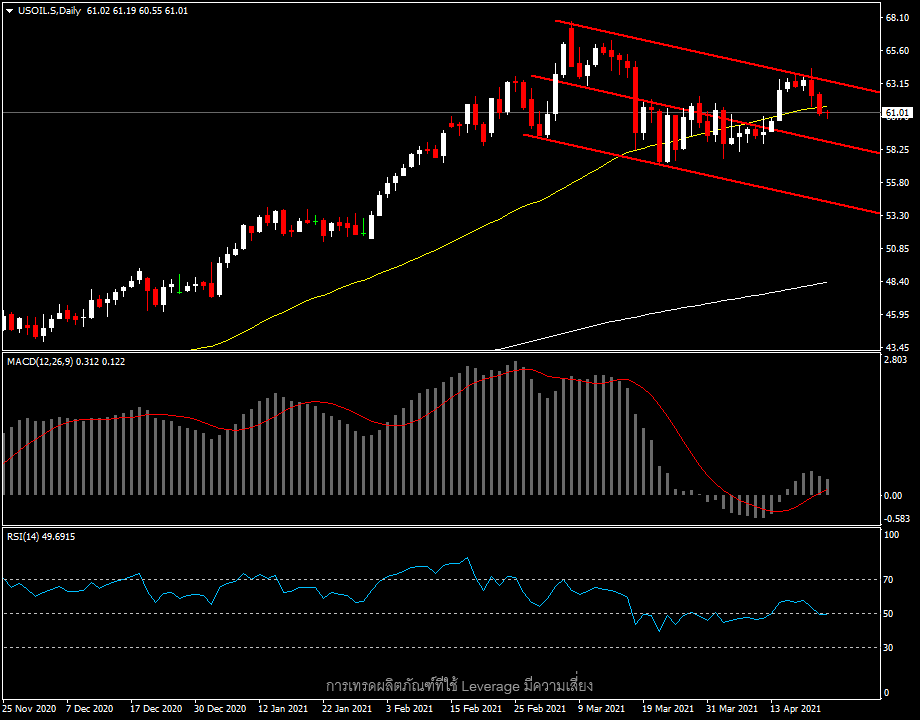

In technical view, Daily timeframe, the price has made a new high lower and begins to see a downward Channel that has the potential to become a Bullish Flag in the future. While prices can now break below the 50-DMA line, MACD is lower, and RSI is mid-range, so it’s possible that the prices will remain unchanged.

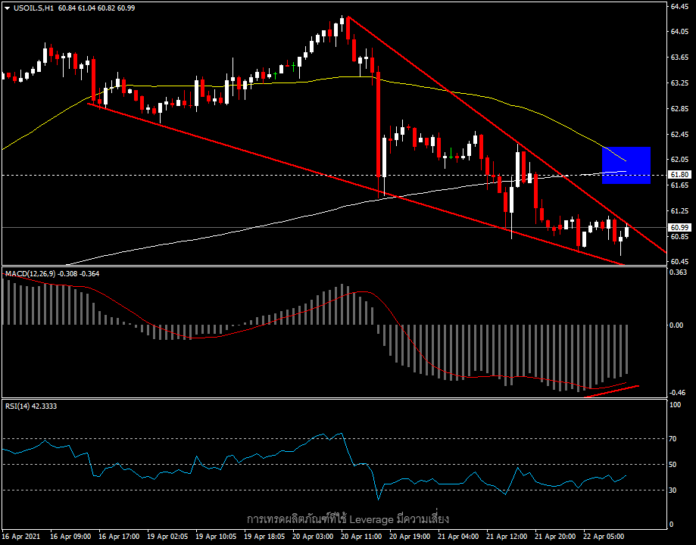

As for today’s oil price outlook, H1 sees a Falling Wedge pattern where prices move in a narrower and lower frame, indicating the possibility that prices may lift again. This time, however, the 50-period MA is moving closer to the 200-period SMA, where, if it crosses, it could confirm a short-term downward trend in oil prices. Today’s support is at the psychological level of 60.00 and resistance is at the MA line at the 61.80 zone.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analysts – HF Educational office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.