The electric vehicle giant – Tesla (#Tesla) is set to release its first quarter earnings in 2021 on the 26th April (Monday) after market close.

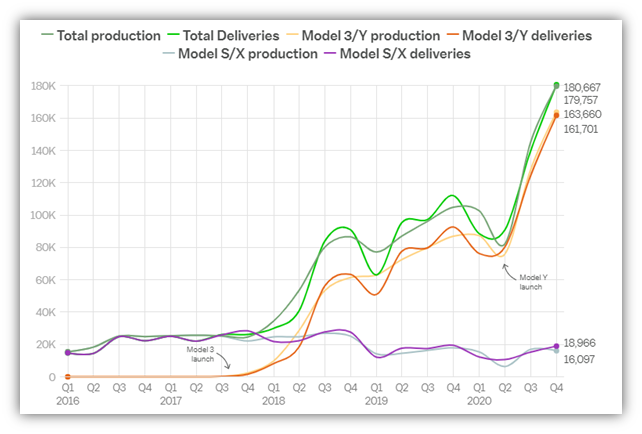

Figure 1: As of January 27, 2021, Tesla vehicle production and deliveries.

Despite the temporary shutdown of manufacturing plant and subsequently shortage of semiconductors, as well as ongoing pandemic haunt, Tesla has done unexceptionally well in its latest delivery numbers. Based on the newly released result, the company has delivered 184,800 vehicles in Q1, up 2.34% (q/q) and more than 100% (y/y). In general, Model 3/Y represents nearly 99% of the total deliveries (with sales in China being the main contributor), as according to CFO Zachary Kirkhorn, the production of a more luxurious model S/X remains low due to “transition to the newly re-architected products” and that the company is in the early stages of ramping production.

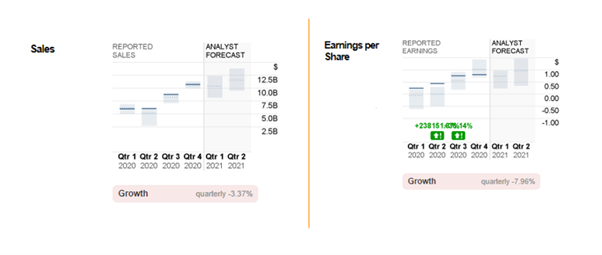

Figure 2: Quarterly sales and earnings per share.

Figure 2: Quarterly sales and earnings per share.

During the previous quarter in 2020, the company’s performance was mixed, with Non-GAAP earnings per share (EPS) at $0.80, down from consensus estimates by more than 20%; On the contrary, reported sales were $10.7 billion, slightly better than market expectation ($10.5 billion).

In an upcoming earnings announcement, following a broad decline in sales of higher-margin luxury vehicles, it is widely expected for both reported sales and EPS to continue riding on a downward trend, at $10.4 billion and $0.74, respectively.

Fundamentally speaking, continuous growth of EV demand in the Chinese market may benefit Tesla. In fact, Tesla has accounted for 21% of the value of all passenger EVs sold in China during 2020. Looking into the future, Wedbush pointed out that China shall contribute at least 40% of the company’s overall sales by 2022. Nevertheless, a downside risk to note is that there may be increased difficulty for Tesla to secure its market share following stiff competition from local players, from IPOs Nio, Xpeng and Li Auto, to smartphone maker Huawei and Xiaomi, plus technology companies such as Tencent and Baidu, which have all viewed the field as “one of the largest business opportunities in the next decade”. Furthermore, recent news that Tesla being unable to meet consumers’ expectation and security being questioned may lead the company gradually losing its share.

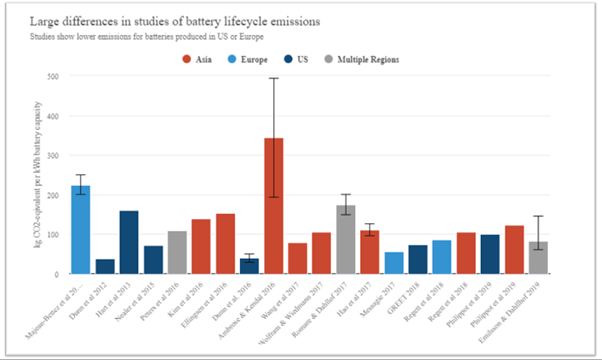

On the other hand, the U.S. government has released its first ever international climate financing plan. President Biden also promised to slash carbon emissions at least in half by the end of 2030. Although it is controversial to say that EVs work perfectly in reducing carbon emissions, as in the case of Germany, it is said that Tesla batteries that are produced in Gigafactory (Nevada, United States) that is entirely powered by renewable energy sources, have substantially lower lifecycle emissions (can go as low as 62kg CO2-equivalent per kWh, near to the low end estimate of 61kg as stated by researchers from the Swedish Environmental Research Institute (IVL)), thus possessing better climate advantages over many other EVs and conventional vehicles.

However, studies have also revealed that in general, lifecycle emissions for batteries manufactured in Asia is about 20% higher than those in the US/Europe, due to the widespread use of coal (instead of renewable energy) for electricity generation in the region, as shown in Figure 3:

Figure 3: Battery life cycle emissions research reports in different regions.

Figure 3: Battery life cycle emissions research reports in different regions.

Thus, considering Tesla’s explosive expansion in China (which belongs to Asia region), the total sum of its emissions (where batteries are manufactured in local factories) may inevitably increase over time (In fact, by 2030, 90% of all new emissions will come from developing countries and China; contrary to the United States, President Xi Jinping once stated that China’s emission shall hit its peak in 2030, and it is expected that it will not achieve carbon neutrality until 2060) and consequently greater pollution – this has clearly diverged from what President Biden hoped for (Biden’s policy may no longer be friendly to Tesla??).

Moreover, an additional risk is added when founder Elon Musk welcomes cryptocurrencies into his business operation, be it direct investment, or accepting bitcoin as payment for its cars. Such moves may result in Tesla’s share price being linked with the high volatility of cryptocurrency, and that it may even “overshadow the EV vision in the near term for investors”.

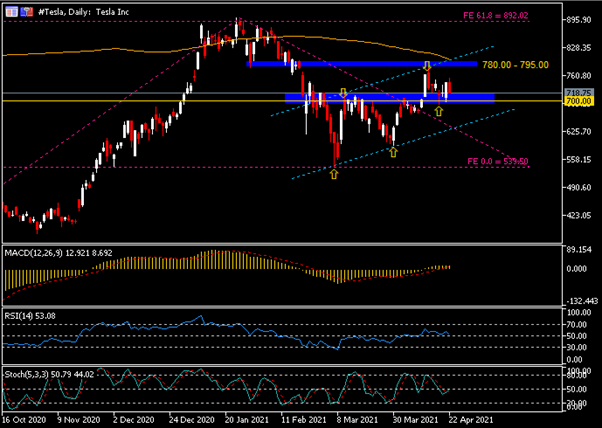

The Daily chart displays #Tesla share price is traded within an ascending channel and has remained solid above key support at $700. Following its rebound from session low $539.50 on 5th March, the company’s share price has recouped nearly half of the realized losses since late January. Currently, #Tesla share price is seen hovered around median target as provided by analysts – $733. Despite expectation for reported sales and EPS to be revised lower, consensus for the company’s share price remains neutral-bullish (hold-buy).

The Daily chart displays #Tesla share price is traded within an ascending channel and has remained solid above key support at $700. Following its rebound from session low $539.50 on 5th March, the company’s share price has recouped nearly half of the realized losses since late January. Currently, #Tesla share price is seen hovered around median target as provided by analysts – $733. Despite expectation for reported sales and EPS to be revised lower, consensus for the company’s share price remains neutral-bullish (hold-buy).

In short-term, $780-$795 remains a key resistance zone to watch. The area also corresponds with SMA 200 (orange), and the upper line of ascending channel. Successful breakout above the critical zone may further aggravate the bullish momentum to test the next resistance, at $890.

On the contrary, if breakout at support $700 is successful, the lower line of ascending channel shall work as the second support and March’2021 low ($539.50) being the third support.

Lastly, in terms of technical indicators, MACD double lines remain hovered above 0 line; RSI inclines to the south but stays above 50; Stochastics oscillator forms a golden cross around the 50 level.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst – HF Educational Office

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.