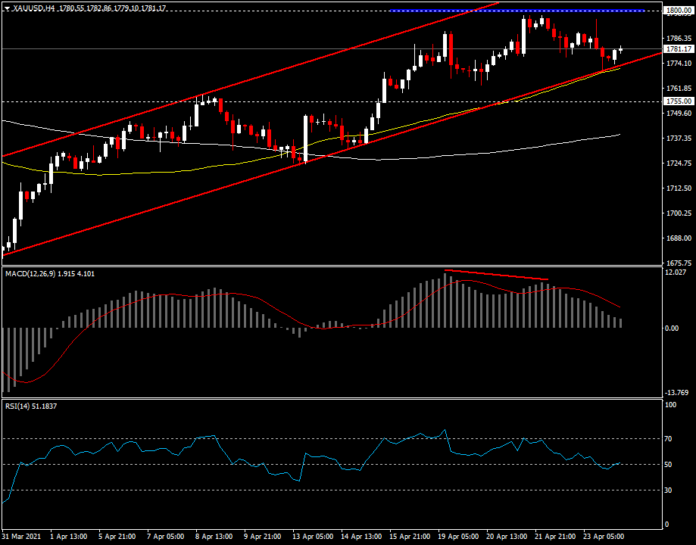

XAUUSD, H4

The direction of the gold price over the past week is not clear. After the US stock markets oscillated between positive and negative days, partly in response to the results from the first quarter earnings reports. Also last week the price of the US Dollar and bond yields started to move in opposite directions as divergence appeared in the relationship. In addition, another move that worried investors was that President Biden proposed raising the tax rate on capital gains on assets held for over one year from 20% to 39.6% for those earning more than $1 million.

Overall for the past week the gold price can still sustain an uptrend due to the depreciation of the US dollar and bond yields. In particular, the USDIndex fell from 91.55 to close at 90.76 last week. And this is the third consecutive week of steady decline. Although the economic and employment numbers remained increasingly positive.

From a technical perspective, H4 continues to hold in the bullish zone above the MA50 and has a significant resistance at $1,800, while Bearish Divergence has been seen since last week, with the MACD falling near the 0 line and the RSI rotating around the 50 level. If the gold price can break the MA50 down today, it will become a short-term sell scenario with the first support at $1,755 while the resistance is still strong at $1,800.

Click here to view the economic calendar or the free webinar.

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.