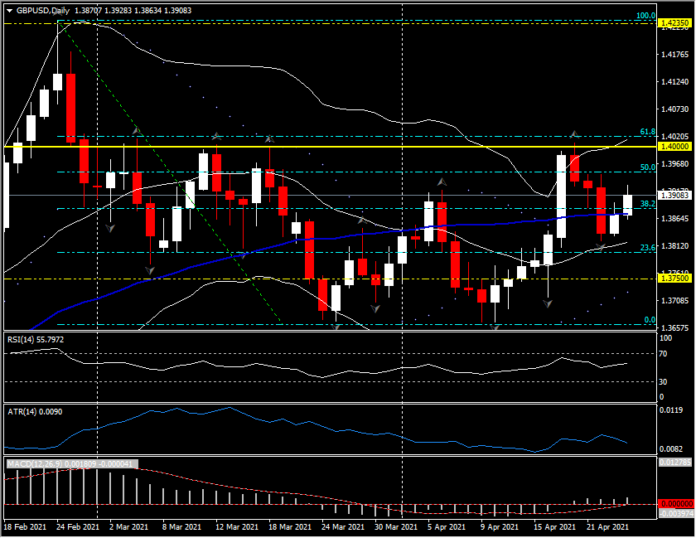

GBPUSD, Daily

The UK economy is amid a rapid re-expansion as pandemic restrictions are lifted. The UK’s preliminary April PMI survey data proved ample evidence of this, with the headline composite PMI beating expectations in rising to a near seven-and-a-half-year high of 60.0 in the headline reading. The data marked a continued robust expansion in the UK’s private sector economy, with the composite reading having risen sharply from January’s recent low of 41.2 in what is now the second strongest phase of improvement in 23 years of PMI history. The PMI report showed the biggest rise in consumer demand in over seven years in April. Employment rose at its fastest pace for over three and a half years, with business confidence for the year ahead near the record high that was seen in March. Exports remained a relatively subdued area, although returning to growth after three consecutive months of decline.

The outlook for exports is good with Covid vaccinations set to scale up markedly across continental Europe in the months ahead, though the rise in global Covid cases remains a concern. With further societal reopening on track in May and June, by which time the majority of the population will have been vaccinated against SARS-Cov2, the outlook remains positive.

One concern is the new coronavirus variants that have been detected in the UK. There have been over 100 detected cases of SARS-Cov2 variant B.1.617, aka the Indian variant, which has been responsible for the tsunami wave of new Covid cases in India. This variant has two ‘escape mutations’ that make it able to dodge antibodies and potentially make existing vaccines obsolete. The situation will be monitored closely, though the massive testing capacity in the UK, including surge testing in areas where new variants are detected, should help contain outbreaks. Available data also suggests that vaccinated people are still resistant to new variants, albeit less so.

Another issue is the re-emergence of the Scottish independence matter, which has reared up going into the UK’s local elections in early May. Re-emerging troubles in Northern Ireland are also a concern. And finally the on-going political fallout between PM Johnson and former chief aide Dominic Cummings has no direct economic impact but politically may also show up in the May elections and undermine confidence and sentiment moving forward.

Sterling remains in mixed mode, robust versus the weaker Dollar this month, and weakening versus the recovering Euro and Yen. Cable rallied to test 1.4000 last week only to then test lower to the 20-day moving average, which again provided key support. This week, 1.3900 and the 38.2 (1.3880) and 50.0 (1.3952) Fib levels provide resistance below the key 1.4000 level, whilst the 20-day moving average and 23.6 Fib level coalesce around 1.3800 for support, blow which is the 1.3700 round number and the March low at 1.3665.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.