Yesterday (April 26), electric car giant Tesla (#Tesla) released its first quarter 2021 financial report as scheduled after the market closed.

According to the fiscal quarter report, Tesla’s first quarter revenue was $10.389 billion, which was about 3.42% lower than the fourth quarter revenue of last year, but it recorded an increase of 73.58% year-on-year. Non-GAAP EPS was $0.93 per share, an increase of 16.25% from the fourth quarter of last year and a surge of 304.35% year-on-year. Not only that, the first quarter’s GAAP net income (Net Income) was $438 million. Among them, the net income of up to $101 million mainly came from the sale of Bitcoin. In this regard, Chief Financial Officer Zachary Kirkhorn said, “The company is satisfied with the liquidity of the Bitcoin market” and provides “a good place to store cash that is not used in daily operations”.

In addition, Tesla said that by “switching to new microcontrollers very quickly” and “developing firmware from chips produced by new suppliers”, the company has solved the shortage of chips. Therefore, in view of this year’s development prospects, founder Elon Musk said that it is expected that car deliveries will increase by an average of 50%, or 750,000 vehicles.

Finally, in addition to expressing that he will focus on improving the fully automated driving (FSD) system, Musk also said that his goal is to be able to use a solar roof that can be used as a “huge distributed utility device” to provide customers in extreme weather conditions the power required. In any case, Tesla’s recent significant increase in its solar roof prices (from 35,000 US dollars to 75,000 US dollars) and battery prices (from 30,000 US dollars to 35,000 US dollars) have caused a large number of customer chargebacks. Therefore, the report shows that Tesla’s energy revenue in the first quarter was only $5.95 trillion, a decline of about 24% compared with the fourth quarter of last year.

Technical analysis:

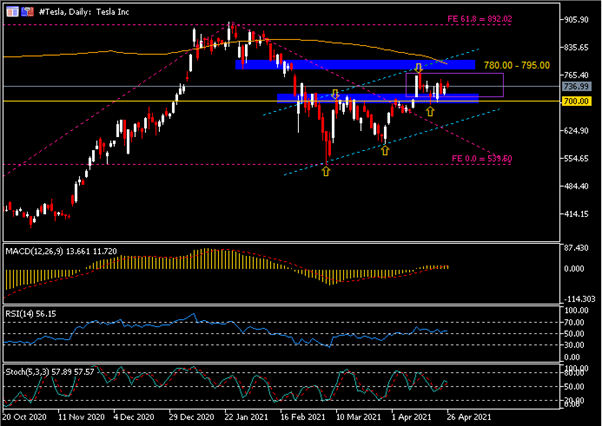

From the daily chart, #Tesla’s share price gapped up slightly to a maximum of $749.24 , then weakened and closed at $736.99. Taking into account the mixed results of the report, it is expected that the price volatility will not change much, and its stock price may tend to fluctuate within the range in the short term.

Above $780 and $795 is still a key resistance area. This position also corresponds to the 200-day simple moving average (orange) and the upper track of the ascending channel. If this key area is successfully broken, the bullish momentum may further intensify and test the next resistance of $890.

On the other hand, the $700 below is the key support. If the breakthrough is successful, the lower rail of the ascending channel will serve as the second support, and the March 2021 low ($539.50) will serve as the third support.

In terms of technical indicators, the MACD double line is still hovering above the 0 axis; the Relative Strength Index (RSI) and Stochastics remain near the 50 level.

Click here to access the HotForex Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.