At last week’s BoC meeting, it adjusted its monetary policy stance on the latest developments, and said that from the end of April it will reduce its weekly bond purchase rate to CAD 3 billion/week, from the current CAD $4 billion/week, and the policy rate will remain at 0.25%. Q121 GDP growth looks much stronger than expected, with the BoC forecasting GDP growth of 6.5% for the whole year. Today (27 April), BoC Governor Macklem is scheduled to present Canada’s current economic outlook.

On the other side of the world meanwhile, early today the BoJ announced steady policy settings. There may not be a strong response to this decision, but there is potential for volatility around the US Federal Reserve meeting, although policy is expected to be on a strong hold, with the benchmark interest rate 0.0-0.25% and monthly bond purchases worth $80 billion in Treasury securities and $40 billion in mortgage agency securities. Average interest rates on US 30-year mortgages shot up by around 50bp from February to March but have since dropped by around 30bp to 3.07%. The Fed is expected to continue to stress policy stability, with non-farm wages still 8 million below their February 2020 peak.

In the FX market, commodity related currencies remain sideways ahead of the FED. USDJPY printed a 1-week high at 108.39, aided by a measure of broader Yen weakness after the BoJ trimmed inflation forecasts. The Greenback also made headway against the Australian Dollar and its dollar bloc brethren. Some position trimming has been at play into risk events, particularly the 7-year Treasury note auction in the US today.

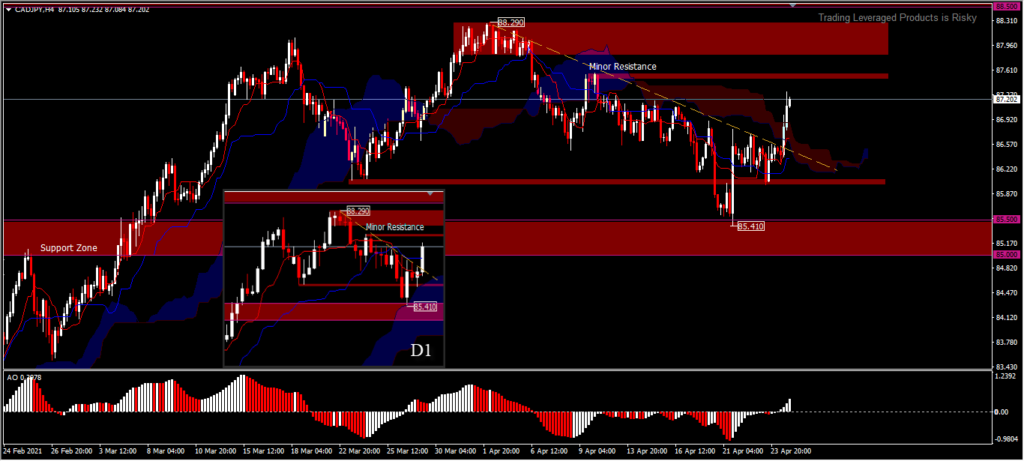

CADJPY, H4

CADJPY was trading higher earlier this week, with a gain of 0.90% below minor resistance +/-87.50. The price position collided on the support area and rebounded from the 85.41 figure after last week’s BoC meeting. Temporary bias returns to the upside after crossing the descending trendline and Kumo. AO also shows positive sentiment with bars developing above the neutral zone. The next rally will test minor resistance and if it breaks it will be possible to track the peak of 88.29. On the downside, as long as the minor resistance holds the price has the potential to retrace back to the range of 86.00.

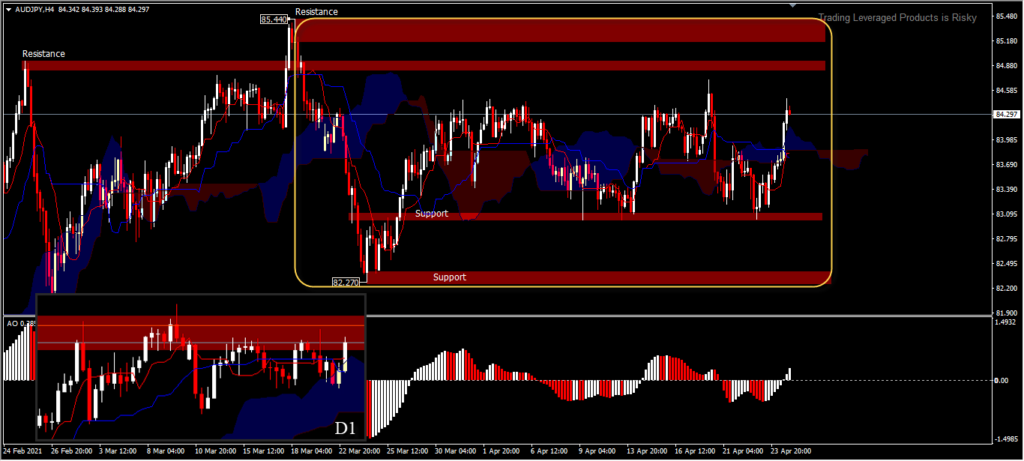

AUDJPY, H4

The RBA guidance didn‘t change in the last meeting, but Australian CPI will probably attract market interest as inflation is expected to increase by 1.5% in Q1, still far from the RBA’s target. If there is no change in price movements in the AUD currency, it is likely that the FOMC meeting later will provide volatility.

AUDJPY started the week with a gain of 0.92%. Price movements tend to be bound within a limited range and consolidation is still continuing with price movements in and out of Kumo. On the upside 85.44 will act as resistance for the price rally which if it is passed will bring the bias out of the consolidation zone towards the strong resistance level at 90.00. If it fails to move higher, the price will test 83.00 and 82.27 support levels. Broadly speaking, the pair has not set a direction.

Click here to access our Economic Calendar

Click here to access our Economic Calendar

Ady Phangestu

Market Analysts – HF Educational office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.