APPLE, Daily

During yesterday’s US trading session, the Dow Jones industrial average fell more than 150 points (0.4%) to just below historical highs, while the S&P500 stabilized by surpassing the new record it had reached two days ago. Meanwhile, the Nasdaq was 0.3% below its own all-time highs after Tuesday’s fall, while Apple dropped by 1%, as the stock continues to build a cup base with a buy point of $145.19 pending the publication of its quarter profit results. (1)

Through a conference call, The Apple Maven reviewed Apple’s second fiscal quarter earnings report, which Wall Street analysts expected to be outstanding. Revenue was expected to see an increase of 32% year after year with earnings per share reaching 53%, strengthened by the iPhone they hoped would benefit from a solid line and simple compositions that would position it with strong double-digit growth and the iMac as another candidate to be the most successful segment of the company during the quarter, because Apple’s PC sales expectations were positioned to increase by 50% or more, compared to last year. (2)

From Apple’s earnings history, it can be noted that its quarterly EPS performance, despite fluctuations during the coronavirus pandemic, has remained generally positive, except for a decline during the fourth quarter of 2020 that was 3.0%, while quarters with year-on-year profit growth have ranged from 3.8% to 34.6%. For its part, Apple’s revenue has also shown steady improvement in recent quarters, posting year-on-year revenue gains in 9 of the last 11 quarters, having only a small stagnation with a gain of 0.5% during the second quarter, but recording a 21.4% year-on-year increase for the first quarter of 2021, considered to be the strongest rise in nearly three years. (3)

It should be noted that Apple surpassed the $100 billion revenue milestone for the first time in the previous quarter, thanks to the boost it received from strong sales across all product categories, highlighting iPhone 5G sales; Apple reported gross revenue of $11.4 billion, an increase of 21.3% year-on-year and with first quarter earnings of $1.68 per share, a 34.4% increase year on year, exceeding analysts’ expectations of $1.42 per share. (4)

Apple announced within the financial results of its second quarter ended March 27, 2021 that it earned a record income of $89.6 billion, up 54% year-over-year, with quarterly diluted earnings per share of $1.40, and international sales accounted for 67% of the quarter’s revenue. The company’s board of directors declared a cash dividend of $0.22 per share of the company’s common stock, a 7% increase to be paid on May 13, 2021, and also authorized a $90 billion increase to the existing share repurchase program. (5)

Apple shares rose more than 4%, earning a EPS of $1.40 versus the estimated $0.99. In the revenue sector, its iPhone product earned revenue of $47.940 million versus $41.430 estimated, an increase of 65.5% year-on-year, its iMac product reported $9.1 billion versus $6.86 billion estimated, an increase of 70.1% year on year, its iPad product published revenues of $7.80 billion versus $5.58 billion estimated, an increase of 78.9% year-over-year, while the revenue in the sectors from services and other products made $16.9 billion with an increase of 26.7% and $7.83 billion with an increase of 24% year on year, respectively. (6)

In early pre-market trading today #APPL is changing hands up 3% at 137.71. US equity markets open at 13:30 GMT, following US Advanced GDP readings for Q1 GDP, which could exceed 7.1%, although consensus is for 6.8%, and Weekly claims which are expected around the 545,000 level again, at 12:30 GMT.

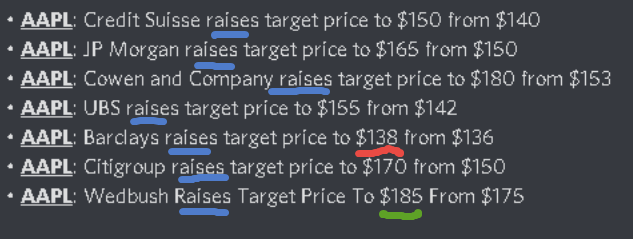

A raft of analysts have issued updates today with Wedbush the most bullish and Barclays the least bullish.

2.- https://www.thestreet.com/apple/news/apple-earnings-day-3-predictions-on-apple-stock-price-moves

3.- https://www.investopedia.com/apple-q2-2021-earnings-report-preview-5180676

4.- https://finance.yahoo.com/news/apple-earnings-preview-expect-134106373.html

5.- https://www.apple.com/newsroom/2021/04/apple-reports-second-quarter-results/

6.- https://www.cnbc.com/2021/04/28/apple-aapl-earnings-q2-2021.html

Click here to access our Economic Calendar

Aldo Weidner Zapien

Reginal Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.