Market News Today – A month-end bid, and rotation out of equities has supported!

Covid continues to wreak havoc in parts of Asia, and will keep investors nervous again this week, as India deals with a firestorm of new cases (the highest daily cases anywhere in the world) and rising deaths. Additionally, parts of Japan remain under a state of emergency with restrictions in areas including Tokyo, Osaka, and Kyoto. Japan will be on Golden Week holidays Monday through Wednesday, and there are no top-tier data releases for the remainder of the week. China’s April trade report is due at the end of the week. The quiet session in Asia impacted trading in Europe today, with the UK still on an extended weekend break. GER30 futures are fractionally higher at the moment, and US futures are outperforming, although the tech heavy USA100 future is struggling amid lingering concern over China’s anti-trust crackdown, that also saw the Hang Seng selling off again. Inflation developments and lingering tapering fears will also be on markets’ minds as the BoE meeting comes into view. Elsewhere, CPI data from around the globe, along with the usual mix of growth, trade, retail sales and US NFP. For central banks, the RBA, BoJ and BoE meet, though no changes are expected. German retail sales jumped 7.7% m/m in March.

In FX markets, the Yen and US Dollar retreated and USDJPY lifted to 109.62, while the USDIndex jumped to 91.40. The US Dollar strengthened as risk trades slipped further. USOIL meanwhile dropped back to $62.90 per barrel. Ethereum has hit a fresh record high, following news of a potential digital bond sale on the ethereum blockchain.

Today – The calendar today includes the final readings for Eurozone April manufacturing PMIs, the US ISM Manufacturing PMI and Fed Chairman Powell’s speech. Earnings season continues with reports from Estee Lauder, Enterprise Products, Alexion Pharmaceuticals, WEC Energy, Williams Companies, ON Semi, SolarEdge, Loews Corp., Diamondback Energy, Chegg, and Apollo Global Management. The Treasury will outline its Q2 and Q3 borrowing projections.

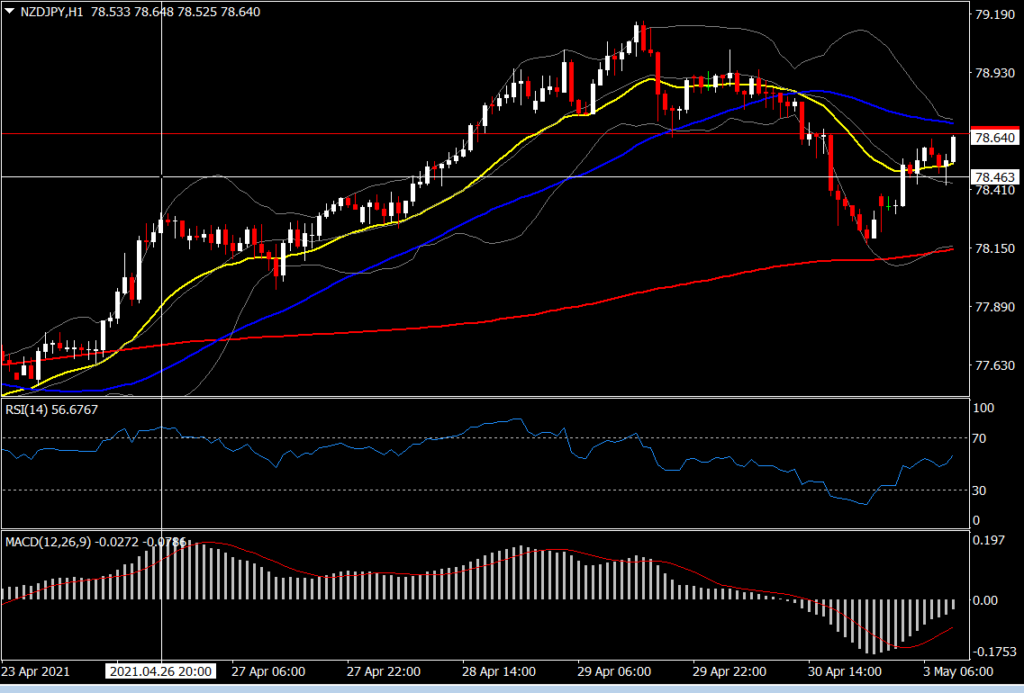

Biggest (FX) Mover @ 07:30 GMT (+0.37%) – NZDJPY reversed Friday’s losses and extended to 78.65. The overall outlook remains positive, while in the 1-hour chart, momentum is rising higher with fast MAs aligned higher, while RSI is breaking above 50 with MACD extending northwards but remains below 0. ATR (H1) at 0.1104 & ATR (D) at 0.6449.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.