Equity markets remain upbeat on global recovery prospects even amid the tragic surge in infections and deaths in India and Brazil, along with fresh restrictions in Japan.

A strong US recovery, light at the end of the tunnel in the Eurozone and faith that vaccines will eventually tame the pandemic globally have boosted Wall Street and many key markets back to or near record highs, even as trading activity has turned choppy amid myriad cross-currents. In the US, the employment report and Chair Powell will be monitored, but are expected to support the outlook. Europe’s docket has final PMIs, which should reflect the bounce in the economy after the Q4/Q1 recession. In Asia, the rising toll of the pandemic on India will remain the focus. Market conditions overall have been quiet with China, Japan and the UK out today, while Chinese and Japanese markets will remain closed through to Wednesday. Holidays already made for a quiet session in Asia and will also impact trading in Europe today, with the UK still on an extended weekend break.

Various central banks will be reviewing monetary policy this week, including the Norges Bank, RBA and BoE. All are expected to maintain prevailing policy rates, with Norges Bank expected to be the most hawkish/least dovish. The BoE’s quarterly MPR is expected to bring upward revisions in both growth and inflation projections.

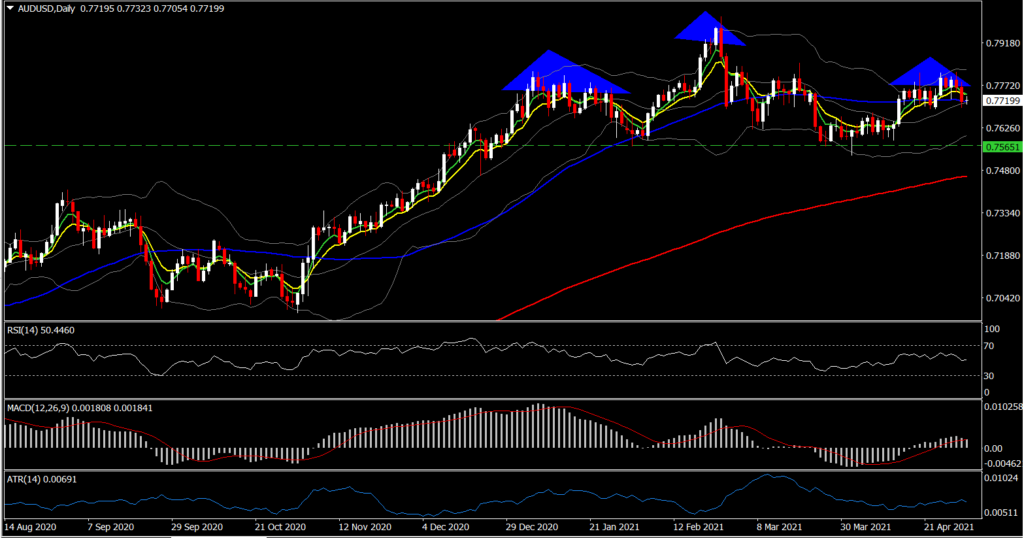

Firstly, the RBA’s meeting on Tuesday will be in the spotlight. We expect no change to the 0.1% setting for the cash rate target. In the minutes to the April meeting, the bank confirmed its commitment to easy policy. Policy makers again stressed that they are committed to maintaining a supportive monetary environment until at least 2024 and until actual inflation is sustainably within the 2-3% target range. The RBA also maintained the 3-year bond yield target of 10 basis points and will consider whether to shift the target bond later in the year. CPI inflation is expected to rise temporarily due to base effects and technical factors, but the minutes showed that the RBA still sees the jobless rate as too high. Wage and price pressures are expected to remain subdued for several years. The bank will keep a close eye on house price developments, however, and officials stressed the need for appropriate lending standards. A reiteration of this forward guidance is anticipated at the May meeting. Also on the docket is a speech from RBA Deputy Governor Debelle (Thursday). The trade report for March (Tuesday) and March building approvals (Wednesday) are the featured economic data this week.

In the UK, the BoE’s MPC meets on monetary policy announcing Thursday, where no change in the repo or QE totals are widely anticipated, while upgraded GDP and inflation forecasts can be expected in the Bank’s quarterly Monetary Policy Report. Local elections are also up (Thursday), where a particular focus will be on whether pro-independence Scottish parties can reach the supermajority threshold. Polling suggests it’s too tight to call.

None of the upcoming data or events are expected to have much bearing on UK markets. The prognosis for the UK economy remains strong as the UK continues on a reopening path on the back of a highly successful vaccine program. From the Sterling perspective, as reported last week, overall the bullish outlook on the Pound has been retained, and more especially the low-yielding currencies of surplus economies, such as Japan and Switzerland, which is hinged on the expectation that the global pandemic recovery trade will continue into 2022. Sterling has also developed a pandemic-era proclivity to correlate positively with risk appetite in global markets and is supported concurrently with a burst in risk appetite in global markets.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.