Market News Today – USD continues its May recovery (USDIndex holds over 91.00), Equities closed lower (Nasdaq shed 1.88%). Mrs. Yellen spooked the market and then toned down her interest rate rise/inflation comments. The Fed’s Kaplan and Allianz’s Al El-Erian also talk up “non-transitory” nature of the inflation threat. Yields cooled on USD advance, fell to 1.55% before moving 1.59%. Overnight Good jobs data from NZD and Housing data from AUD lift the antipodean pair. Japan, China and South Korea still closed.

EUR – down to test 1.2000 zone, JPY holds over 109.00 at 109.40, Cable rotates around 1.3900. AUD has support at 0.7700 and CAD still rotates through 1.2300

USOIL at 38-day high peaked at $66.00, Gold – $1776 following a volatile session (highs $1798, lows $1770) Commodities remain robust. BTC back to test $55,000(PP).

European Open – The rout in tech stocks that hit markets yesterday has eased somewhat and US futures are moving higher – DAX and FTSE 100 futures are also sought. Comments from US Treasury Secretary Yellen yesterday reminded markets that with economies strengthening as fiscal stimulus picks up it is not a question of if, but when central banks will take the foot off the accelerator. Official rates may remain low for a while to come, but when asset purchases are reigned in, the long end will suffer. Stocks meanwhile may continue to see rotations out of companies that benefited from stay home orders to cyclicals. With the DAX closing below the 15000 mark yesterday there is room to the downside.

Today – Eurozone & US services & composite PMIs, ISM services PMI, ADP Employment, Oil Inventories, Fed’s Evans, Rosengren, Mester, ECB’s Lane, Earnings from GM, Barrick Gold, Maersk, Deutsche Post, Uber, PayPal & Hilton Hotels.

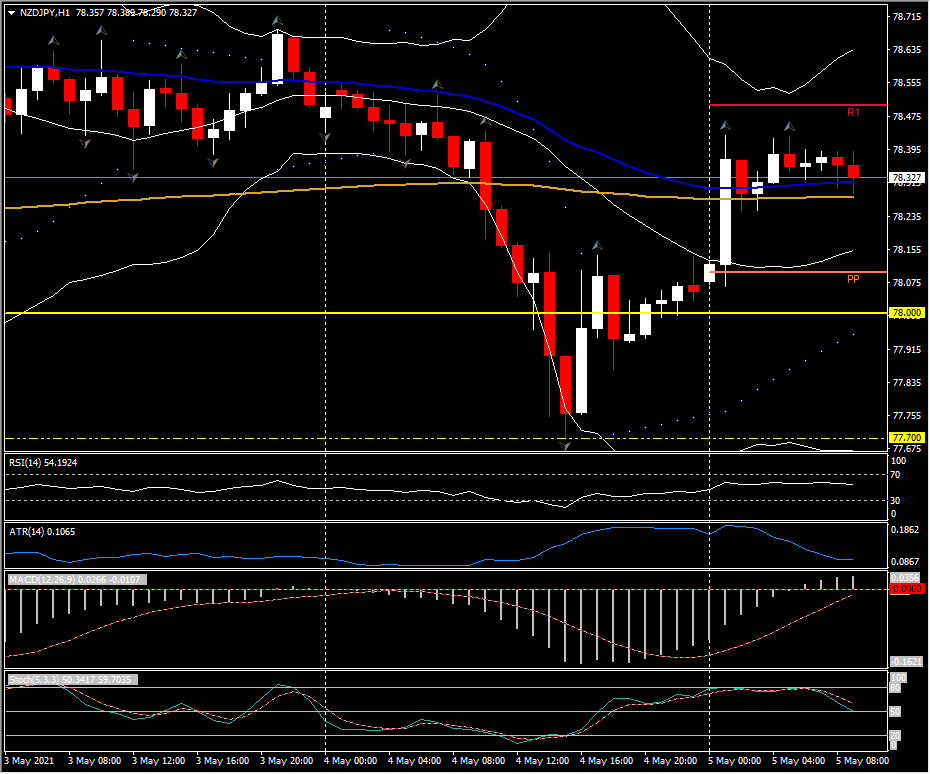

Biggest (FX) Mover @ (07:30 GMT) NZDJPY (-0.27%) rallied from 6-day low yesterday (77.70) over 78.00. Today, PP at 78.07 and R1 at 78.50. Faster MAs remain aligned higher, RSI 53 & neutral, MACD histogram over 0 line & signal line aligned higher but under 0 line. Stochs cooling to neutral. H1 ATR 0.1065, Daily ATR 0.6200.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.