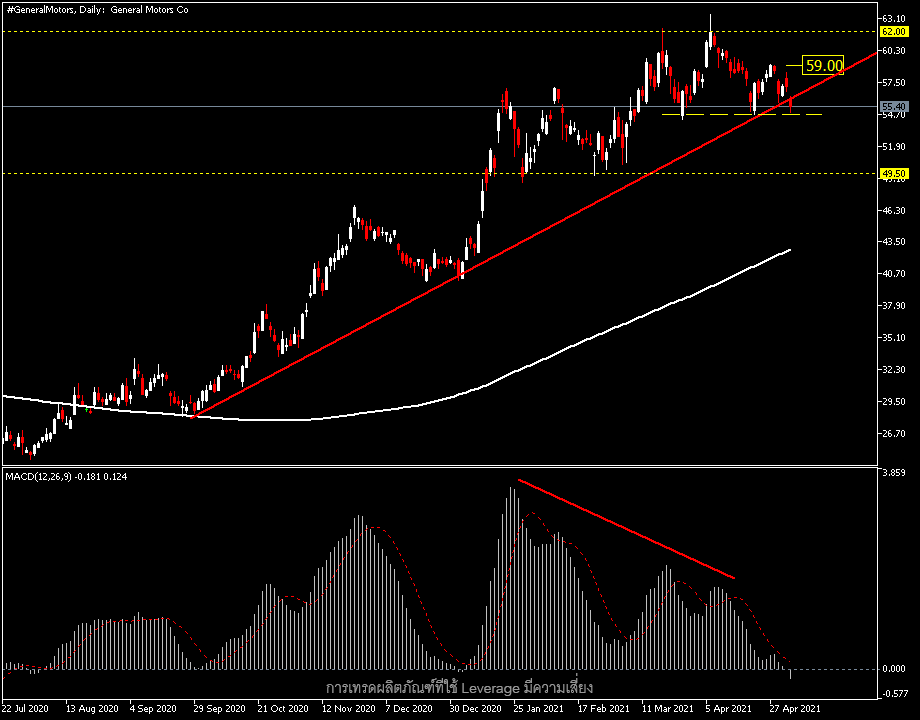

PayPal ( #PayPal ) is an electronic payment provider for merchants and consumers. First-quarter results are scheduled for May 5 after the market close, with Zacks forecasting PayPal’s Q1 earnings per share of $1.01, down from $1.08 in the fourth quarter but higher than the $0.66 in the same quarter of last year. Revenue is expected to be $5.9 billion, down from $6.1 billion a quarter ago.

By the end of 2020, PayPal had 377 million active accounts and 29 million merchant accounts. Venmo, an inter-person money transfer service provider, with a steady increase in revenue every quarter since 2017, is expected to play a significant role in boosting PayPal’s current quarterly revenue. Last month, Venmo was connected to Paxos Trust Company to enable clients to trade currencies. Cryptocurrencies are available on the Venmo app as well.

Source: statista.com

PayPal was one of the biggest beneficiaries of online spending during the Covid-19 outbreak, along with other e-commerce giants. As well as a service introduced in some countries called Buy Now, Pay Later, which the company plans to expand to other countries, PayPal also announced another new addition last March, Checkout with Crypto, which is a service that allows US customers to make payments in cryptocurrencies without any fees. Both Buy Now, Pay Later and Checkout with Crypto are expected to support the Company’s revenue growth in the short to medium term.

Looking at the current technical trend, the stock price has fallen to the trend line around 250.00 after the price continued to fall over the past week. If the performance turns out to be as good as expected the stock price is likely ready to bounce off the trend line to test the April high again at 278.00, but if the report comes out lower than expected there may be a sellout until the price can break the trend line down to the key support MA200 at 225.00.

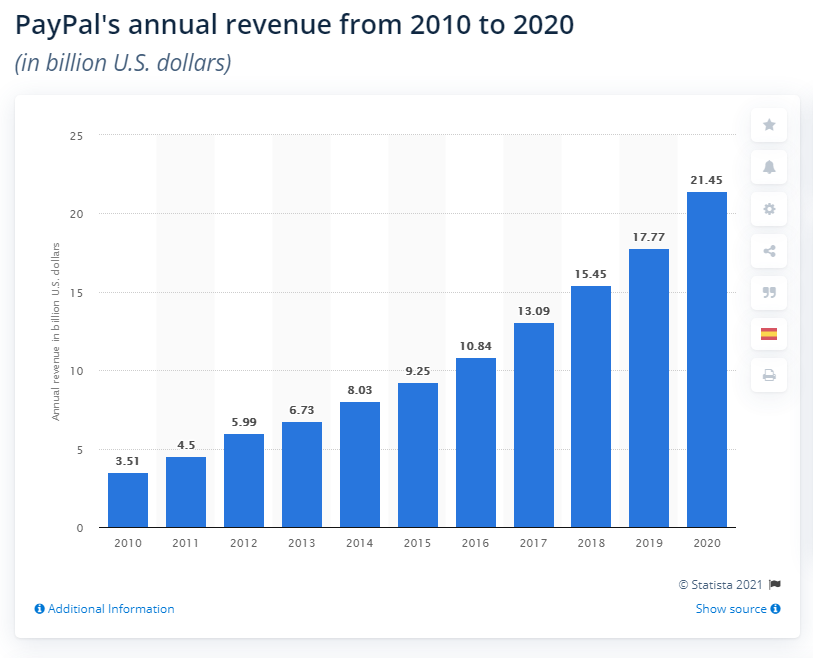

General Motors Co. ( #GeneralMotors ) is General Motors Corp. (formerly GM) that went bankrupt in 2009 and remains an industry leader in the United States. With a market share of 17.3% in 2020, the first-quarter earnings report will be ahead of the US market today (May 5), with Zacks forecasting earnings per share of the company at $1.02 , which is at the low end of the range. Below the $1.93 in the last quarter, but higher than $0.62 in the same quarter a year ago. Forecasts for current quarter sales of $33.26 billion.

The same is true for electric car maker Tesla, which has major sales in China. Which since the second quarter of the past year After the massive economic stimulus of the Chinese government As a result, car sales in China continue to grow. As one of the first countries to recover from the outbreak, in the first quarter of 2021, General Motors in China grew 69% (yearly) with more than 780,000 units sold, and the systematic shift to electric cars for the Chinese consumer market. Ultium Drive discrete batteries are expected to play a significant role in supporting the company’s current quarterly revenue.

For the trend of stock prices for #GeneralMotors, we can now see Bearish Divergence with MACD falling to its lowest level since March. Yesterday it was able to break through the line 0 for the first time in several months, at the same time as the price is testing the April trendline lows. If the turnover is lower than expected the company’s share price may fall sharply, with the key support at the 49.5 zone. On the other hand, if the results are good, the target for the uptrend will be at 59.00 and the original high at 62.00, respectively.

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Click here to access our Economic Calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.