Fidelity (FIS) is a global financial services technology company and a leader in providing technology solutions to merchants, banks and capital market firms worldwide. The company is dedicated to upgrading the way the world and banks pay and invest by applying their benchmarks, deep expertise, and data-driven insights. On April 30, 2021, it announced a regular quarterly dividend of $0.39 per common share. The dividend is payable on June 25, 2021 to shareholders of record , effective from the end of business on June 11, 2021. Meanwhile, based on Zacks estimates, the company is expected to report weak revenue-growth performance for Q1, with the overall revenue consensus at $3.16 billion, while EPS is seen at $1.25 per share, a 2.3% decline y/y.

Fidelity Technical Analysis:

The technical analysis shows the stock price movement of Fidelity above the Ichimoku Cloud. The price crossed and surpassed the cloud higher on February 19, 2021, at 132.28. The price also tested the cloud on March 31 at 140.78. The cloud currently acts as support as the price trades steadily above it.

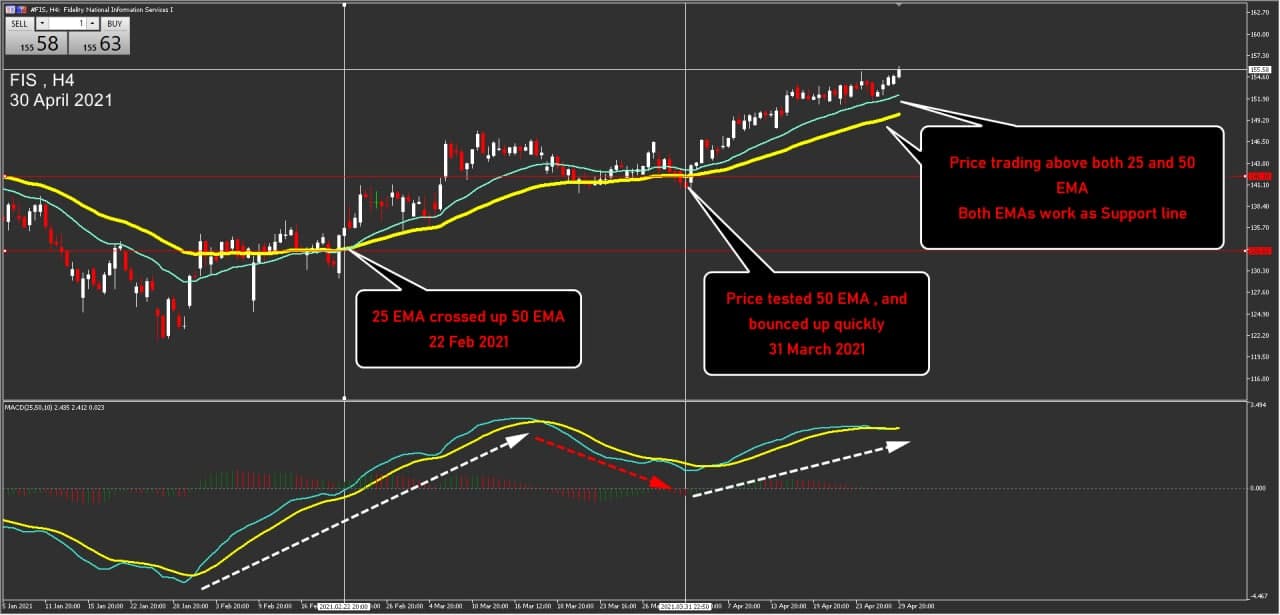

The following chart shows the Exponential Moving Average (EMA) of Fidelity, where the share price has been moving in an upward channel on the 4-hour timeframe above the 25- and 50- EMA since February 22, 2021. The price also retested the 50- EMA on March 31, 2021 and then bounced back up quickly. The price is currently trading above the 25- and 50- EMA, and both of them act as support lines for the price.

And in the last part of Fidelity’s analysis on a 4-hour timeframe, the chart shows support and resistance lines, as the price rose to 158.30 on February 14, 2020, and then fell sharply on the 18th of the following month to 89.70, to move in a sideways channel posting a double bottom formation, at 118.97-120.98. After the reversal from the double bottom the asset held below the resistance at 158.30. In the meantime, the RSI is at 70 (overbought), with the indicator posting two highs above the 70 barrier, at the times where the asset retested the 158 area.

Moderna Corporation is an American pharmaceutical and biotechnology company which focuses on drug discovery, drug development, and mRNA-based vaccine technologies. According to a company announcement, Moderna is set to generate an estimated $ 9.3 billion in net income in 2021 as it supplies millions of doses of the COVID-19 vaccine. Such profit growth puts the company in a really good financial position after it has been continuously losing money the past three years. As the big biotech companies are now busy ramping up production to meet the massive demand for Covid-19 vaccines, Moderna recently announced the expansion of its technology center in Massachusetts, in order to achieve an increase of its production by 50%. Overall the outlook for biotech companies looks positive, as the pandemic has been beneficial for them.

The company is expected to reveal massive improvements in both earnings and revenue in Q1, with EPS at $2.30 from -0.35 in Q1 2020, while revenue is expected at $2,006.9 million, implying a rise of around 23,822.7% compared to the year-ago quarter. This will be Moderna’s first quarterly EPS in at least three years.

| Moderna Key Stats | |||

|---|---|---|---|

| Estimate for Q1 2021 (FY) | Q1 2020 (FY) | Q1 2019 (FY) | |

| Earnings Per Share ($) | 2.30 | -0.35 | -0.40 |

| Revenue ($M) | 2,006.9 | 8.4 | 16.0 |

What’s key for the release ahead is any remarks from the company regarding how Moderna will expand production of its vaccine to meet the growing demand. In a press release issued on April 29, the company announced that it is investing in manufacturing facilities to reach a global production capacity of 3 billion doses by 2022. The company has also raised its supply forecast for 2021 to between 800 million and 1 billion doses.

Moderna Technical Analysis:

On a 4-hour timeframe Moderna’s share price during the first quarter of this year rebounded from 102.68 on January 4, 2021, to reach its peak on February 8 at 189.22, failing to break that resistance line. The share price finds support within the 117-119 area. Currently the momentum indicators are neutral with RSI rejecting the 70 barrier as it sustains above 50.

Regeneron Inc., another pharmaceutical and biotechnology company, also reports today. Regeneron originally focused on neurological factors and regenerative capabilities, but has since branched out into the study of both cytokine and tyrosine kinase receptors. Today, May 6, 2021, Regeneron is expected to announce its earnings before the market opens. The report will be for the fiscal quarter ending March 2021. According to Zacks Investment Research, the overall earnings per share forecast for the quarter is $7.78. Earnings per share for the same quarter of last year was $5.87.

Regeneron Technical Analysis:

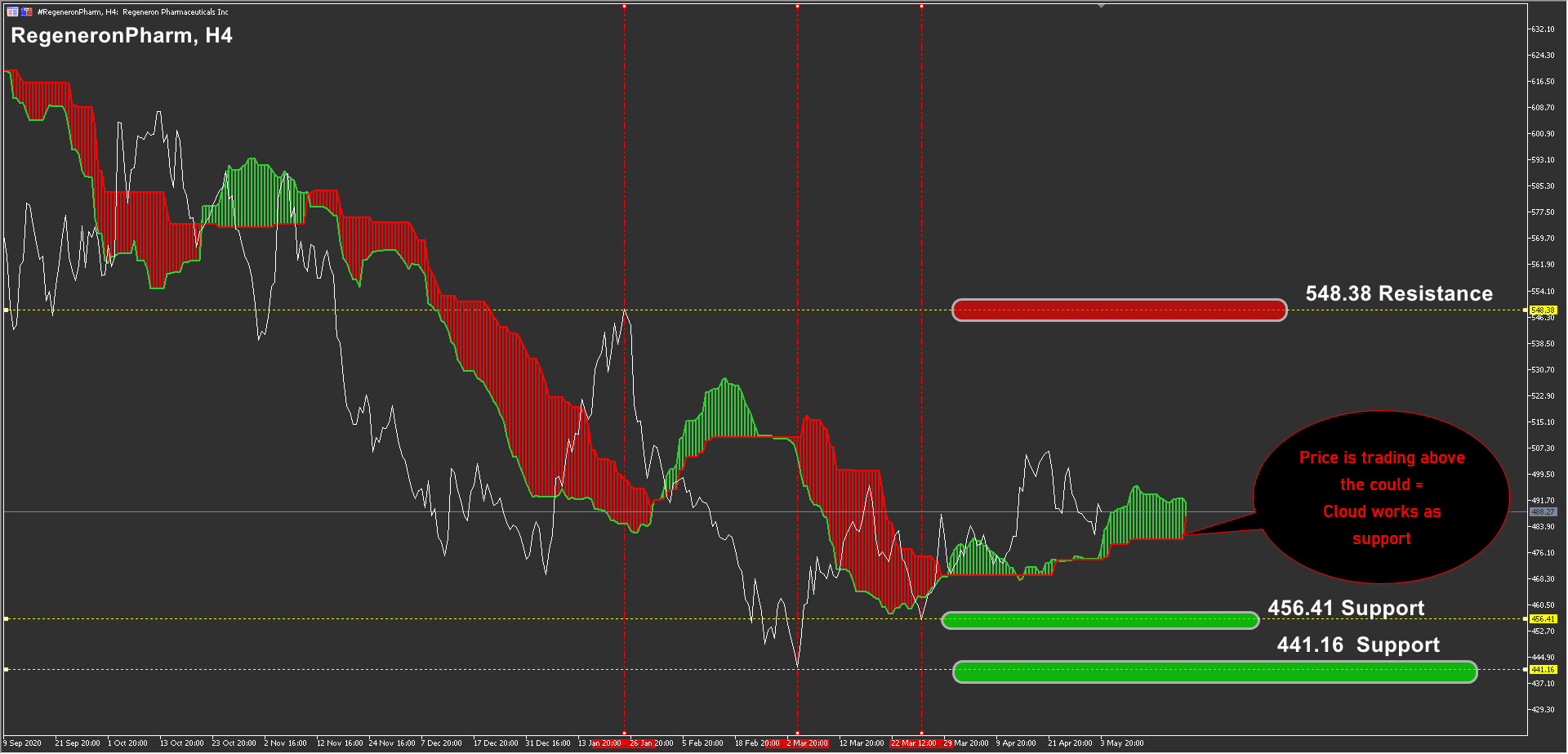

Over the last 4 years, the Regeneron stock price chart presents a key level at 440 which was a key Resistance for 2019-2020 and is now considered to be an immediate Support level for the asset.

Intraday as shown below the asset is currently moving in a descending channel above the Ichimoku cloud that acts as support.

Click here to access our Economic Calendar

Eslam Salman

Regional Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.